HONG KONG — Alice Zhang, a 29-year-old marketer in the southern Chinese city of Guangzhou, spent only roughly half what she did last year during the “Singles’ Day” online shopping festival, switching to cheaper choices and giving up on buying new shoes after pay was cut by more than 20%.

That’s typical, analysts say, of the trend for the extended discount campaign that is China’s equivalent to Black Friday sales, initiated by China’s Alibaba in 2009 as a 1-day event on Nov. 11 — Double 11 in Chinese parlance, and considered a symbol of unattached singles.

“I’ve made a conscious effort to cut back,” said Zhang, who spent around $421 this year.

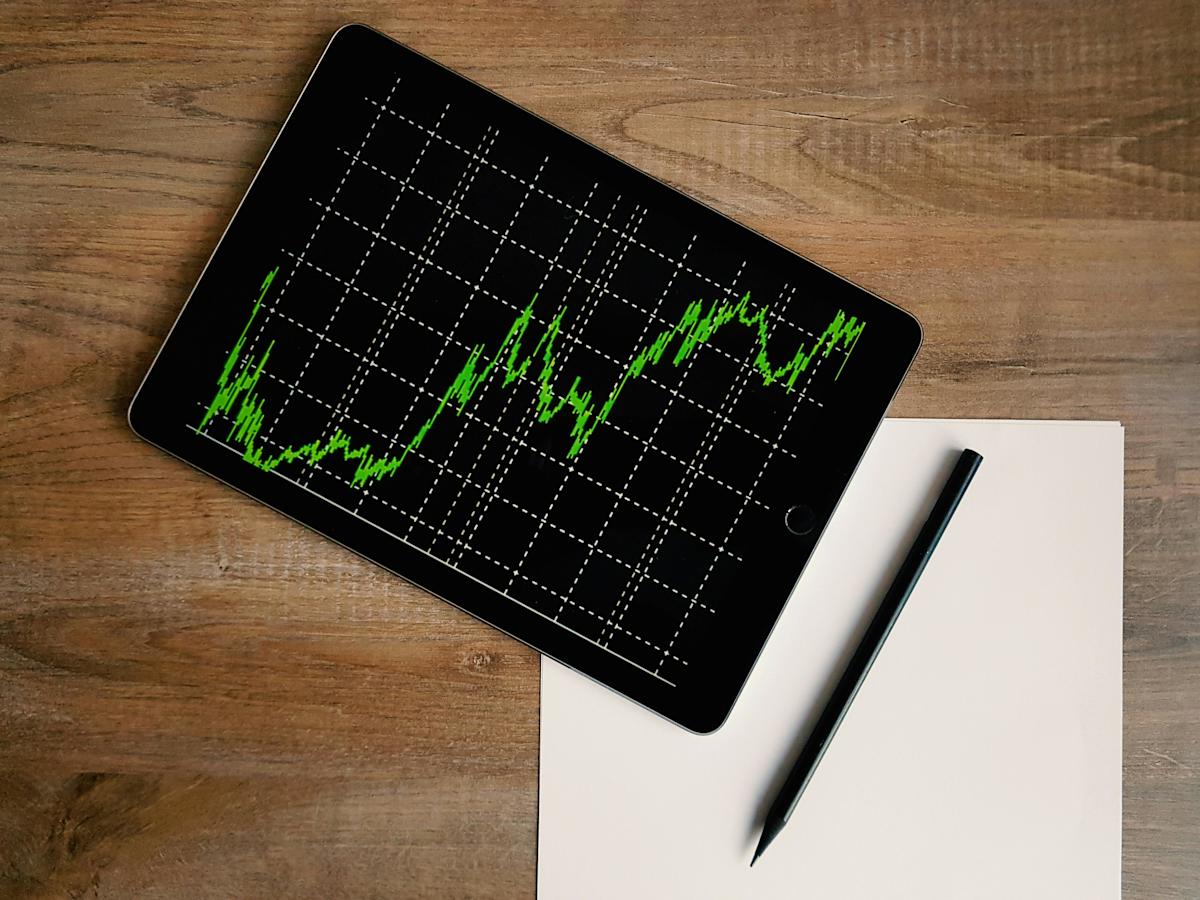

Sales during Singles’ Day jumped almost 18% from a year earlier but the pace of growth slowed as bargain hunters opted for more affordable deals.

Consumers have been tightening their belts, spending cautiously due to a prolonged slump in the property market, lagging wages and high unemployment among the young Chinese population who usually would be most likely to splurge on online purchases.

Singles’ Day spending is closely watched by observers and economists as an indicator for the wider economy. This year, the sales period began as early as Oct. 9, several days earlier than in 2024, and finished this week.

Chinese retail data provider Syntun said Wednesday that the estimated combined sales value for this year’s online retail bonanza reached almost $238 billion.

The almost 18% increase in sales was just over half the nearly 27% increase in 2024, when sales totaled roughly $202.5 billion.

Syntun noted that the comparison was not direct, since this year’s festival was roughly a week longer. Analysts said that was partly to help prop up sales for the e-commerce companies at a time of softer demand.

“This year’s Singles’ Day should be viewed as a positive signal for China’s consumer economy,” said Jacob Cooke, CEO of the consultancy WPIC Marketing + Technologies.

“The longer sales window means year-on-year comparisons are imperfect, but the underlying indicators — strong participation, high engagement, and broad category strength — show that consumers are still spending,” Cooke said.

Consultancy Bain & Company said in a recent report that Singles’ Day’s “once-stellar growth” has been maturing over the past several years. Increasing sales beyond current high levels may be tough, partly because of the sluggish economic climate, it said.

Still, JD.com, one of China’s biggest e-commerce platforms, said its turnover reached a record high, with a nearly 60% jump in the number of orders and a 40% increase in the number of shoppers.

It did not provide further details or say how much of that increase came from inside China versus overseas. Fashion, beauty and sports items were among the best sellers, JD.com said.

Alibaba’s Tmall and Taobao e-commerce platforms have not disclosed their total sales figures, although the company said some merchants achieved “more than 100%” growth in terms of sales compared with before the festival began.

Many Chinese consumers were hesitant to spend big.

“Apart from daily necessities, I don’t need to buy any big items,” said Zhang Shijun, a 45-year-old Beijing-based staffer at a vocational training institution. “I still need to buy some clothes for my family, because winter is coming.”

Sonia Song, a freelance media worker who also lives in Guangzhou, is among many who suspect retailers hike their prices to exaggerate the discounts they offer during the Singles’ Day sales.

She puts way more effort into researching apparent bargains than she used to, watching livestreaming platforms like Douyin and Xiaohongshu to compare prices with sites like Taobao or JD.com.

“I’ll only buy what’s cheapest or most cost-effective now,” said Song.

Also reducing the appeal of Singles’ Day discounts, the Chinese government has been paying rebates to people who trade in home appliances and vehicles to buy new ones.

“The logic is fairly simple. For example, if you bought a new washing machine earlier in the year at a discount, further discounts, no matter how steep, are not likely to attract new purchases,” said ING’s Song.

Information for this article was contributed by Chan Ho-Him, Shihuan Chen and Yu Bing of The Associated Press.