Ultra High Purity (UHP) Valve Market Forecast and Outlook (2025-2035)

The ultra-high purity (UHP) valve market is projected to reach USD 615.4 million in 2025 and expand to USD 1,155.2 million by 2035, reflecting a compound annual growth rate (CAGR) of 6.5%. This growth is driven by increasing demand for precise fluid control in semiconductor manufacturing, pharmaceutical production, and chemical processing. UHP valves ensure minimal contamination, high reliability, and consistent performance in critical processes where purity standards are stringent. Rising adoption of advanced manufacturing processes and expansion of high-tech industries globally are fueling market growth. The trajectory demonstrates that UHP valves will remain indispensable components for industries requiring stringent contamination control and process optimization.

Quick Stats for Ultra High Purity (UHP) Valve Market

- Ultra High Purity (UHP) Valve Market Value (2025): USD 615.4 million

- Ultra High Purity (UHP) Valve Market Forecast Value (2035): USD 1,155.2 million

- Ultra High Purity (UHP) Valve Market Forecast CAGR: 6.5%

- Key Segment in Ultra High Purity (UHP) Valve Market: Semiconductor Processing (52.8%)

- Top Growth Regions in Ultra High Purity (UHP) Valve Market: China, India, Germany

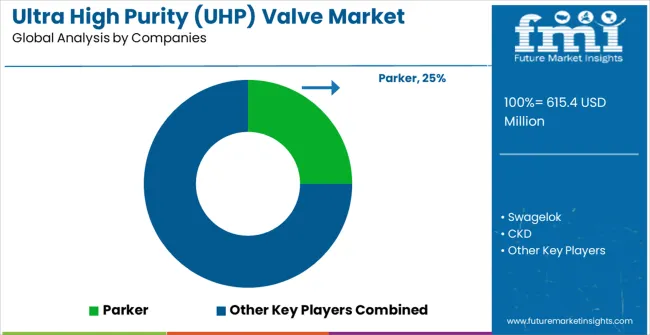

- Key Players in Ultra High Purity (UHP) Valve Market: Parker, Swagelok, CKD

Ultra High Purity (UHP) Valve Market Key Takeaways

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 615.4 million |

| Forecast Value in (2035F) | USD 1,155.2 million |

| Forecast CAGR (2025 to 2035) | 6.5% |

A key factor contributing to growth is the focus on technological precision and operational efficiency. Year-on-year growth shows steady upward momentum, with market values increasing from USD 449.2 million in 2023 to USD 615.4 million in 2025, and continuing to rise across the forecast period. Innovations in valve materials, sealing technologies, and flow control mechanisms enhance performance and durability. Partnerships between valve manufacturers and high-tech industry players are accelerating adoption. Additionally, global expansion in semiconductor fabrication plants, biopharmaceutical facilities, and chemical processing units supports the rising demand for UHP valves, ensuring reliable process control and regulatory compliance.

The ultra-high purity valve market is expected to reach USD 843.2 million by 2030 and eventually USD 1,155.2 million by 2035, reflecting a CAGR of 6.5%. Analysis of half-decade weighted growth reveals that market gains are not uniform across the decade; stronger growth is observed in the first and second halves of the period, driven by industrial expansions, technological upgrades, and new facility commissioning. Despite minor fluctuations, the long-term trend indicates sustained value accumulation.

Why the Ultra High Purity (UHP) Valve Market is Growing?

Market expansion is being supported by the rapid growth of semiconductor manufacturing worldwide and the corresponding need for ultra-pure fluid handling systems that can maintain contamination-free conditions throughout complex production processes. Modern semiconductor fabrication requires precise control of process gases, chemicals, and ultrapure water with contamination levels measured in parts per billion or lower. UHP valves provide the necessary sealing performance, material purity, and operational reliability to ensure optimal manufacturing yields and product quality in these demanding applications.

The growing complexity of pharmaceutical and biotechnology manufacturing processes is driving demand for UHP valve solutions that can maintain sterile conditions while providing precise flow control for critical applications. Advanced pharmaceutical production requires contamination-free handling of active pharmaceutical ingredients, biological materials, and specialized process fluids that demand the highest levels of purity and reliability. Regulatory requirements and quality standards are establishing stringent contamination control protocols that require specialized valve technologies with validated performance characteristics and comprehensive documentation.

Segmental Analysis

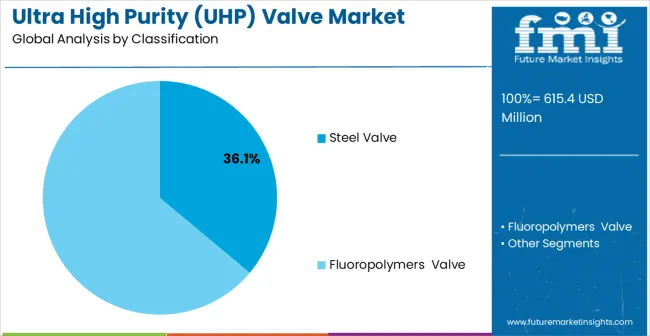

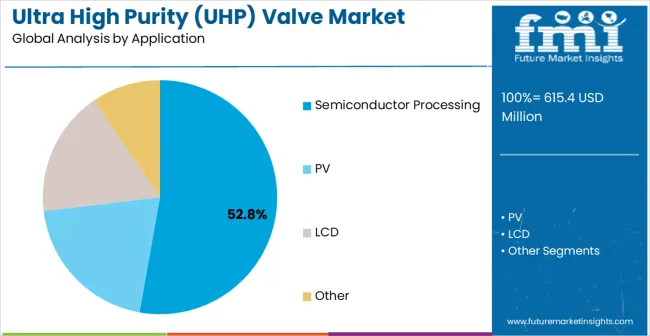

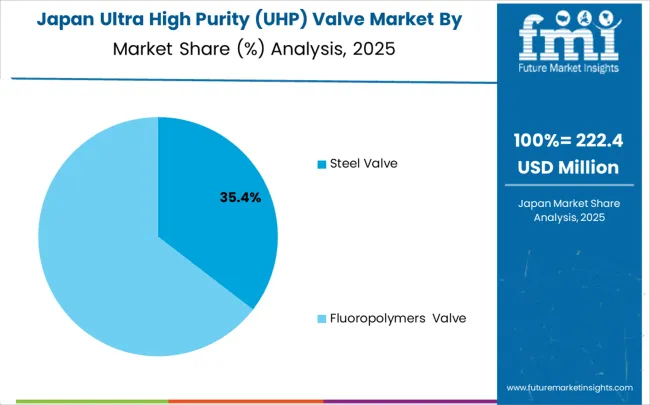

The market is segmented by material type, end-use, and region. By material type, the market is divided into steel valve and fluoropolymers valve. Based on end-use, the market is categorized into semiconductor processing, photovoltaic (PV), LCD, and others. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

By Material Type, Steel Valve Segment Accounts for 36.1% Market Share

Steel valves are projected to account for 36.1% of the ultra-high purity (UHP) valve market in 2025. This leading share is supported by the superior mechanical properties and cost-effectiveness of stainless steel materials in demanding high-purity applications. Steel UHP valves provide excellent corrosion resistance, high strength characteristics, and proven reliability in semiconductor and pharmaceutical manufacturing environments. The segment benefits from established manufacturing processes, comprehensive material specifications, and extensive qualification databases that facilitate adoption across diverse applications. Advanced steel alloys and specialized surface treatments enable superior contamination control performance while maintaining competitive cost structures for high-volume manufacturing applications.

Steel valve technology continues advancing through development of specialized surface finishing techniques, improved sealing systems, and enhanced material purity standards that meet evolving application requirements. The segment growth reflects increasing adoption of stainless steel solutions in expanding semiconductor fabrication facilities and growing pharmaceutical manufacturing operations. Manufacturers are developing next-generation steel valve designs with integrated sensors, advanced actuator systems, and comprehensive monitoring capabilities that support predictive maintenance and operational optimization in critical manufacturing processes.

By End-use, Semiconductor Processing Segment Accounts for 52.8% Market Share

Semiconductor processing applications are expected to represent 52.8% of ultra-high purity (UHP) valve demand in 2025. This dominant share reflects the semiconductor industry’s extensive use of UHP valves for process gas delivery, chemical distribution, and ultrapure water systems throughout fabrication facilities. Modern semiconductor manufacturing requires precise control of hundreds of different process chemicals and gases with contamination levels that can affect product yields and performance characteristics. The segment benefits from ongoing capacity expansion in semiconductor manufacturing and increasing complexity of advanced node technologies that require more sophisticated fluid handling systems.

Semiconductor industry transformation toward smaller geometries and advanced packaging technologies is driving significant UHP valve demand as manufacturers implement more stringent contamination control requirements and complex process sequences. The segment expansion reflects increasing emphasis on process reliability, yield optimization, and operational efficiency that depend on superior valve performance and contamination control capabilities. Advanced semiconductor applications are incorporating artificial intelligence monitoring, predictive maintenance systems, and comprehensive process analytics that require sophisticated valve technologies with enhanced connectivity and diagnostic capabilities.

What are the Drivers, Restraints, and Key Trends of the Ultra High Purity (UHP) Valve Market?

The ultra-high purity (UHP) valve market is advancing steadily due to increasing semiconductor manufacturing capacity and growing emphasis on contamination control in critical applications. However, the market faces challenges including high development costs, stringent qualification requirements, and complex material compatibility considerations. Technological advancement efforts and industry standardization programs continue to influence product development and market expansion patterns.

Integration of Smart Monitoring and Diagnostic Technologies

The growing integration of intelligent monitoring systems and predictive diagnostic capabilities into UHP valve designs is enabling real-time performance monitoring, automated fault detection, and proactive maintenance scheduling that enhance overall system reliability. Smart valve technologies provide comprehensive data analytics, remote monitoring capabilities, and integrated connectivity that support advanced process control and optimization strategies. These technological advances enable manufacturers to achieve higher levels of process reliability and operational efficiency while reducing maintenance costs and minimizing unplanned downtime.

Development of Next-Generation Materials and Surface Technologies

UHP valve manufacturers are developing advanced materials and specialized surface treatment technologies that provide superior contamination control performance while meeting evolving application requirements. Next-generation polymer materials, advanced coating systems, and specialized surface finishing techniques enable enhanced chemical compatibility, improved particle control, and extended service life in demanding applications. These material innovations support broader market adoption by providing enhanced performance characteristics that address specific application challenges and regulatory requirements.

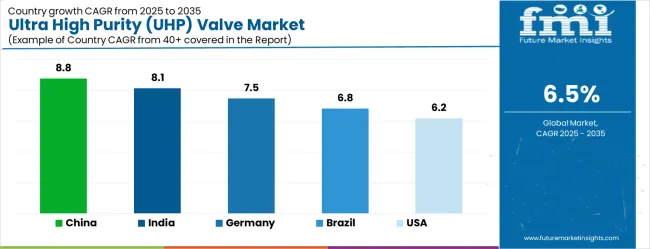

Key Country Analysis of Ultra High Purity (UHP) Valve Market

| Country | CAGR (2025-2035) |

|---|---|

| China | 8.8% |

| India | 8.1% |

| Germany | 7.5% |

| Brazil | 6.8% |

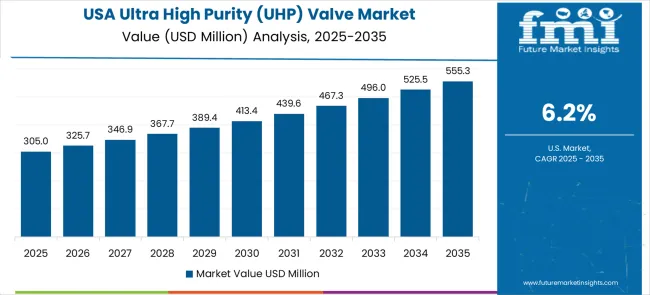

| United States | 6.2% |

| United Kingdom | 5.5% |

| Japan | 4.9% |

The ultra-high purity (UHP) valve market demonstrates varied growth patterns across key countries, with China leading at an 8.8% CAGR through 2035, driven by massive semiconductor manufacturing expansion, government technology initiatives, and growing pharmaceutical production capabilities. India follows at 8.1%, supported by increasing electronics manufacturing, expanding pharmaceutical sector, and growing foreign investment in high-technology industries. Germany records 7.5% growth, emphasizing advanced manufacturing technologies, precision engineering excellence, and comprehensive quality management systems.

Brazil shows steady growth at 6.8%, developing indigenous semiconductor capabilities and expanding pharmaceutical manufacturing infrastructure. The United States maintains 6.2% growth, focusing on semiconductor technology leadership and pharmaceutical innovation. The United Kingdom demonstrates 5.5% expansion, supported by biotechnology sector development and specialty manufacturing capabilities. Japan records 4.9% growth, leveraging technological leadership and precision manufacturing expertise.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

Analysis of Ultra High Purity UHP Valve Market in China

Ultra-high purity (UHP) valves market in China is projected to exhibit the highest growth rate with a CAGR of 8.8%, driven by unprecedented semiconductor manufacturing capacity expansion, government support for domestic technology development, and growing pharmaceutical production requirements. The country’s comprehensive semiconductor industry development strategy includes massive investments in fabrication facilities, advanced packaging operations, and supporting infrastructure that require sophisticated UHP valve solutions. Major technology companies and manufacturing conglomerates are establishing comprehensive supply chains that support domestic UHP valve production and technology development. Government initiatives promoting technological self-reliance are driving demand for indigenous UHP valve capabilities across semiconductor and pharmaceutical manufacturing sectors.

- Government semiconductor development programs are supporting UHP valve technology advancement through research funding, manufacturing incentives, and comprehensive technology transfer initiatives that accelerate domestic capability development across critical manufacturing sectors.

- Pharmaceutical manufacturing expansion is creating demand for specialized UHP valve solutions that support biotechnology production, active pharmaceutical ingredient processing, and sterile manufacturing operations.

Ultra-High Purity UHP Valve Market expansion in India

Revenue from ultra-high purity (UHP) valves in India is projected to expand at a CAGR of 8.1%, supported by rapid electronics manufacturing development, increasing pharmaceutical production capabilities, and growing foreign direct investment in high-technology industries. The country’s emphasis on becoming a global manufacturing hub is driving demand for UHP valve solutions that support semiconductor assembly, pharmaceutical production, and specialty chemical manufacturing operations. Government programs promoting electronics manufacturing are creating favorable conditions for UHP valve adoption across diverse industrial applications. Major international companies are establishing manufacturing facilities that require comprehensive UHP valve systems and technical support services.

- Electronics manufacturing initiatives are supporting UHP valve adoption through government incentives, infrastructure development programs, and comprehensive training initiatives that build domestic technical capabilities across semiconductor and electronics manufacturing sectors.

- Pharmaceutical sector expansion is creating opportunities for UHP valve suppliers that can provide comprehensive solutions including design support, qualification services, and ongoing technical assistance for diverse manufacturing applications and regulatory requirements.

In depth analysis of Ultra High Purity UHP Valve Market in Germany

Demand for ultra-high purity (UHP) valves in Germany is projected to grow at a CAGR of 7.5%, supported by the country’s leadership in advanced manufacturing technologies, comprehensive quality management systems, and emphasis on precision engineering excellence. German manufacturers are implementing sophisticated UHP valve solutions that meet stringent performance standards while supporting complex manufacturing processes across semiconductor, pharmaceutical, and specialty chemical industries. The country’s extensive research and development capabilities are driving innovation in UHP valve technology and application development. Automotive industry transformation toward electric vehicles is creating new demand for UHP valve applications in battery manufacturing and advanced materials processing.

- Advanced engineering capabilities are supporting development of next-generation UHP valve solutions that incorporate sophisticated materials, precision manufacturing techniques, and comprehensive testing protocols while meeting rigorous German quality and performance standards.

- Research and development programs are driving UHP valve technology advancement through collaborative initiatives between industry, academic institutions, and government organizations that address emerging application requirements and technological challenges.

Expansion strategy for Ultra High Purity UHP Valve Market in Brazil

Ultra-high purity (UHP) valves market in Brazil is projected to grow at a CAGR of 6.8%, driven by expanding pharmaceutical manufacturing capabilities, growing electronics sector development, and increasing emphasis on industrial modernization initiatives. Brazilian manufacturers are investing in UHP valve solutions to enhance production capabilities and meet international quality standards while supporting domestic market requirements. Government programs supporting industrial development are facilitating access to advanced manufacturing technologies and technical expertise. Regional manufacturing centers are developing specialized capabilities that support diverse UHP valve applications across pharmaceutical, electronics, and chemical processing industries.

- Industrial modernization programs are supporting UHP valve adoption through funding assistance, technical training initiatives, and comprehensive infrastructure development that enhances domestic manufacturing capabilities across diverse industrial sectors.

- Pharmaceutical sector development is creating demand for UHP valve solutions that support biotechnology production, sterile manufacturing operations, and active pharmaceutical ingredient processing while meeting international regulatory and quality requirements.

Demand forecast and sales forecast for Ultra High Purity UHP Valve Market in the USA

Demand for ultra-high purity (UHP) valves in the United States is projected to expand at a CAGR of 6.2%, driven by semiconductor industry leadership, pharmaceutical innovation capabilities, and ongoing technology advancement initiatives. American manufacturers are implementing advanced UHP valve solutions to maintain global competitiveness while supporting cutting-edge research and development programs. The biotechnology sector is driving significant UHP valve demand for specialized applications including cell therapy production, biopharmaceutical manufacturing, and advanced drug development processes. Government initiatives supporting domestic semiconductor manufacturing are creating substantial demand for UHP valve systems and technical support services.

- Technology leadership programs are supporting advanced UHP valve development through research funding, collaborative partnerships, and comprehensive innovation initiatives that address emerging application requirements and technological challenges across diverse industrial sectors.

- Semiconductor manufacturing expansion is driving demand for sophisticated UHP valve solutions that support advanced node technologies, specialized materials processing, and comprehensive contamination control requirements for next-generation manufacturing facilities.

United Kingdom outlook for Ultra High Purity UHP Valve Market

Ultra-high purity (UHP) valves market in the United Kingdom is projected to grow at a CAGR of 5.5%, supported by expanding biotechnology sector capabilities, pharmaceutical manufacturing development, and increasing emphasis on specialty chemical production. British manufacturers are investing in UHP valve solutions to support advanced pharmaceutical development, biotechnology research, and specialty manufacturing operations. The country’s strong academic research base is facilitating technology development and application innovation across diverse UHP valve applications. Government initiatives supporting life sciences sector development are creating favorable conditions for UHP valve adoption and technology advancement.

- Biotechnology sector expansion is supporting UHP valve adoption through government funding programs, research initiatives, and comprehensive infrastructure development that enhances domestic capabilities for advanced pharmaceutical and biotechnology manufacturing operations.

- Pharmaceutical manufacturing development is creating opportunities for specialized UHP valve solutions that support drug development processes, sterile manufacturing operations, and advanced therapeutic production while meeting stringent regulatory and quality requirements.

Outlook on Ultra High Purity UHP Valve Market in Japan

Revenue from ultra-high purity (UHP) valves in Japan is projected to expand at a CAGR of 4.9%, supported by advanced semiconductor technology development, comprehensive manufacturing expertise, and emphasis on precision engineering principles. Japanese manufacturers are implementing sophisticated UHP valve solutions that demonstrate superior performance characteristics while supporting diverse high-technology applications. The country’s electronics and semiconductor sectors are driving demand for advanced UHP valve technologies that support precision manufacturing processes and stringent contamination control requirements. Collaborative research programs between industry and academic institutions are developing innovative UHP valve technologies that maintain Japan’s competitive advantage in global high-technology markets. Quality management systems and continuous improvement principles are driving adoption of UHP valve solutions that enhance operational excellence and manufacturing reliability.

- Technological innovation programs are supporting development of advanced UHP valve solutions that incorporate cutting-edge materials, precision manufacturing techniques, and comprehensive performance validation while maintaining Japan’s reputation for manufacturing excellence and quality leadership.

- Semiconductor industry leadership is driving demand for sophisticated UHP valve technologies that support advanced manufacturing processes, emerging technology applications, and stringent contamination control requirements for next-generation electronic device production and advanced packaging operations.

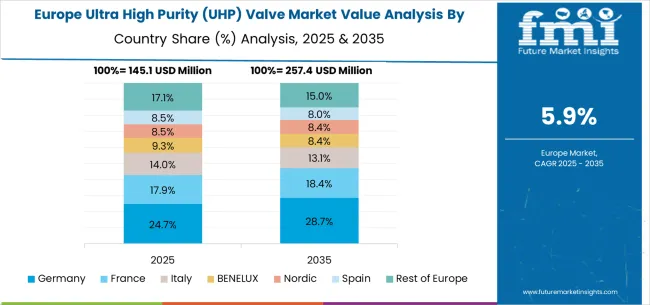

Europe Market Split by Country

The ultra-high purity (UHP) valve market in Europe is projected to grow from USD 166.7 million in 2025 to USD 312.8 million by 2035, registering a CAGR of 6.5% over the forecast period. Germany is expected to maintain its leadership with 32.8% market share in 2025, projected to grow to 33.4% by 2035, supported by its extensive semiconductor manufacturing infrastructure and pharmaceutical production capabilities. France follows with 18.9% market share in 2025, expected to reach 19.2% by 2035, driven by aerospace industry requirements and specialty chemical manufacturing operations.

The Rest of Europe region is projected to maintain stable share at 17.6% throughout the forecast period, attributed to emerging semiconductor manufacturing initiatives in Eastern European countries and expanding pharmaceutical production facilities. United Kingdom contributes 15.3% in 2025, projected to reach 15.1% by 2035, supported by biotechnology sector growth and specialty manufacturing applications. Italy maintains 15.4% share in 2025, expected to decline slightly to 14.3% by 2035, while other European countries demonstrate steady growth patterns reflecting regional industrial development and technology advancement initiatives.

Competitive Landscape of Ultra High Purity (UHP) Valve Market

The ultra-high purity (UHP) valve market is characterized by competition among specialized valve manufacturers, fluid handling technology providers, and precision engineering companies. Companies are investing in advanced materials technology, precision manufacturing capabilities, comprehensive testing facilities, and technical support services to deliver reliable, contamination-free, and high-performance valve solutions. Strategic partnerships, technological innovation, and application expertise development are central to strengthening product portfolios and market presence.

Parker Hannifin, USA-based, offers comprehensive UHP valve solutions with focus on semiconductor applications, advanced materials technology, and precision manufacturing capabilities. Swagelok, USA, provides specialized UHP valve systems emphasizing reliability, comprehensive support services, and application expertise across diverse industries. CKD Corporation, Japan, delivers advanced valve technologies with focus on precision control, contamination prevention, and comprehensive system integration capabilities.

SMC Corporation, Japan, emphasizes pneumatic and fluid control solutions with specialized UHP valve offerings for semiconductor and pharmaceutical applications. Entegris, USA, focuses on contamination control technologies and specialized valve solutions for critical applications. TK-Fujikin, Japan, provides precision valve technologies with emphasis on ultra-clean applications and advanced manufacturing processes. Saint-Gobain Performance Plastics offers specialized materials and valve components that support demanding high-purity applications across diverse industrial sectors.

Ultra High Purity (UHP) Valve Market – Stakeholder Contribution Framework

Ultra High Purity (UHP) valves represent precision-engineered flow control solutions critical for maintaining contamination-free environments in semiconductor fabrication, LCD manufacturing, and other high-tech processes. With the market expanding from $615.4M to $1,155.2M at 6.5% CAGR, driven by advanced semiconductor node transitions, display technology evolution, and stringent contamination control requirements, this specialized valve sector requires coordinated stakeholder efforts to address supply chain localization, material innovation, and process integration challenges.

How Governments Could Strengthen Domestic UHP Manufacturing Capabilities?

Advanced Manufacturing Incentives: Establish targeted subsidies and tax credits for domestic UHP valve manufacturing, recognizing these components as critical infrastructure for semiconductor and display industries essential to national technological competitiveness.

Materials Research Investment: Fund research into next-generation fluoropolymer coatings, ultra-clean steel alloys, and alternative materials that can withstand increasingly aggressive process chemistries while maintaining contamination levels below 1 ppb.

Quality Infrastructure Development: Invest in national metrology institutes and testing facilities capable of validating UHP cleanliness standards, particle detection at sub-nanometer levels, and trace metal contamination analysis that smaller manufacturers cannot afford independently.

Trade Policy Coordination: Implement strategic trade policies that protect domestic UHP valve manufacturing while ensuring access to specialized raw materials and components, balancing supply security with cost competitiveness.

Workforce Specialization: Support technical education programs focused on precision machining, clean assembly techniques, and contamination control principles specific to UHP applications, addressing the skills gap in ultra-precision manufacturing.

How Industry Standards Bodies Could Enable Market Expansion?

Contamination Control Standards: Develop unified cleanliness specifications across semiconductor, LCD, and emerging applications (solar, LED, bioprocessing) to enable suppliers to design products serving multiple end markets efficiently.

Material Qualification Protocols: Establish accelerated testing methods for new materials and coatings that predict long-term performance in corrosive process environments, reducing the traditional 2-3-year qualification cycles.

Interoperability Standards: Create common interface specifications for UHP valves across different equipment manufacturers, enabling end users to source from multiple suppliers and reducing vendor lock-in.

Performance Benchmarking: Define industry-standard metrics for valve performance including leak rates, particle generation, and chemical compatibility to enable objective supplier comparisons and drive continuous improvement.

Supply Chain Transparency: Develop traceability requirements for critical materials and components throughout the UHP valve supply chain, ensuring contamination sources can be identified and eliminated.

How Valve Manufacturers Could Capture High-Growth Opportunities?

Advanced Material Integration: Develop proprietary fluoropolymer formulations and surface treatments that extend valve life in next-generation plasma processes while maintaining ultra-low contamination levels required for sub-3nm semiconductor nodes.

Smart Valve Technology: Integrate sensors and IoT capabilities for real-time monitoring of valve performance, predictive maintenance, and process optimization, creating recurring revenue streams through data services and remote diagnostics.

Modular Design Architecture: Create configurable valve platforms that can be customized for specific applications while leveraging common manufacturing processes, reducing development costs and improving supply chain efficiency.

Regional Manufacturing Strategy: Establish localized assembly and testing facilities near major semiconductor and LCD manufacturing clusters to reduce lead times and provide rapid technical support for process optimization.

Application-Specific Innovation: Develop specialized valve designs for emerging applications including atomic layer deposition (ALD), extreme ultraviolet (EUV) lithography, and next-generation display manufacturing requiring unprecedented cleanliness levels.

How End-User Industries Could Optimize UHP Valve Performance?

Integrated Process Design: Collaborate with valve suppliers during fab planning to optimize valve placement, sizing, and specifications based on actual process requirements rather than over-conservative generic specifications.

Predictive Maintenance Programs: Implement condition monitoring and predictive analytics to optimize valve replacement schedules, reducing unplanned downtime while avoiding premature component replacement.

Supplier Partnership Development: Establish long-term strategic relationships with key valve suppliers including joint technology development, inventory management, and technical support to ensure component availability and performance optimization.

Process Chemistry Collaboration: Share process chemistry roadmaps and contamination sensitivity requirements with suppliers to enable proactive development of compatible materials and designs for future manufacturing nodes.

Performance Data Sharing: Participate in industry databases tracking valve performance across different applications and operating conditions to accelerate learning and improve specifications industry-wide.

How Financial Enablers Could Unlock Market Potential?

Advanced Manufacturing Investment: Finance specialized manufacturing equipment including ultra-clean machining centers, automated assembly systems, and contamination-controlled testing facilities that enable competitive UHP valve production.

Technology Development Funding: Support R&D investments in breakthrough materials, manufacturing processes, and testing methodologies that can significantly improve valve performance or reduce manufacturing costs.

Supply Chain Resilience Capital: Invest in diversified supplier networks and strategic inventory programs that ensure component availability during geopolitical disruptions or supply chain stress events.

Market Expansion Financing: Back companies expanding UHP valve applications into emerging sectors including renewable energy, biotechnology, and advanced materials processing where contamination control is becoming increasingly critical.

Acquisition & Consolidation Support: Finance strategic combinations that create suppliers with sufficient scale to serve global semiconductor and display manufacturers while investing in next-generation technologies and manufacturing capabilities.

Key Players in the Ultra High Purity (UHP) Valve Market

- Parker Hannifin

- Swagelok

- CKD Corporation

- SMC Corporation

- Entegris

- TK-Fujikin

- Saint-Gobain

Scope of the Report

| Item | Value |

|---|---|

| Quantitative Units (2025) | USD 615.4 million |

| Material Type | Steel Valve, Fluoropolymer Valves, and Other Materials |

| End-use | Semiconductor Processing, Photovoltaic (PV), LCD Manufacturing, and Other Applications |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Parker Hannifin, Swagelok, CKD Corporation, SMC Corporation, Entegris, TK-Fujikin, Saint-Gobain |

| Additional Attributes | Dollar sales by material type and end-use segments, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established valve manufacturers and specialized technology providers, buyer preferences for steel versus fluoropolymer valve solutions, integration with advanced semiconductor manufacturing processes and pharmaceutical production systems |