When a letter from the City of Los Angeles arrived in September, Chelsie Rivera thought it was a mistake.

“I was very confused,” Rivera said. “I didn’t really understand what it was.”

Rivera said she received a notice saying she might have to file as a business and demanded records of her earnings tied to a job at the nonprofit art gallery Junior High, which is actually in Glendale.

“Because the team is so small, they don’t pay out their employees with a W-2. They pay them out with a 1099,” Rivera explained. “The letter came asking for my records from 2022 to 2023.”

She’s not alone.

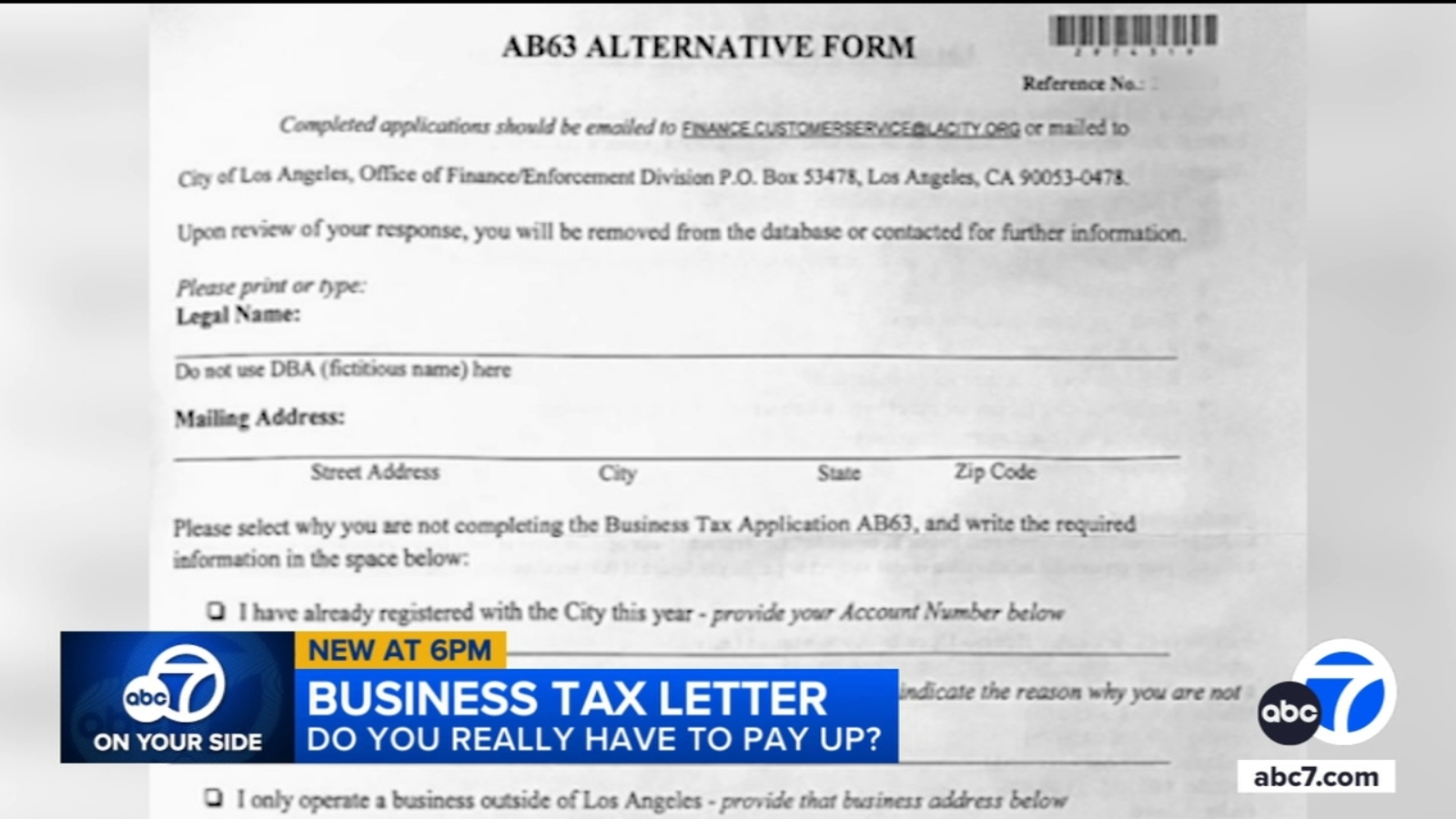

If you’re a gig worker, independent contractor or anybody who gets a 1099, you may have gotten a letter in the mail from the City of Los Angeles saying you owe a business tax. Many people have taken to social media saying they got similar notices in the mail — even though they don’t run a business.

The City of Los Angeles sent us a statement, which says in part: “Independent contractors, who often operate as individuals and receive 1099s, are taxable under the City’s business tax. I don’t know the specific situations of the people you’ve spoken to, but it is very possible that they owe business tax even though they do not own a “business”.

The city’s website says, “small businesses with fewer than $100,000 in receipts per year, as well as creative artists and non-profit/charitable organizations, may not need to pay business taxes.”

Certified Public Accountant Armine Alajian said, “Right now, the City of L.A. needs money. So they’re targeting everyone that has any sort of nexus with the city.”

Alajian said the key is in the fine print.

“If you’re a target, they’re sending letters saying you owe taxes. If you read carefully, it says estimated taxes,” she explained. “It doesn’t mean you owe. It just means you need to register.”

For some the letter feels threatening-and unclear.

“I sent in a response, so I’m waiting… and I’m hoping that another shoe doesn’t drop,” Rivera said. “Because, you know, with the city, you never know what they’re going to make you pay.”

If you get one of these notices, CPAs say don’t ignore it. You may only need to register and file and you might not owe anything.

“Don’t automatically assume you owe this and pay them,” Alajian said. “I’m sure a lot of people would. They’re like, ‘Oh, here.’ But, that doesn’t mean it’s right.”

Copyright © 2025 KABC Television, LLC. All rights reserved.