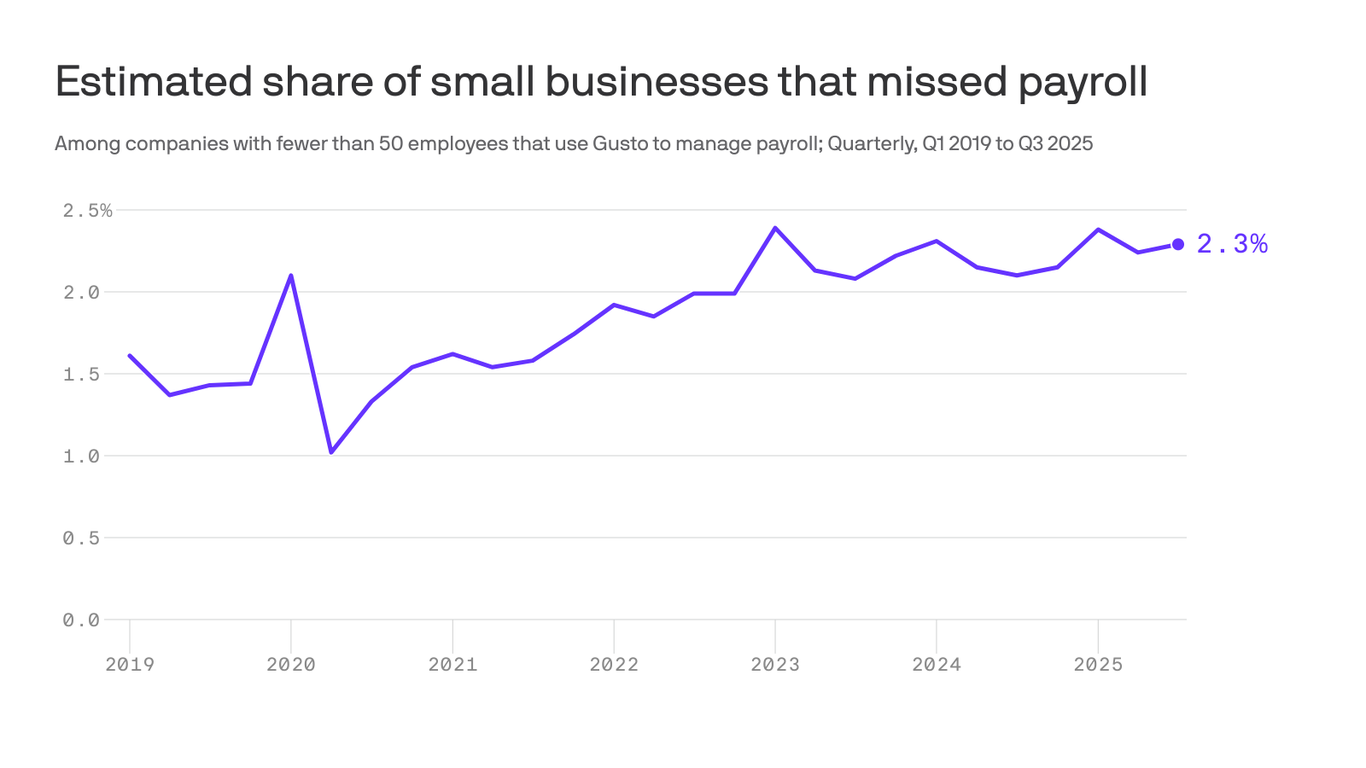

- The IRS announced new federal income tax brackets for 2026.

- The standard deduction is also increasing, saving taxpayers more money.

- Here’s what the new tax brackets look like.

Federal income tax brackets and the standard deduction are about to look a little bit different in the US.

The Internal Revenue Service announced changes to the tax code on Thursday, driven by both inflation adjustments and President Donald Trump’s “Big Beautiful Bill.”

The standard deduction for married couples filing jointly is set to increase to $32,200, a $700 increase from the $31,500 deduction this year.

For single filers, the deduction is increasing by $350, up to $16,100 in 2026 from $15,750 this year.

The changes will begin in 2026, meaning taxpayers will notice the changes when they file their taxes in 2027.

Here’s how the tax brackets are changing for single filers:

And here’s how they’re changing for married couples filing jointly: