Thinking about what to do with Chipotle Mexican Grill stock right now? You are definitely not alone. The restaurant chain’s shares have been anything but quiet lately. After a small bounce of 2.4% over the last week, the stock is still down 3.5% for the past month, and the longer-term numbers have investors raising their eyebrows. We are talking about a year-to-date drop of 32.8% and a 29.0% slip for the trailing year. On the bright side, stepping back further reveals gains of 33.6% over three years and 57.1% for the last five, showing the company’s staying power through more than a few market swings.

So, what is driving these moves? While restaurant stocks have been facing some headwinds from changing consumer patterns and some sector-wide volatility, Chipotle’s resilience keeps it on many watchlists. At the same time, those price dips may be making some investors wonder whether there is an opportunity hiding in plain sight or if the current risks still outweigh the potential reward.

Digging into the numbers, Chipotle currently clocks a valuation score of 1 out of 6, indicating it is undervalued in just one major yardstick. Is that a sign to buy the dip or a caution flag? In the next sections, we will walk through the different methods for sizing up Chipotle’s value and hint at an even better lens for understanding what this stock might be really worth.

Chipotle Mexican Grill scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Chipotle Mexican Grill Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s value by projecting its future cash flows and then discounting those figures back to their present-day value. By focusing on fundamentals instead of short-term price moves, DCF helps investors get a sense of what a business is really worth based on how much cash it is expected to generate.

For Chipotle Mexican Grill, the current Free Cash Flow stands at $1.45 Billion. Analyst estimates suggest that this will grow year over year, reaching $2.63 Billion by the end of 2029. These projections combine both official analyst estimates for the next five years and further extrapolations for the years after that.

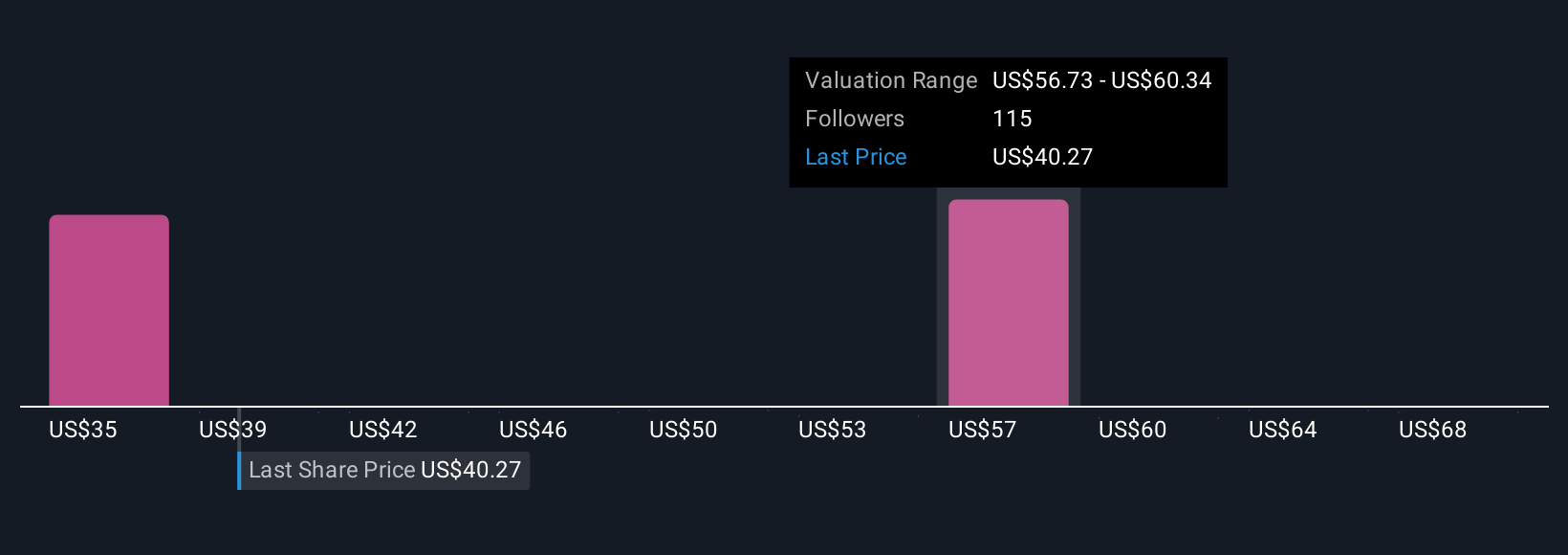

Based on these forecasts, the DCF approach calculates an intrinsic fair value for Chipotle shares of $35.13. This result is 14.6% lower than the current share price, which means the stock currently trades above its calculated true value using this method.

Result: OVERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Chipotle Mexican Grill.

Our Discounted Cash Flow (DCF) analysis suggests Chipotle Mexican Grill may be overvalued by 14.6%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Chipotle Mexican Grill Price vs Earnings

The Price-to-Earnings (PE) ratio is a tried and tested way to value profitable companies like Chipotle Mexican Grill, as it connects the company’s share price directly to its earnings power. Investors see the PE ratio as a quick gauge of how much they are paying for a dollar of earnings. This makes it a go-to metric for comparing businesses with solid bottom lines.

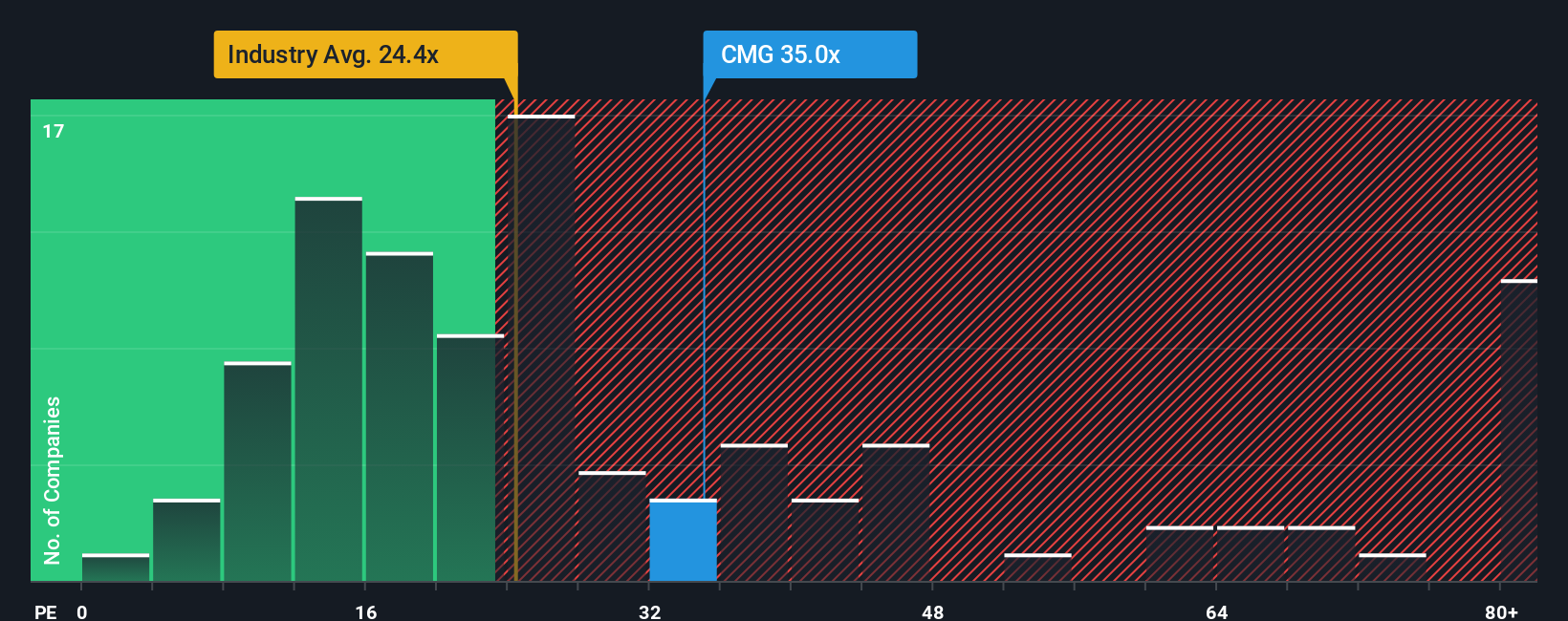

But what is a fair PE ratio? This depends on a company’s expected earnings growth and its perceived risk. Businesses slated for faster expansion or those considered safer investments often command higher multiples. Slower growers or riskier companies tend to have lower ones. The current PE ratio for Chipotle is 35.0x, which is noticeably higher than both the hospitality industry average of 24.4x and the peer average of 28.2x.

This is where Simply Wall St’s “Fair Ratio” comes in. Unlike standard peer or industry comparisons, the Fair Ratio is a proprietary benchmark based on Chipotle’s specific growth outlook, margin profile, market cap, risks, and industry landscape. For Chipotle, the Fair Ratio sits at 30.0x, which suggests that the current market price is set a bit above what these underlying fundamentals would justify.

Comparing the Fair Ratio to the actual PE ratio, the difference is about 5x. This points to a stock that is priced higher than what its own metrics would typically command.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Chipotle Mexican Grill Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is simply your perspective or story about a company, connecting what you believe about Chipotle Mexican Grill’s future, such as international expansion, menu innovation, or market risks, to specific forecasts for things like revenue and earnings, and then translating that into an estimated fair value.

Instead of relying solely on static measures and historic multiples, Narratives let you easily link your expectations for the business to a financial outlook, putting you in control of the assumptions behind the numbers. On Simply Wall St’s platform, you will find Narratives right on the Community page, used by millions of investors, where you can both contribute your view and learn from others’ insights.

Each Narrative updates automatically when new news or earnings data come in, helping you track how the story changes and compare your idea of fair value to the current share price. For example, some investors might believe that Chipotle’s aggressive moves into Mexico and Europe, with double-digit revenue growth and increased margins, justify a bullish target as high as $65, while others, more cautious about competition and economic headwinds, may see a fair value closer to $46.

Do you think there’s more to the story for Chipotle Mexican Grill? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Explore Now for Free

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com