-

In recent commentary, Crocs reported that constant currency growth over the past two years fell short of expectations, prompting calls for greater investment in product improvements despite an anticipated expansion in free cash flow margin.

-

However, concerns about waning returns on capital from an already weak base have put management’s past and current capital allocation decisions under sharper scrutiny.

-

Next, we’ll explore how concerns over Crocs’ weaker constant currency growth might reshape the existing investment narrative around its global expansion.

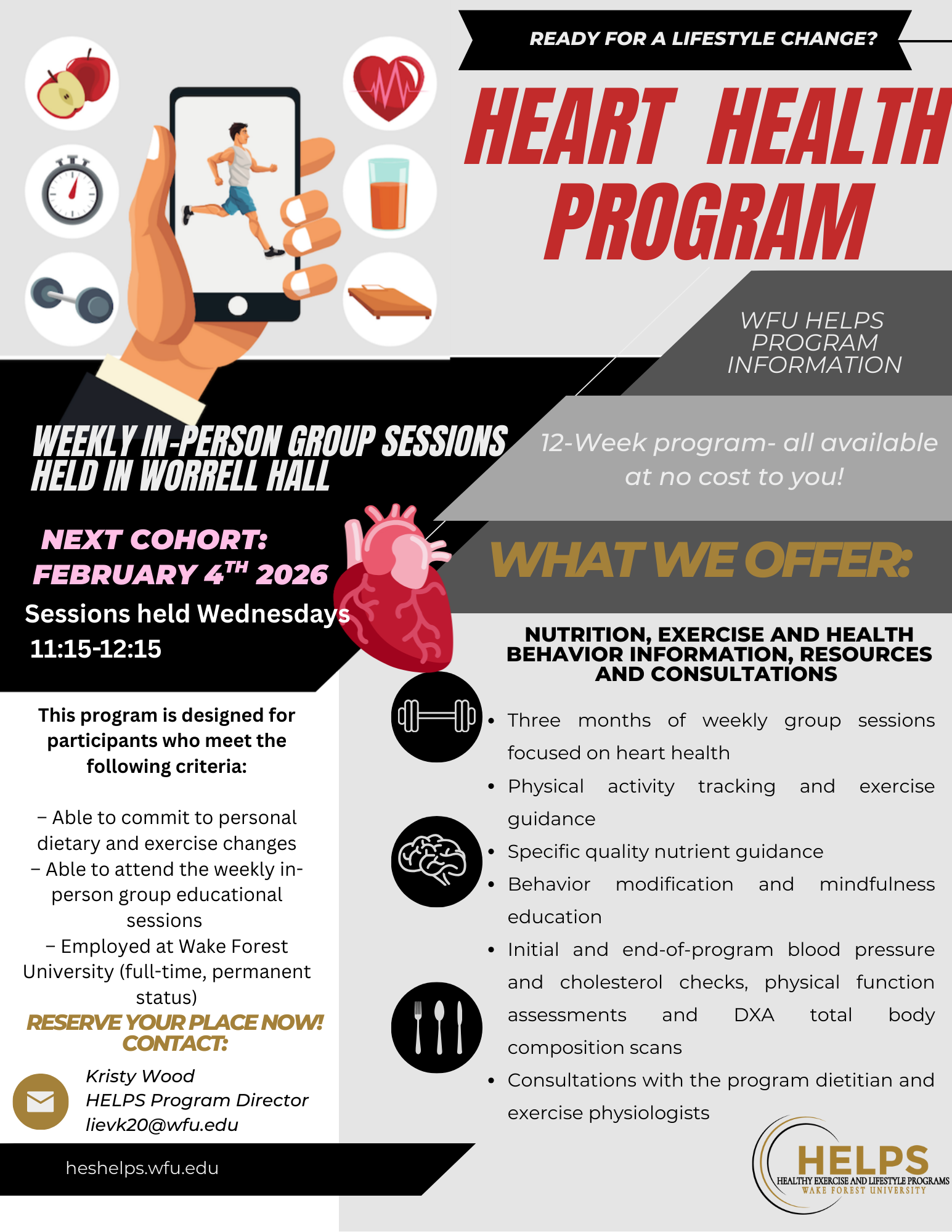

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

To own Crocs today, you generally need to believe in its ability to reinvigorate demand and keep the brand relevant globally while managing margin pressure. The recent comments on weaker constant currency growth highlight execution risk in the short term, but they do not fundamentally alter the key near term catalyst, which is restoring growth quality without further diluting returns on capital, or the main risk, which is fashion cyclicality and fading consumer interest.

Among recent developments, the ongoing share repurchase activity, with over US$2,582.69M spent on 51,779,383 shares by Q2 2025, stands out alongside the expectation of expanding free cash flow margins. This combination puts a brighter spotlight on whether Crocs can convert that financial flexibility into product improvements that support international expansion, without further compressing already strained returns on capital.

Yet behind the potential upside, investors should be aware that fashion cyclicality and shifting consumer preferences could…

Read the full narrative on Crocs (it’s free!)

Crocs’ narrative projects $4.0 billion revenue and $925.2 million earnings by 2028. This implies a 1.0% yearly revenue decline and about a $688.7 million earnings increase from $236.5 million today.

Uncover how Crocs’ forecasts yield a $89.75 fair value, in line with its current price.

Sixteen fair value estimates from the Simply Wall St Community span roughly US$89.75 to US$168.11, showing how far apart individual views can be. Against that backdrop, recent concerns about weaker constant currency growth and pressure on returns on capital give you important context to weigh these different perspectives before deciding which ones to explore further.