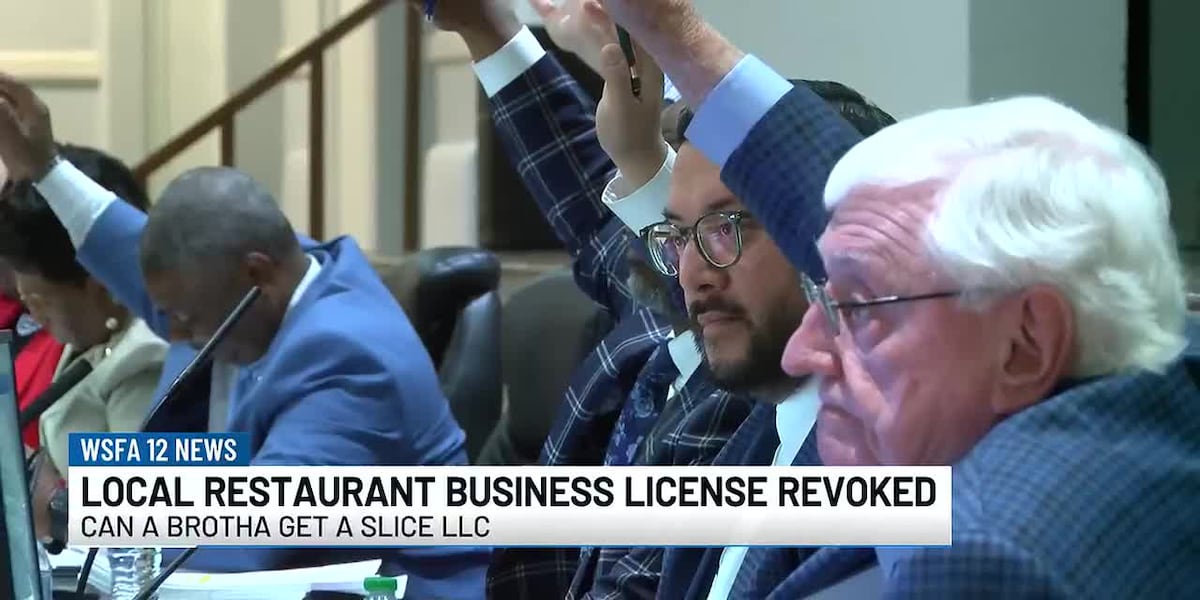

President Donald Trump speaks during the 56th annual World Economic Forum, in Davos, Switzerland, Jan. 21, 2026.

Jonathan Ernst | Reuters

President Donald Trump on Wednesday floated the idea of allowing depreciation — a yearly income tax deduction to recover certain property costs over a set period of time — for personal residences.

“The crazy thing is a person can’t get depreciation on a house, but when a corporation buys it, they get depreciation,” Trump said during an address at the World Economic Forum in Davos, Switzerland. “Okay, here’s something we’re gonna have to think about.”

However, it’s unclear how that idea might come to fruition, and whether the proposal has congressional support amid other legislative priorities.

How depreciation deduction works

Under current law, depreciation is permitted for business or income-producing rental property, but generally not for primary residences, with exceptions for business use.

The depreciation deduction is based on the property’s “basis,” or up-front purchase price plus improvements, and when it was “placed in service.” The annual tax break also depends on the accounting method used, which outlines how many years the owner has to recover the cost basis.

If the property is later sold at a profit, the IRS recoups some of the deduction claimed, known as “depreciation recapture.”

Trump’s comments follow other housing affordability efforts, including an executive order signed Tuesday to ban large institutional investors from buying single-family homes.

The cost of living has become a key theme among policymakers as many Americans struggle to pay for housing, health care, food and other living expenses. Both parties are focused on household economic issues as Republicans seek to defend a razor-thin House majority during a mid-term election year.