U.S. e-commerce crossed $10 trillion in cumulative sales during Q3 2025, reaching a milestone that reveals something far more significant than the raw figure suggests. Since the Department of Commerce began tracking e-commerce in 1999, the market has evolved through three remarkably consistent growth phases, disrupted only twice by global crises, with just five outlier quarters across 25 years of data.

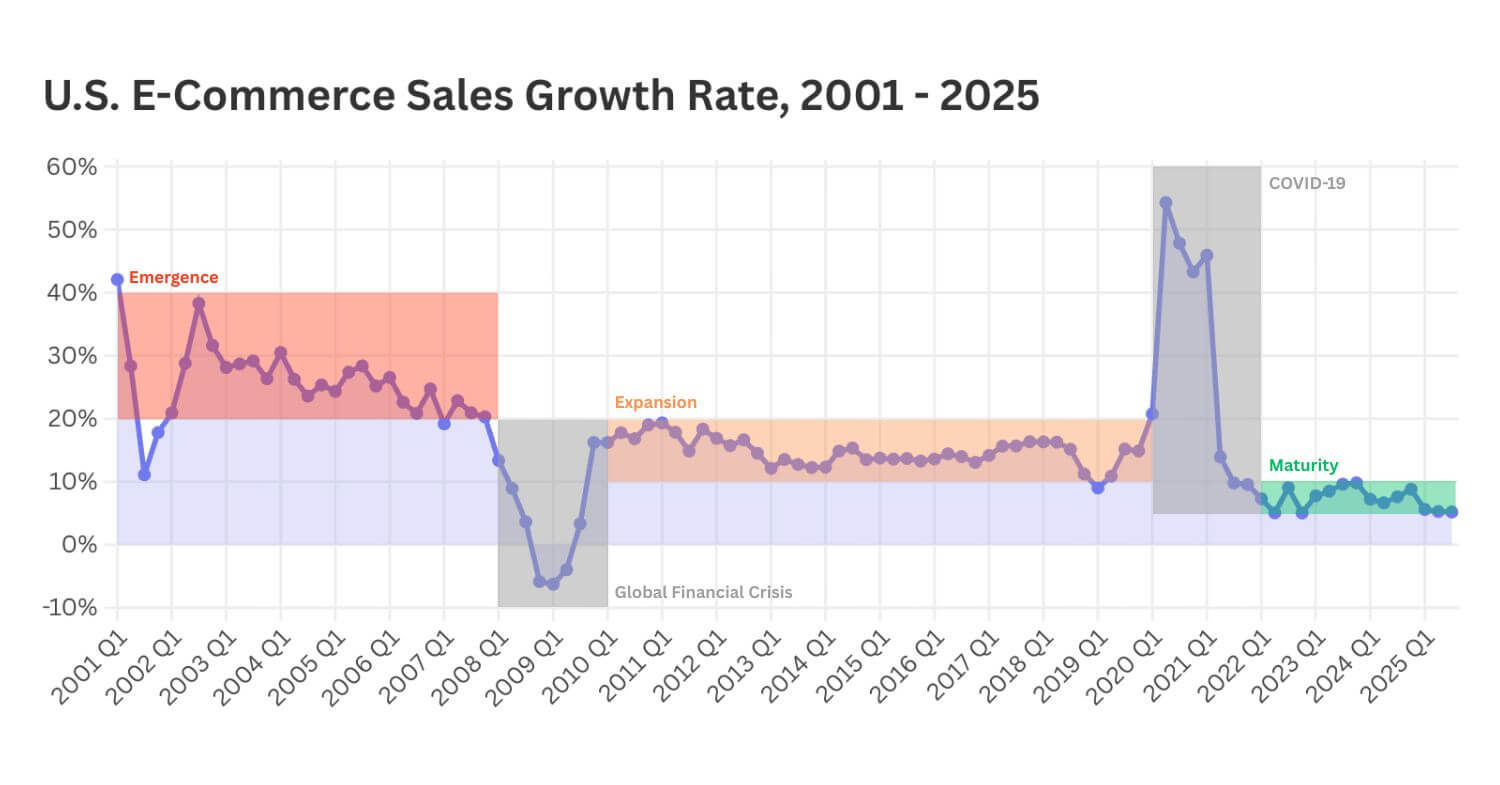

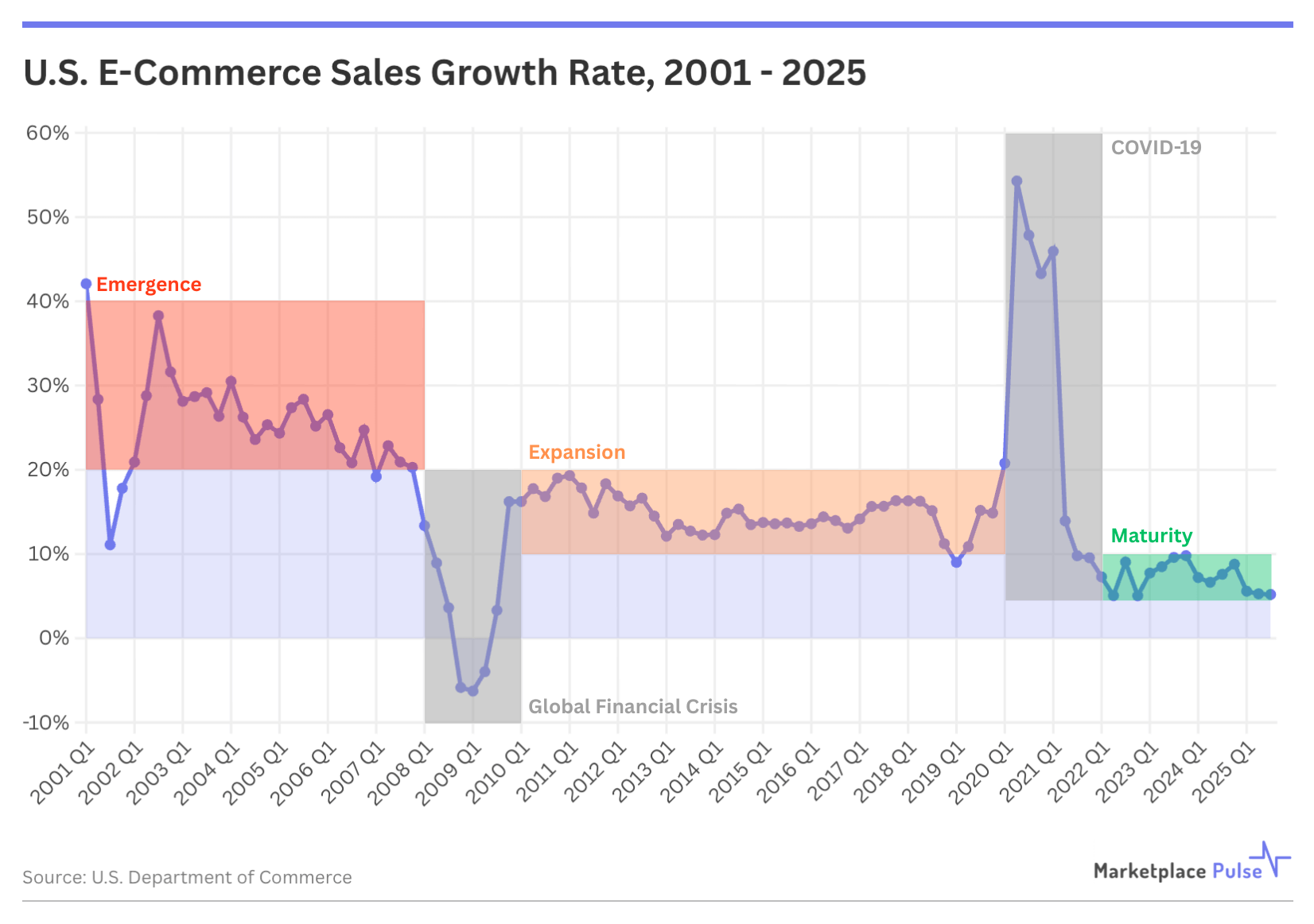

The pattern is striking in its predictability. The emergence phase, from 2001 to 2007, delivered 20-40% quarterly growth rates in nearly every quarter as online shopping transitioned from novelty to necessity. The expansion phase, spanning 2010 to 2019, sustained 10-20% growth across all but one quarter. The current maturity phase, beginning in 2022, has registered exclusively 5-10% growth rates. Only the 2008-2009 financial crisis and 2020-2021 pandemic temporarily disrupted this otherwise linear progression, with just 2019 Q1 falling outside the established ranges over the past 18 years.

The market’s absolute scale now dwarfs its early years. U.S. e-commerce generates in one quarter what took the first five years of record-keeping combined to achieve – the $275 billion transacted in Q3 2025 alone surpasses the $270 billion cumulative total through Q2 2005. The 5.2% quarterly growth rate represents the new baseline for a mature market, far below the 20-40% rates that characterized e-commerce’s emergence, yet delivering more absolute dollars in a single quarter than entire years once produced.

This return to predictable patterns came only after the industry corrected a fundamental miscalculation: treating crisis-driven adoption as permanent change. Both the 2008-2009 financial crisis and the 2020-2021 pandemic created dramatic short-term disruptions, yet e-commerce recalibrated to its underlying trajectory within two years of each event. The pandemic boost wasn’t a step-change but borrowed growth that has now reverted to the mean. The recently released Q3 data confirms this reversion is complete. E-commerce penetration has returned to levels consistent with its pre-pandemic trajectory, though the rate of total retail share gain continues to decelerate as the market matures. The five-year detour through crisis and correction has essentially returned the industry to its natural growth path.

What distinguishes this mature phase extends beyond decelerated growth rates, though. The competitive landscape has fundamentally transformed. Active seller counts on Amazon declined 25% from peak levels, while the number generating $100 million+ annually quadrupled. Amazon seller registration rates have declined as casual sellers exit, leaving an ecosystem where operational excellence determines survival. The bar for execution has never been higher. Sellers must now master advertising optimization, AI-enabled operations, complex supply chains, and multi-platform strategies simultaneously. Yet for those who clear that bar, opportunity has never been greater, with traffic per active Amazon seller up 31% since 2021 as numerical competition decreases.

The mature market’s 5-10% growth trajectory represents sustainable expansion in an industry that has completed its transition from experimental channel to infrastructure. The $10 trillion milestone marks not just cumulative achievement but the establishment of a mature market baseline where, absent unforeseen global disruptions, growth rates will likely remain in the 5-8% range for the foreseeable future. Growth at these rates still compounds meaningfully. The next $10 trillion will arrive faster than the first, even as percentage growth rates continue to decelerate – a function of the dramatically expanded base.