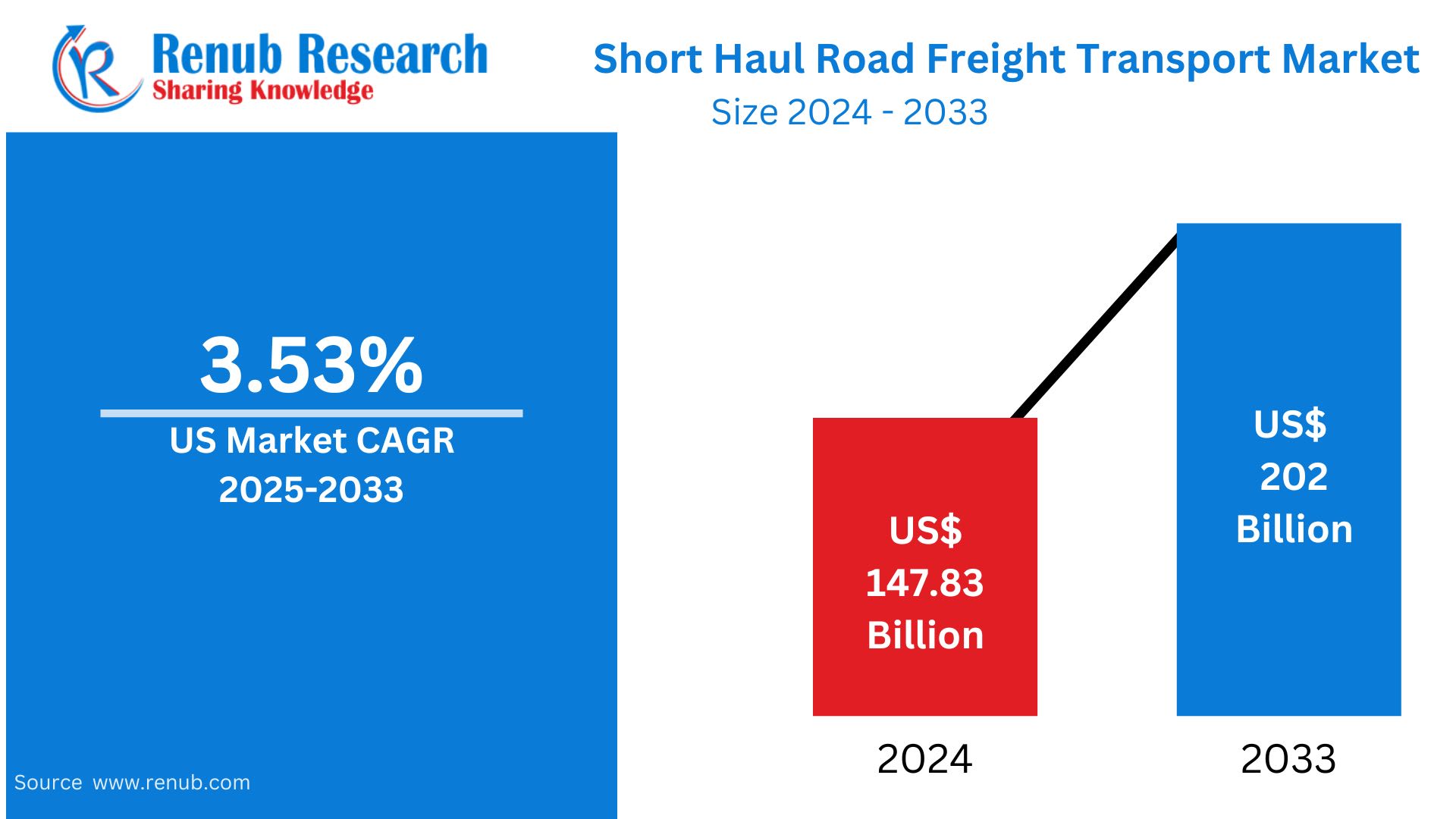

The United States Short Haul Road Freight Transport Market is on a steady upward trajectory, powered by the nation’s thriving e-commerce ecosystem, expanding manufacturing activities, and rapid advances in fleet management technologies. According to Renub Research, the market is expected to reach US$ 202 billion by 2033, rising from US$ 147.83 billion in 2024, growing at a CAGR of 3.53% from 2025 to 2033. This sustained demand reflects the critical role that short-distance freight plays in supporting modern supply chains, last-mile delivery, and urban logistics across the U.S.

Short haul road freight—typically involving distances under 300 miles—serves as the backbone of regional distribution networks. Whether it’s replenishing retail shelves, transporting food products, or delivering online orders to customers’ doorsteps, this segment ensures speed, flexibility, and operational continuity for businesses nationwide.

In this editorial, we explore the market dynamics, growth drivers, regional outlook, challenges, and recent developments that define the rapidly evolving U.S. short haul freight landscape.

United States Short Haul Road Freight Transport Industry Overview

Short haul road freight transport includes the movement of goods within limited geographic areas, often between neighboring towns, ports, warehouses, retail stores, and urban centers. It is particularly essential for:

Last-mile delivery

Perishable and non-perishable goods distribution

Just-in-time (JIT) inventory systems

Urban and suburban freight movement

The industry relies primarily on light commercial vehicles (LCVs), heavy commercial vehicles (HCVs), vans, and regional trucks, providing cost-efficient and fast transport solutions. Compared to long-haul trucking, short haul operations prioritize speed, agility, and high-frequency delivery cycles—critical elements for e-commerce, grocery distribution, pharmaceuticals, and FMCG companies.

As U.S. cities expand and consumer expectations for rapid delivery grow, short haul freight has become the nerve center of regional logistics. The rise of micro-fulfillment centers, on-demand delivery, and nearshoring manufacturing further deepens its relevance in America’s supply chain ecosystem.

Key Growth Drivers in the U.S. Short Haul Road Freight Transport Market

1. Explosive E-Commerce Growth

The continued rise of e-commerce is the single largest catalyst for short haul freight expansion. Online shoppers today expect fast, reliable, and flexible delivery options—ranging from same-day to next-day services. This trend requires a dense network of regional warehouses, micro-hubs, and fulfillment centers, all of which depend heavily on short haul transportation.

Promotional events, flash sales, and seasonal peaks amplify demand for frequent, route-optimized local deliveries. Retailers and logistics companies are expanding local distribution hubs to accelerate click-to-door speed, making short haul freight indispensable to maintaining customer satisfaction.

2. Technological Advancements and Digital Transformation

Technology is reshaping short haul logistics more rapidly than ever. Tools such as:

Fleet telematics

AI-based route optimization

GPS-enabled real-time tracking

Warehouse automation

Predictive analytics

are helping logistics companies cut fuel costs, enhance visibility, and reduce delivery times.

A landmark development occurred in September 2024, when FedEx partnered with Nimble, an AI robotics and autonomous fulfillment innovator, to enhance its omnichannel operations. FedEx’s extensive network—spanning over 130 warehouse facilities and processing 475 million returns annually—now uses Nimble’s autonomous tech to streamline local logistics, reinforcing the importance of digitally enabled short haul operations.

3. Growth of Just-in-Time (JIT) Inventory Systems

JIT inventory practices minimize storage costs and ensure goods are replenished only when needed. This increases the frequency of short haul deliveries across industries such as:

Automotive

Electronics

Retail

FMCG

Short haul freight plays a crucial role in JIT operations by enabling rapid movement between production sites, warehouses, and retail outlets. As more U.S. companies shift toward lean supply chain operations, the demand for flexible, reliable short haul services continues to grow.

Challenges Facing the U.S. Short Haul Road Freight Market

1. Rising Fuel Costs

Fuel remains a major operational expense for freight carriers. Short haul operations—characterized by frequent stops, idling in congested traffic, and lower fuel efficiency—are particularly vulnerable to fuel price volatility. Smaller operators face tighter margins and limited capital for fleet upgrades, making cost pressures even more significant.

While many companies are adopting fuel-efficient vehicles, electric fleets, and route optimization tools, volatile fuel prices continue to challenge overall profitability.

2. Congestion and Urban Delivery Restrictions

Urbanization is increasing, and so are the challenges associated with last-mile delivery:

Traffic congestion

Limited parking spaces

Strict delivery time windows

Low-emission zones

Vehicle size restrictions

Metropolitan areas like New York, Chicago, and Los Angeles enforce stringent policies that complicate route planning and raise delivery costs. To navigate these constraints, companies are turning to smaller vehicles, EVs, and advanced telematics—yet congestion remains a persistent bottleneck in short haul operations.

Regional Insights: Key U.S. States Driving Market Growth

1. California

As the nation’s most populous state, California is a vital hub for short haul logistics. With bustling cities such as Los Angeles, San Diego, and San Francisco, the state sees massive e-commerce-driven last-mile volumes. Its strong manufacturing, agriculture, and technology sectors further fuel demand.

However, California also presents challenges:

Severe urban congestion

Strict environmental regulations

Limited delivery windows

Companies are increasingly adopting electric trucks, innovative routing tools, and sustainable practices to remain compliant and competitive.

2. Texas

Texas’ vast land area and powerful industrial base make it a cornerstone of short haul road freight. Major metro regions—including Houston, Dallas, Austin, and San Antonio—generate strong demand in:

E-commerce

Retail

Energy and petrochemicals

Agriculture

The state’s expanding highway network supports efficient short haul movement, though long distances between cities and urban congestion pose operational challenges. Texas’ fast-growing population and business-friendly environment are expected to sustain market growth through 2033.

3. New York

New York’s dense urban population and high consumer demand make it a highly lucrative yet challenging short haul market. The New York City metro area drives enormous last-mile logistics needs across:

Retail & fashion

Food and beverages

Healthcare

E-commerce

Severe traffic congestion, strict regulations, and parking constraints create complexities for carriers. Logistics companies are increasingly investing in smaller delivery vehicles, electric fleets, and micro-fulfillment centers to manage intense urban delivery volumes.

4. Florida

Florida’s booming tourism industry, rapid population growth, and expanding retail sector fuel strong demand for short haul transport. Cities such as Miami, Orlando, and Tampa require consistent regional deliveries of:

Perishable goods

Pharmaceuticals

Consumer products

Weather-related challenges, such as hurricanes and seasonal fluctuations, impact operations. However, the state’s strategic ports and advancement in telematics tools are supporting growth in efficient short haul logistics.

Recent Developments Transforming the U.S. Short Haul Freight Market

August 2024 – FedEx Innovation in Digital Visibility

FedEx introduced advanced digital visibility tools that integrate real-time shipment data, predictive analytics, and premium post-purchase tracking. This innovation allows businesses to better manage delivery experiences and optimize logistics operations through:

Track API

Track EDI

Webhook subscription services

These upgrades strengthen FedEx’s capabilities in regional and last-mile logistics.

August 2024 – CEVA Logistics & Bolloré Logistics Integration

CEVA and Bolloré Logistics began operating under a consolidated brand. This union enhances CEVA’s footprint in multimodal logistics, including ground and road transport. The integration, supported by the implementation of CargoWise, is expected to elevate operational efficiency across short haul networks in the U.S.

Market Segments

Vehicle Type

Light Commercial Vehicles (LCVs)

Heavy Commercial Vehicles (HCVs)

Destination

Domestic

International

End-Use Applications

Manufacturing

Retail

Wholesale

Construction

Agriculture

Fishing & Forestry

Oil & Gas

Mining & Quarrying

Others

Distribution Channels

Home Centers

Specialty Stores

Online Channels

Hypermarkets & Warehouse Clubs

Others

State Coverage (29 Viewpoints)

Includes major states such as:

California, Texas, New York, Florida, Illinois, Pennsylvania, Ohio, Georgia, New Jersey, Washington, North Carolina, Massachusetts, Virginia, Michigan, Maryland, Colorado, Tennessee, Indiana, Arizona, Minnesota, Wisconsin, Missouri, Connecticut, South Carolina, Oregon, Louisiana, Alabama, Kentucky, and the Rest of the U.S.

Key Players in the U.S. Short Haul Road Freight Market

Schneider National, Inc.

DHL Group

FedEx

United Parcel Service of America, Inc. (UPS)

XPO, Inc.

Landstar System Inc.

PS Logistics

Knight-Swift Transportation Holdings Inc.

Ryder System, Inc.

These companies focus on technology adoption, operational optimization, network expansion, and sustainability to maintain competitiveness in a fast-evolving logistics landscape.

Final Thoughts

The United States Short Haul Road Freight Transport Market is entering a new era, shaped by digital transformation, evolving consumer expectations, and strategic infrastructure development. With the market projected to reach US$ 202 billion by 2033, short haul freight will continue to be a cornerstone of America’s logistics ecosystem.

From e-commerce acceleration to state-level innovations and the rise of electric vehicle fleets, the sector is set for steady, technology-driven expansion. Companies that invest in automation, sustainability, and dynamic route optimization will be best positioned to thrive in this competitive landscape.