TAZEWELL, Va. (WVVA) – With the ringing in of the new year, numerous bills have been passed, and concerns are growing of how it’ll affect local businesses’ bottom line.

As soon as the clock struck midnight on December 31st, Virginia’s minimum wage increased from $12.41 per hour to $12.77 per hour.

The 36-cent raise has one local business owner feeling like the new bill is its own double-edged sword.

Joseph Damato, co-owner of The Happy Goat, said the wage increase presents both benefits and challenges.

“I mean, I guess that with the minimum wage, it’s a good thing and a bad thing because it’s good to have your employees get paid more, but it also is always difficult with rising costs of everything and with running a small business,” Damato said.

Damato shares that handling these kinds of economic shifts comes with owning a business and says he doesn’t foresee any major changes at least at The Happy Goat.

“I mean, I don’t think it will affect, ‘cause we’re not planning on necessarily raising prices currently. So it shouldn’t necessarily impact our business per se,” Damato said.

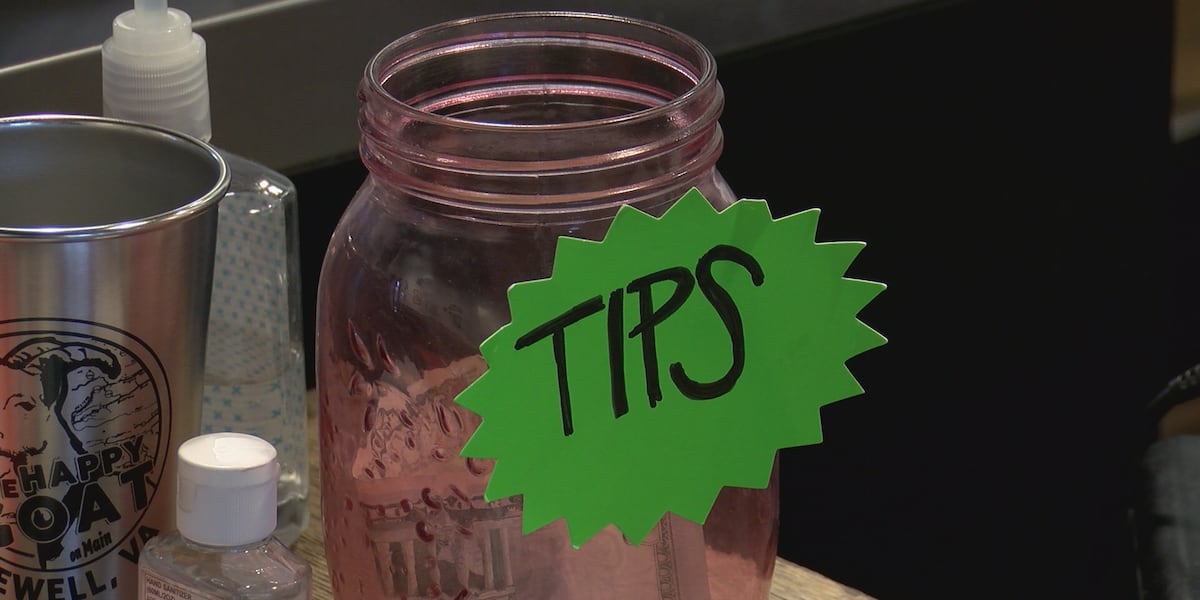

In addition to minimum wages rising in certain states, the elimination of taxes on tips was implemented January 1st.

With the new bill, Damato says he’s happy that it lets his employees get some extra cash in their pockets.

“I mean, there’s definitely positives for people getting more money on their paycheck for minimum wage and the taxes are hopefully used for good things,” Damato said.

Even though The Happy Goat plans to continue business as usual, Damato hopes that lawmakers consider the effect some bills will have on smaller businesses.

“I think it should be something that’s considered that it affects the small businesses more than the big corporations. So all the high taxes definitely make things more difficult for small business for sure,” Damato said.

The minimum wage in West Virginia stayed at $8.75.

Copyright 2026 WVVA. All rights reserved.