Shares in retail giant Walmart (WMT) were higher today as it looked to further boost international growth by opening its first store in Africa.

TipRanks Black Friday Sale

From Toys to Beef

The Johannesburg, South Africa store opened over the weekend boasting “unique international products such as toys at Everyday Low Prices” to attract local consumers. It also has home-sourced products such as beef from nearby farms.

While Walmart has operated in South Africa for years through its fully owned subsidiary Massmart, which runs chains like Makro, Game, and Builders Warehouse, it has never launched stores bearing its own name.

The move is part of Walmart’s broader strategy to expand its global presence and tap into Africa’s growing consumer base.

Walmart also launched a 60-minute online delivery service to rival the Checkers’ Sixty60 on-demand platform, operated by South Africa’s largest grocery chain, Shoprite.

“Opening the first Walmart store in South Africa is about much more than a business milestone; it is a commitment to helping customers save money and live better by consistently delivering the lowest total cost for the basket of products they need,” Andrea Albright, executive vice president of Walmart, said.

The store has created 80 new jobs and partnered with 15 local small- and medium-sized businesses.

Global is Paying Off

Walmart recently launched a mobile app in South Africa including online ordering and delivery.

According to 6Wresearch, the South African food and grocery retail market is estimated to grow at a compound annual growth rate (CAGR) of approximately 4.8% from 2025 to 2031. It is likely to be driven by rising disposable incomes in the country.

The demand for food and grocery products is also being boosted by more urbanization and the growing popularity of modern shopping options such as E-Commerce.

International sales were a bright spot of Walmart’s recent Q3 results with sales up 11%. E-Commerce sales were up 26%, led by marketplace and store-fulfilled pickup & delivery.

Its main overseas markets at the moment include Canada, Mexico and India – see above.

Is WMT a Good Stock to Buy Now?

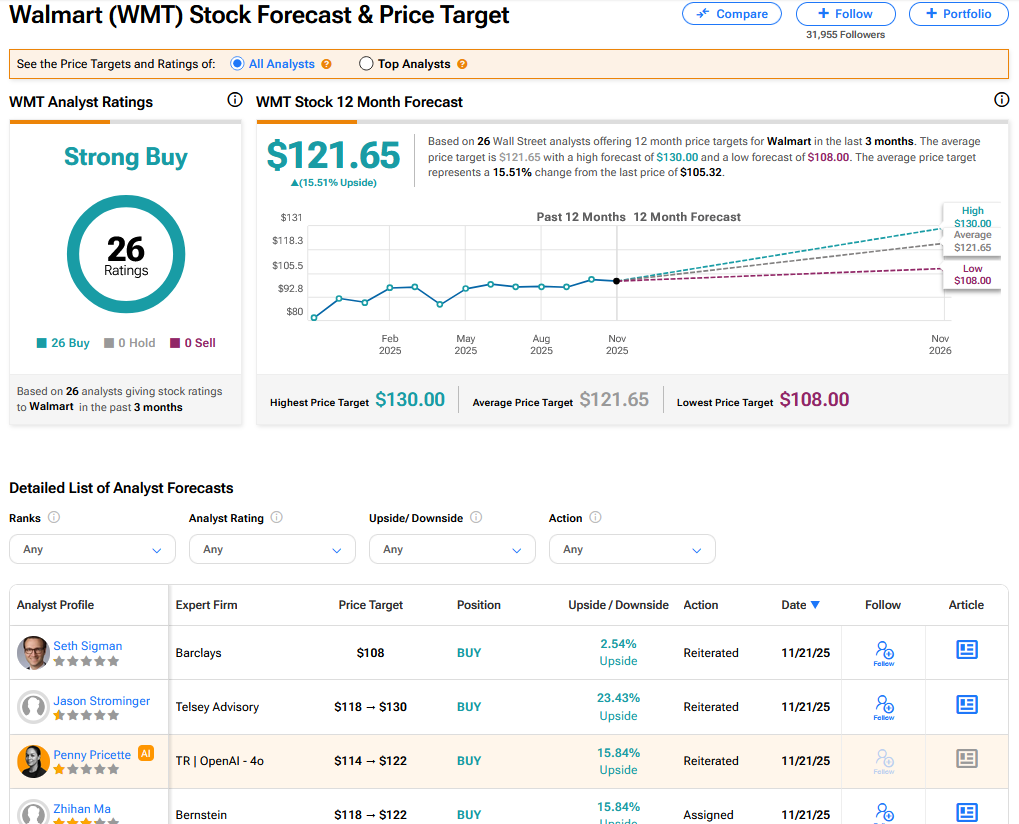

On TipRanks, WMT has a Strong Buy consensus based on 26 Buy ratings. Its highest price target is $130. WMT stock’s consensus price target is $121.65, implying a 15.51% upside.

See more WMT analyst ratings

Disclaimer & DisclosureReport an Issue