In Bangladesh, small shops and MSMEs have long dominated commerce but face a critical conundrum. While smartphone penetration deepens and digital payments become mainstream and millions of small businesses attempt to transition from traditional retail to e-commerce, the tools to sell efficiently online remain stubbornly out of reach.

Many existing global e-commerce platforms demand technical expertise, hefty monthly subscriptions, and credit cards, all in short supply for many of these MSMEs and digital merchants in Bangladesh. Additionally, many of these platforms are too complex, and critically, not designed for local market conditions.

Instead, these entrepreneurs cobble together makeshift solutions, primarily selling through Facebook (hence F-commerce) with manual record-keeping and cash-on-delivery arrangements.

This digital disconnect, millions of small sellers unable to access suitable e-commerce infrastructure despite eager customers, is not unique to Bangladesh. Across South Asia and the Middle East, a curious paradox exists: rapid digital adoption at the consumer level has outpaced the development of appropriate tools for merchants.

This gap represents not just a business opportunity but a structural economic bottleneck. How do you digitize millions of small merchants who lack technical expertise, capital resources, and access to integrated local solutions?

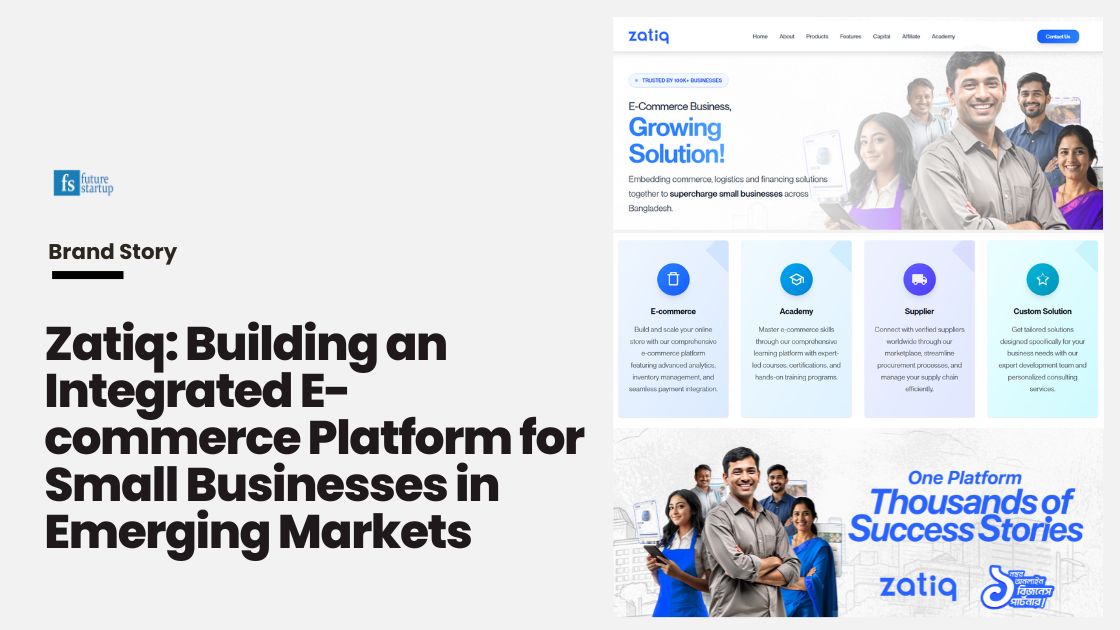

Enter Zatiq, a three-year-old startup that’s built an all-in-one e-commerce infrastructure specifically engineered for emerging markets. The company says it aims to simplify the transition to online business for SMEs in Bangladesh and beyond by offering a suite of accessible, affordable, and user-friendly solutions that address both the entry-level needs of first-time sellers and the advanced requirements of scaling brands.

Its thesis is deceptively simple: by removing technical barriers and upfront costs, while integrating deeply with local payment and logistics systems, they can unlock a massive $100B+ opportunity by activating 30M+ currently untapped sellers across South Asia and MENA. The company says it has enabled over 65,000 sellers to generate $17.35 million in revenue in 2024, focusing on making online business simple and accessible with zero upfront costs. In 2025 So far, the company says it scaled further, empowering more than 150,000 sellers and driving $33.75 million in revenue.

Zatiq now positions itself as an ecosystem for merchants of every size. ZatiqEasy makes starting simple for MSMEs and first-time sellers, while ZatiqPlus equips scaling brands with advanced inventory, customer, and finance tools.

The company is also preparing Supplier Integration for seamless sourcing and multi-channel sales, alongside Zatiq AI for product visuals and content. To broaden access, a Free Plan will let merchants launch stores with 5 products and 10 monthly orders at no cost.

The Market Gap

Bangladesh alone has approximately 10 million SMEs contributing roughly 25% of the country’s GDP. The broader South Asian and MENA e-commerce market is projected to reach $140 billion by 2030. Yet traditional e-commerce enablement platforms have failed to capture this market for several structural reasons.

Technical complexity barriers. Platforms like Shopify require technical knowledge that many small business owners in emerging markets don’t possess

High upfront costs. Monthly subscription fees create significant barriers in price-sensitive markets

Missing local integrations. Global platforms lack native integration with critical local services such as mobile financial services like bKash and Nagad (Bangladesh), local logistics providers familiar with complex addressing systems, and locally trusted payment gateways.

Finally, platforms built for Western markets assume business formality, banking relationships, and technical infrastructure that often don’t exist

The result: while there are over 300,000 businesses actively selling through Facebook in Bangladesh alone (a phenomenon known as F-commerce), most hit a growth ceiling. They can’t scale beyond manual operations or compete effectively without professional e-commerce tools.

This is more than a technology problem—it’s a structural economic inefficiency.

This gap doesn’t just affect micro-merchants. As Zatiq highlights, larger SMEs and established brands also face bottlenecks when trying to digitize at scale.

Enterprise-grade solutions often assume Western-style supply chains, banking systems, and consumer behaviors—making them difficult to adapt locally. By introducing ZatiqPlus for advanced operations, ZatiqEasy for micro-merchants, and a forthcoming Supplier Integration network to connect sellers directly with trusted manufacturers and wholesalers, Zatiq positions itself as a bridge across the full spectrum of merchant needs in emerging markets.

Zatiq Solution: From Quick Launch to Enterprise Scale

Sultan Moni, Zatiq’s founder, frames the company’s mission with unabashed ambition: “We’re unlocking a $100bn market opportunity by empowering 30m untapped sellers.” The company’s flagship product, Zatiq Easy, makes an equally bold promise, creating fully functional online stores “in just 10 seconds.”

Such claims would typically warrant skepticism, yet the company’s traction suggests substance behind the marketing flair. Since launching in 2022, Zatiq claims to have enabled over 150,000 merchants across Bangladesh, who have collectively generated more than $33.75 million in revenue this year alone.

The company now employs 32 people and has expanded its operations across seven departments, with backing from Dekko ISHO Venture Capital, a prominent Bangladeshi investor.

What makes Zatiq noteworthy is not merely its growth trajectory but its fundamentally different approach to e-commerce infrastructure. Rather than attempting to transplant Western platforms with some local adjustments, Zatiq built its ecosystem from the ground up around the specific constraints of emerging markets: mobile-first users with limited technical knowledge, fragmented payment and delivery systems, and extremely price-sensitive merchants.

The result is a platform that seems almost implausibly simplified compared to many existing alternatives. Creating an online store requires no coding knowledge and costs just 500 taka (approximately $4.50) monthly—less than one-sixth the entry-level price of Shopify, the Canadian e-commerce giant.

Yet within this simplicity lies sophisticated integration with local payment systems like bKash and Nagad, and logistics providers including Pathao, Redx, and Steadfast—companies virtually unknown outside the region but critical to commerce within it.

The Three-legged Digital Stool

Zatiq’s approach extends beyond mere storefront creation. The company frames its offering as a “three-pillar solution” addressing what it sees as the fundamental barriers to digital commerce success in these markets: technical complexity, inventory access, and knowledge gaps.

The first pillar, Zatiq Easy, handles the technological heavy lifting, allowing merchants to create and manage professional-looking online stores without technical knowledge.

For scaling SMEs and established brands, ZatiqPlus extends this foundation with enterprise-grade modules for inventory, marketing, finance, and customer management.

Separately, Zatiq AI provides merchants with creative tools—generating polished product visuals, professional-quality images, and compelling descriptions—helping even the smallest sellers project an enterprise-ready presence.

The second, Zatiq Supplier, connects these merchants with both local and international suppliers through what the company calls a “pay-after-sale” model—essentially allowing merchants to list products without holding inventory, mitigating cash flow constraints.

Looking forward, this supplier network will expand into a Supplier Integration system, allowing merchants to source products seamlessly and sell across multiple channels from a single dashboard—removing one of the biggest bottlenecks for growth in emerging markets.

The third, Zatiq Academy, provides access to e-commerce education and expert services.

This holistic approach reflects a sophisticated understanding of the interconnected challenges facing small merchants in these economies.

Simply providing website templates would be insufficient when merchants struggle to source reliable inventory or lack the knowledge to optimize their digital operations. By addressing these linked constraints simultaneously, Zatiq aims to create a self-reinforcing ecosystem that can potentially scale across similar emerging markets.

A Different Kind of Disruption

In Silicon Valley parlance, disruption typically involves challenging incumbent businesses with new technology. Zatiq’s model represents a different variety, not displacing existing e-commerce giants but rather building infrastructure where functional alternatives barely exist.

The company’s true competitors are not Shopify or WooCommerce but rather the manual, informal systems that merchants have cobbled together: Facebook pages with WhatsApp ordering, paper ledgers for inventory, and cash payments.

The most telling statistic about Zatiq’s potential market comes not from its own projections but from the Bangladesh government’s estimate that the country has approximately 10 million small and medium enterprises contributing roughly 25% of GDP.

The vast majority of these businesses remain digitally underserved, operating with minimal technology despite serving increasingly digital consumers.

Similar patterns exist across Zatiq’s target expansion markets. Pakistan has around 5.2 million SMEs contributing nearly 40% of GDP. Egypt’s approximately 3.7 million SMEs generate around 80% of the country’s jobs and 40% of economic output. Saudi Arabia and the UAE, while wealthier, still have significant SME sectors operating below their digital potential despite high internet penetration and smartphone usage.

Such projections would typically warrant skepticism, but the sheer size of the untapped market makes them at least theoretically achievable, provided the company can manage the complex challenges of multi-market expansion while maintaining its technological edge.

The Economics of Accessibility

Perhaps most intriguing about Zatiq’s model is its business model innovation. While many existing e-commerce platforms typically charge $29-299 monthly plus transaction fees, ZatiqEasy offers two fascinating alternatives: either a flat 500 taka monthly fee (approximately $4.50) with no per-transaction charges or a Free Plan will let merchants launch stores with 5 products and 10 monthly orders at no cost. The free plan expands accessibility and is designed to let first-time sellers experiment with digital commerce without financial risk, while offering a clear upgrade path to higher tiers as their businesses grow.

For businesses aiming to scale, ZatiqPlus is available with flexible subscription tiers and enterprise plans tailored for larger operations.

This pricing structure reflects a sophisticated understanding of emerging market economics, where monthly cash flow constraints often outweigh long-term cost efficiency. By allowing merchants to choose between fixed and variable cost structures, Zatiq accommodates both established businesses and newcomers testing the digital waters.

The economics work for Zatiq because of lower operating costs in its home market and exceptional capital efficiency. Its technology stack was built in-house with local engineering talent rather than expensive imported solutions.

Customer acquisition leverages existing social networks and community structures rather than costly digital advertising. Support operations utilize local talent familiar with the specific challenges of merchants in these markets.

This approach contrasts sharply with Western technology companies that have struggled to adapt their business models to emerging market realities.

Many have attempted to enter these markets with essentially unchanged products and pricing, only to reach a tiny fraction of potential users.

Zatiq’s bottom-up approach, building specifically for local constraints rather than adapting global templates, may prove more sustainable in the long run.

Origin, Evolution, and Growth

Zatiq’s story begins with a clear problem identification: the growing gap between social commerce and professional e-commerce in Bangladesh. While 300,000+ businesses were actively selling on Facebook, they lacked proper tools to scale efficiently.

Founded in 2022 by Sultan Moni, the company focused on rapid iteration based on real user feedback. This approach proved crucial in a market where traditional market research often fails to capture the nuanced challenges of small businesses.

The initial thesis was straightforward: simplify the transition to online business for SMEs in Bangladesh by offering an accessible, affordable, and user-friendly platform that addressed their unique challenges. The founding team brought global experience, having built and scaled startups across Canada, Pakistan, Nigeria, and the UAE.

What’s particularly interesting is how Zatiq evolved through deliberate, user-centric development:

- Phase 1: Technology Barrier Removal: Creating an ultra-simple platform that anyone could use

- Phase 2: Supply Chain Integration: Building a supplier network with pay-after-sale models

- Phase 3: Knowledge Transfer: Developing an expert marketplace for guidance and automation

This phased approach allowed Zatiq to address the three core obstacles preventing small businesses from scaling online: technology limitations, inventory access, and expertise gaps.

While Zatiq started with website creation, it has evolved into a much more comprehensive platform. The current product includes:

- Website Builder: Zero-coding required, creates sites in 10 seconds

- Business Management Tools: Online order management, inventory tracking, receipt printing

- Marketing Integration: Facebook Pixel and GTM integration, loyalty programs

- Financial Tools: Payment processing, financial reporting

- Logistics Management: Integrated delivery services, tracking, and notifications

- Supplier Network: Direct connections to product suppliers with pay-after-sale models

- Expert Ecosystem: Access to verified experts for consulting and store automation

- AI Tools: Image editing, product photoshoot generation, and automated content creation for product descriptions

- Enterprise Modules: Advanced inventory, CRM, finance dashboards, and multi-warehouse management for scaling brands

What makes this approach powerful is that it creates a complete business ecosystem rather than just a technical tool.

Combinedly, timing, a product that meets the needs of its users, and a creative business model, has helped Zatiq to grow from an idea to Bangladesh’s fastest-growing e-commerce enablement platform in just a few years.

The company now employs 32 professionals across seven departments and has expanded its operations beyond Bangladesh.

Current metrics showcase impressive traction:

- 1,50,000+ active merchants

- 405+ crore BDT (~$33.75M USD) in facilitated sales

- Operations in Bangladesh, Saudi Arabia, UAE, Pakistan, and Egypt

The company has also secured backing from Dekko ISHO Venture Capital (DIVC), providing capital for expansion.

What’s particularly notable is diversifying revenue streams. While the core business comes from subscription fees, the expansion into supplier marketplaces and expert services creates additional monetization opportunities as merchants grow.

Challenges amid opportunity

Despite promising early traction, significant obstacles remain on Zatiq’s path to achieving its ambitious growth targets. Infrastructure limitations persist across its target markets, with inconsistent internet connectivity still plaguing rural areas.

Educational barriers require substantial investment in user onboarding and support.

Trust-building remains essential in regions where digital commerce is relatively new and customer skepticism runs high.

Perhaps most challenging will be maintaining platform scalability and performance while growing exponentially across diverse markets with different regulatory environments, payment systems, and logistics networks. The company’s plans for AI-driven tools and enhanced analytics will require sophisticated technology development beyond its current capabilities.

Competitive threats also loom. Global platforms with deep pockets could potentially develop simplified, localized offerings for these markets. Local competitors with strong regional connections could emerge in each target country. There are in fact several local players in Bangladesh operating in this space.

As the potential of these markets becomes more widely recognized, competition will inevitably intensify.

Yet Zatiq’s first-mover advantage and deep local integration create meaningful barriers to entry.

The company’s connections with local payment providers, delivery services, and supplier networks would be difficult for new entrants to replicate quickly. Its growing merchant base provides valuable data for continuous improvement and feature development.

Most importantly, its fundamental understanding of local market dynamics informs product decisions in ways that would be challenging for outsiders to match.

Digital Infrastructure as Economic Catalyst

Beyond its business potential, Zatiq represents something potentially more significant: a new model for digital economic development built from within emerging markets rather than imposed from outside.

By creating infrastructure specifically designed for local realities, such platforms could potentially enable millions of entrepreneurs to participate in the digital economy on their own terms.

The economic impact extends beyond direct platform revenues to broader effects throughout local economies: job creation as businesses scale, increased formalization of previously informal activities, expanded market access for local manufacturers, greater financial inclusion through digital payment adoption, and skills development as entrepreneurs acquire digital capabilities.

If successful in its regional expansion, Zatiq and companies like it could help reshape the digital commerce landscape across regions where small businesses have historically been excluded from e-commerce growth.

The companies that successfully bridge these infrastructure gaps may ultimately create more economic value than their more visible counterparts in developed markets—not by disrupting existing retail channels, but by enabling entirely new ones.

For now, Zatiq remains focused on execution, continuously refining its platform while carefully managing its expansion across culturally and economically diverse markets. Whether it can successfully navigate these challenges will determine if it truly becomes the infrastructure backbone for a new generation of digital entrepreneurs across South Asia and the Middle East.