- Wondering whether lululemon athletica is ripe for a comeback or still overpriced? Here is a closer look at what is happening beneath the surface to help inform your perspective.

- In just the last week, lululemon’s share price has surged 9.6%. This is a notable move after a much tougher year, with the stock still down 43.1% over the past twelve months.

- Investors are watching closely as headlines highlight the company’s global expansion plans and partnerships, which are fueling renewed excitement. This recent momentum builds on news indicating a shift in sentiment and potential new growth opportunities for lululemon.

- For those focused on value, lululemon scores a solid 5/6 on our valuation checks, suggesting the market may not be fully recognizing the company’s potential. Here is a look at what that means and why traditional methods might only be part of the overall valuation picture.

Find out why lululemon athletica’s -43.1% return over the last year is lagging behind its peers.

Approach 1: lululemon athletica Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model projects the company’s future cash flows and then discounts them back to today’s value. This provides investors with an idea of what lululemon athletica might be worth based on its potential to generate cash over time.

For lululemon athletica, the model begins with its current Free Cash Flow (FCF) of $1.16 billion. Analysts provide estimates for the next five years, showing moderate growth, and further projections up to 2035 are used to outline possible long-term performance. By 2030, simplywall.st projects lululemon’s annual FCF will reach $1.60 billion, indicating consistent increases each year.

With this approach, the DCF calculation estimates lululemon athletica’s fair value at $253.52 per share. This is a 28.2% discount compared to its recent share price, suggesting the stock may be undervalued by the market according to these cash flow forecasts.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests lululemon athletica is undervalued by 28.2%. Track this in your watchlist or portfolio, or discover 932 more undervalued stocks based on cash flows.

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for lululemon athletica.

Approach 2: lululemon athletica Price vs Earnings

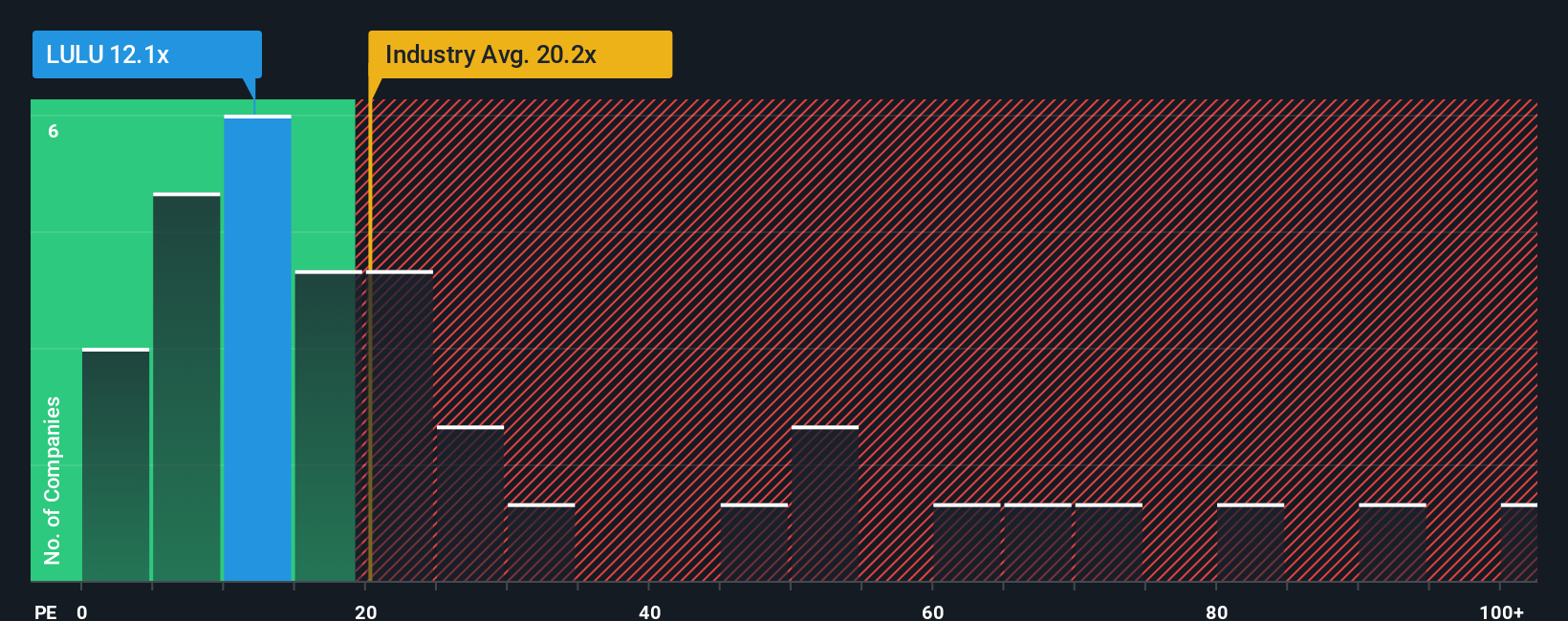

For well-established, profitable companies like lululemon athletica, the Price-to-Earnings (PE) ratio is a widely used valuation tool. The PE ratio helps investors compare how much they are paying for each dollar of the company’s earnings. This makes it especially useful when analyzing companies that reliably generate profits.

Growth expectations and risks are key factors influencing what is considered a “normal” or “fair” PE ratio. Companies growing quickly with strong future prospects typically command higher PE multiples. Those facing uncertainty or slowdowns are valued at lower multiples to reflect increased risk.

Currently, lululemon’s PE ratio stands at 12.1x. This is much lower than the industry average PE of 20.2x and the peer group average of 47.9x. While these benchmarks are useful starting points, they do not always account for lululemon’s specific growth rates, risk profile, profit margins, and relative market size.

This is where Simply Wall St’s Fair Ratio comes in. This proprietary metric sets a “fair” PE ratio by factoring in lululemon’s earnings growth, industry characteristics, profitability, risks, and market capitalization. Unlike broad peer or industry averages, the Fair Ratio offers a more customized and accurate picture of what investors should expect.

In lululemon’s case, the Fair Ratio is 15.7x. With the stock trading at a PE of 12.1x, this points to the company being undervalued based on expected earnings, risk, and growth potential.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1441 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your lululemon athletica Narrative

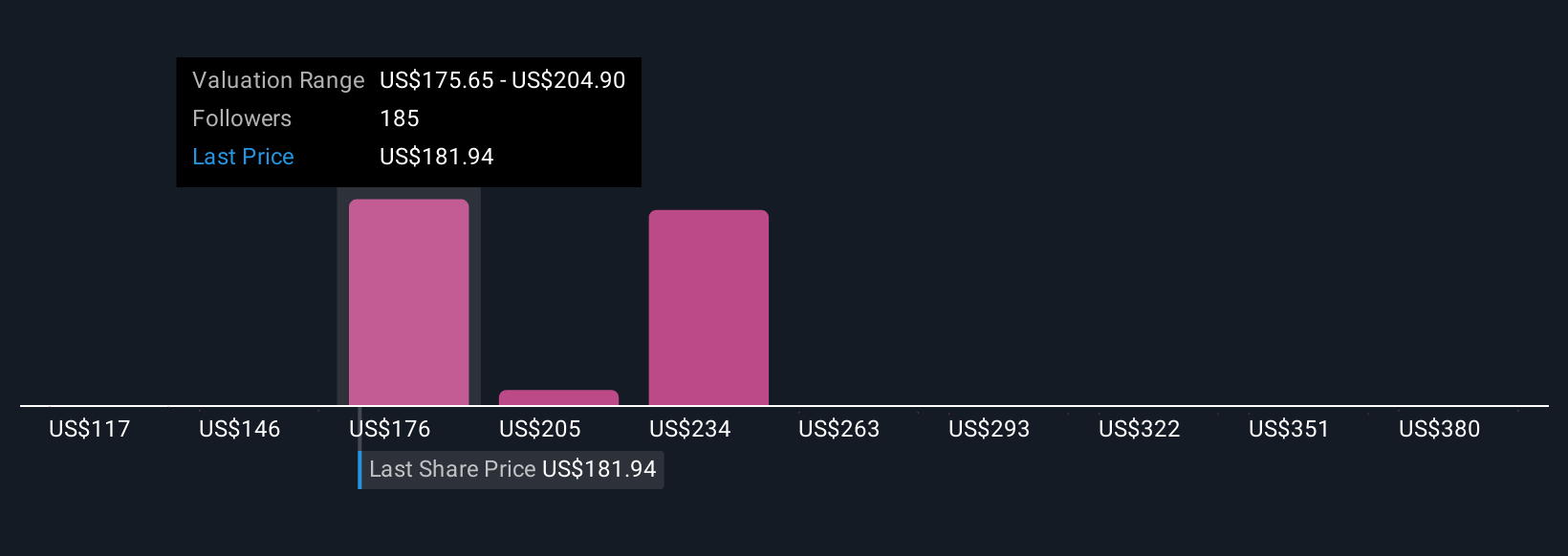

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your personalized story about a company, where you outline how you believe lululemon athletica will perform in the future, connecting your expectations for growth, profitability, and risks to a specific fair value. Narratives go beyond the numbers by capturing your perspective on why the company might succeed or struggle, blending financial forecasts with real-world developments.

On Simply Wall St, Narratives are simple and accessible tools used by millions of investors in the Community page. When you create or follow a Narrative, you can clearly see how your fair value compares to the current share price. This makes it easier to decide whether to buy, hold, or sell based on your own convictions.

Narratives are kept up to date as fresh news and earnings results come in, giving you a living, breathing investment thesis that evolves with the market. For example, some users see strong brand loyalty and global growth driving lululemon’s fair value above $225, while others focus on slowing U.S. trends and risk, setting their expectations closer to $100. Narratives help every investor connect the story they believe in with the numbers that matter.

Do you think there’s more to the story for lululemon athletica? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if lululemon athletica might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free Analysis

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com