Joe Tesoro popped into Schaefer’s Ace Hardware in Commack recently to pick up vinyl gasket weather seal to waterproof a door at his mom’s home.

The Melville man was among a handful of customers who chatted with store employees about the supplies they needed for their home projects.

“Yeah, I’m a good son,” said Tesoro, 65, a retiree who likes to do repairs himself rather than pay professionals.

Tesoro used to shop at Costello’s Ace Hardware in Melville, which was closer to his home, but that store closed in September. He prefers to buy some supplies from locally owned Ace stores, even though it can be more expensive, he said.

WHAT NEWSDAY FOUND

- Dozens of hardware stores have closed on Long Island in the past 20 years, as the businesses have faced growing online and big-box retail competition, rising expenses and the lack of family succession plans, industry experts said.

- Between 2010 and 2024, the number of hardware stores declined 25% to 112 stores on Long Island, according to the state Labor Department.

- Some hardware stores are trying to stave off closings by merging with family-owned competitors, industry experts said.

But at Ace, he said he gets “personalized help.” Whereas at places like Home Depot, where he also shops sometimes, “you got to take everything off the shelf and stuff,” he said.

Joe Tesoro, of Melville, seen at Schaefer’s Ace Hardware in Commack recently, said he prefers to buy some supplies from locally owned Ace stores, even though it can be more expensive. Credit: Barry Sloan

Dozens of hardware stores, like Costello’s in Melville, have closed on Long Island in the past 20 years, as the small businesses have faced growing challenges from online and big-box retail competition, steeply rising business expenses, and, in many cases, the lack of family succession plans to ensure the business’ continued legacy, retailers and industry experts said.

“Our society has changed in the last 50 years. And you see a lot of the kids of owners of these businesses now that are becoming … nurses and doctors and lawyers or whatever they might do. And running a small business doesn’t, perhaps, hold the same allure it once did,” said Dan Tratensek, chief operating officer at the North American Hardware and Paint Association, a trade group headquartered in Indianapolis.

Some hardware stores are trying to stave off closings by merging with family-owned competitors, combining resources to improve economies of scale, industry experts said.

While the number of hardware stores, the vast majority of which are independently owned small businesses, is declining nationwide, the decrease has been steeper on Long Island and in New York State.

Hardware stores in New York are dealing with a higher cost of doing business, such as the cost of rent, utilities, insurance and labor, than stores in other states, retailers said.

Between 2010 and 2024, the number of hardware stores declined 14.5% to 925 stores in New York State and 25% to 112 stores on Long Island, according to the New York State Department of Labor.

Those numbers do not include large retailers, such as The Home Depot and Lowe’s, which are classified as home centers and are taking the biggest slices of the revenue pie.

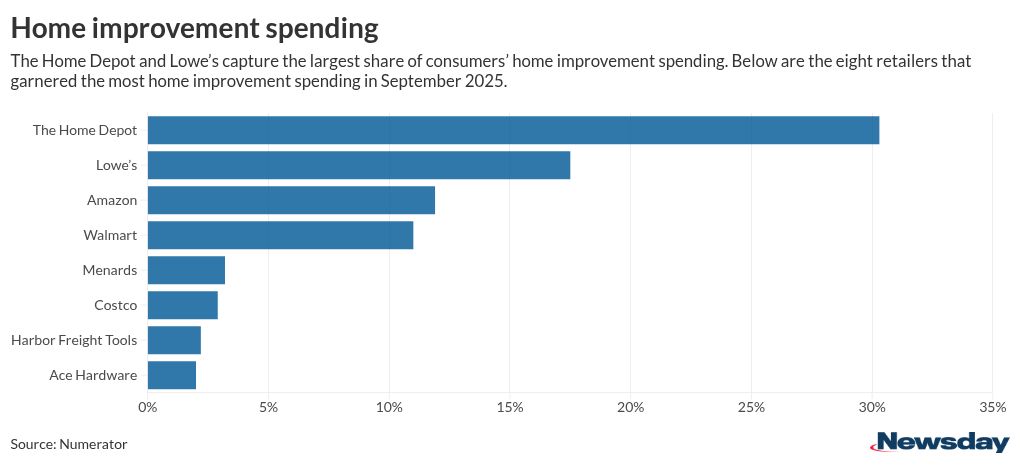

In September, The Home Depot and Lowe’s captured the largest share of consumers’ home improvement spending, 30.3% and 17.5%, respectively, according to Numerator, a Chicago-based market research firm. Ecommerce giant Amazon ranked third, with 11.9%. Ace Hardware ranked eighth, with 2%.

Ace Hardware Corp. is an Oak Brook, Illinois-based retailers’ cooperative that has more than 5,000 member stores worldwide, but most are independently owned and operated.

On Long Island, hardware stores that have closed in recent years include Schaefer’s Ace Hardware, which closed four stores in 2025, leaving two — in Commack and Bayville.

Also, Islip True Value Hardware closed in 2023, leaving the Main Street building without a hardware store for the time since the mid-1800s. Hardware store Charles of Glen Cove closed in 2020 after 62 years in business. And Agnew & Taylor’s Hardware in Lake Ronkonkoma closed in 2017 after more than 100 years in business.

Even the largest independent hardware chain on Long Island, Costello’s Ace Hardware, despite its growth, has not been left unscathed. The Deer Park-based retailer, which has 62 stores on Long Island and elsewhere, closed its Melville store in September and its Bethpage and North Brunswick, New Jersey, stores in 2024.

Cristy Schaefer, right, with her son, Chris Pecoraro, and daughter-in-law, Fernanda Techachal, at Schaefer’s Ace Hardware in Commack. Credit: Barry Sloan

‘All your expenses add up’

Three generations of the Schaefer family have run Schaefer’s hardware, which started after Walter Schaefer bought the business in 1955, said his grandson, Chris Pecoraro, a manager.

Last year, the family decided to close four of their hardware stores — in Glen Cove, Hewlett, Plainview and Rockville Centre — to focus on the remaining two stores in Bayville and Commack, Pecoraro said.

The main driver behind the closings was the cost of doing business, he said.

“You have high rents, you have high payroll, you have high expenses between your electric and your water. … All your expenses add up so much, you need to have the volume to sustain it,” he said.

Competition from online and big-box retail has been challenging for his stores but it’s not as much of a disrupter as it used to be, he said.

But Pecoraro said small retailers can learn by studying large chains to see what they’re doing well and where they struggle.

Small stores can pivot more quickly to customers’ needs than large competitors, he said, citing the recent snowstorm as an example.

“The Home Depot only has 50-pound bags [of salt], or they had nothing and they sold out,” he said, but his stores can call different suppliers and “have a same-day delivery or next-day delivery for some of those essentials.”

‘We are the succession plan’

Mom-and-pop stores have historically passed on their business to their children, but that is happening less these days, retail experts said.

The average owner of a mom-and-pop hardware store is a man in his mid-60s, Tratensek said.

“A lot of these folks were really good at running their businesses but they weren’t really good about planning for retirement and putting accurate values on their businesses,” he said. But he added that there has been an uptick in younger ownership groups aggressively buying stores in danger of closing.

Brinkmann’s Hardware Corp. in Sayville, is run by, from left, Ben Brinkmann, Mary Neimeth and Hank Brinkmann — who bought their parents out about 15 years ago. Credit: Newsday/Alejandra Villa Loarca

Some hardware stores’ lack of successors to take over the businesses has created opportunities for competitors, as was the case with Brinkmann’s Hardware Corp. in Sayville.

The family-owned chain has seven stores, including Trio Hardware in Plainview, which it bought in October. Trio, which has been in operation for more than 60 years, was run mostly by the Carlow family during that time.

Brinkmann’s bought Trio from Todd and Ritsa Kirschner, a married couple who had been longtime employees of Trio before they acquired 50% ownership from the Carlows in 2012 and 100% ownership in 2017. But the Kirschners didn’t have a succession plan, and Brinkmann’s, which was looking to expand into a new area, made an offer to buy Trio, co-owner Hank Brinkmann said.

“It’s been a great store for a long time,” he said. It has “a great history of service and it’s in a great market, great community.”

Brinkmann’s made a previous acquisition, in 2024, when it bought the 3-acre Ging’s Nursery property in Miller Place for $2.2 million from Loni Corp., an affiliate of Aliano Real Estate in Miller Place. The hardware retailer is building a 30,000-square-foot store on the former Ging’s site — the nursery is now closed — to replace Brinkmann’s 11-year-old, 10,000-square-foot Miller Place store. The relocation, expected to occur in the third quarter of this year, is an indication of success, Brinkmann said.

“That’s our highest sales-per-square-foot store. It performs well and … we’re always making sure that we’re serving our markets properly,” he said.

Founded in 1976 by Tony and Pat Brinkmann, Brinkmanns now is run by their three children — Hank and Ben Brinkmann and Mary Neimeth — who bought their parents out about 15 years ago, said the youngest sibling, Hank Brinkmann, 46.

The second-generation operators enjoy continuing the legacy their parents started 50 years ago, but they are thinking about what lies ahead for the chain’s succession, he said.

“I do have kids. My sister has kids. … Possibly that’ll be a conversation in the future, but for the foreseeable future, we are the succession plan,” he said.

Brinkmann’s has about 130 employees and annual sales of $30 million, up from $10 million a decade ago, he said.

“And our goal is to get to $100 million by the year 2035. And we have every intention of hitting that goal,” he said.

Some of the challenges that retailers are facing are due to their failure to innovate, Brinkmann said, adding that his family business constantly looks for ways to improve its offerings and efficiencies.

Except for the store in Glen Cove, Brinkmann’s owns all its store properties, which allows the retailer to tailor the physical layout of the sites to its needs, such as adding bigger loading docks and wider curb cuts, said his brother, Ben Brinkmann.

The bigger financial investment upfront for real estate purchases allows for more savings over the long run, Ben Brinkmann said.

“We believe there’s nothing more expensive than cheap real estate and there’s nothing more expensive than cheap help,” he said.

To improve logistics, Brinkmann’s relocated its warehouse from a 3,000-square-foot space in Holbrook to a 20,000-square-foot space in Patchogue in 2020, Hank Brinkmann said.

“Now we’re able to buy …. truckload quantities [of inventory] direct from manufacturers, which helps us put out some of the most competitive pricing in our markets,” he said. “We can stand up there with the big-box stores, with our pricing on many products that we buy direct.”

Costello’s expansion plans

In 2017, when Costello’s Ace Hardware had about 20 stores in New York and New Jersey, the chain began focusing on expanding by acquiring other chains without succession plans, said Mike Costello, whose father, Vincent Costello, founded the business in Deer Park in 1973.

Costello’s Ace Hardware now has 1,300 employees and 62 stores in six states, including 22 stores on Long Island, and plans to have 100 stores by 2030, said Mike Costello, who declined to disclose the chain’s annual sales.

Costello’s acquisitions have included the purchase of Ace Hardware & Hearth’s three stores in Maryland in 2017 and Rommel’s Ace Home Centers, a family-owned group of 11 stores in Maryland, Delaware and Virginia, last September.

The company continues to set its sights off Long Island for growth, Costello said.

“We can find more affordable rents and property taxes off Long Island that help make the whole store model work better. A lot of time we’ve looked at Long Island markets recently, but just the cost and what that’s going to be, just doesn’t make sense,” he said.

Costello, 58, said he is not concerned about a succession plan because the family is so big. He is one of 10 children, six of whom co-own the family’s business.

“We don’t have a nailed-down succession plan, but it is something we plan on. We have a lot of younger kids … and some that aren’t ready to decide if they want to be in the business, and a few that already are,” he said.