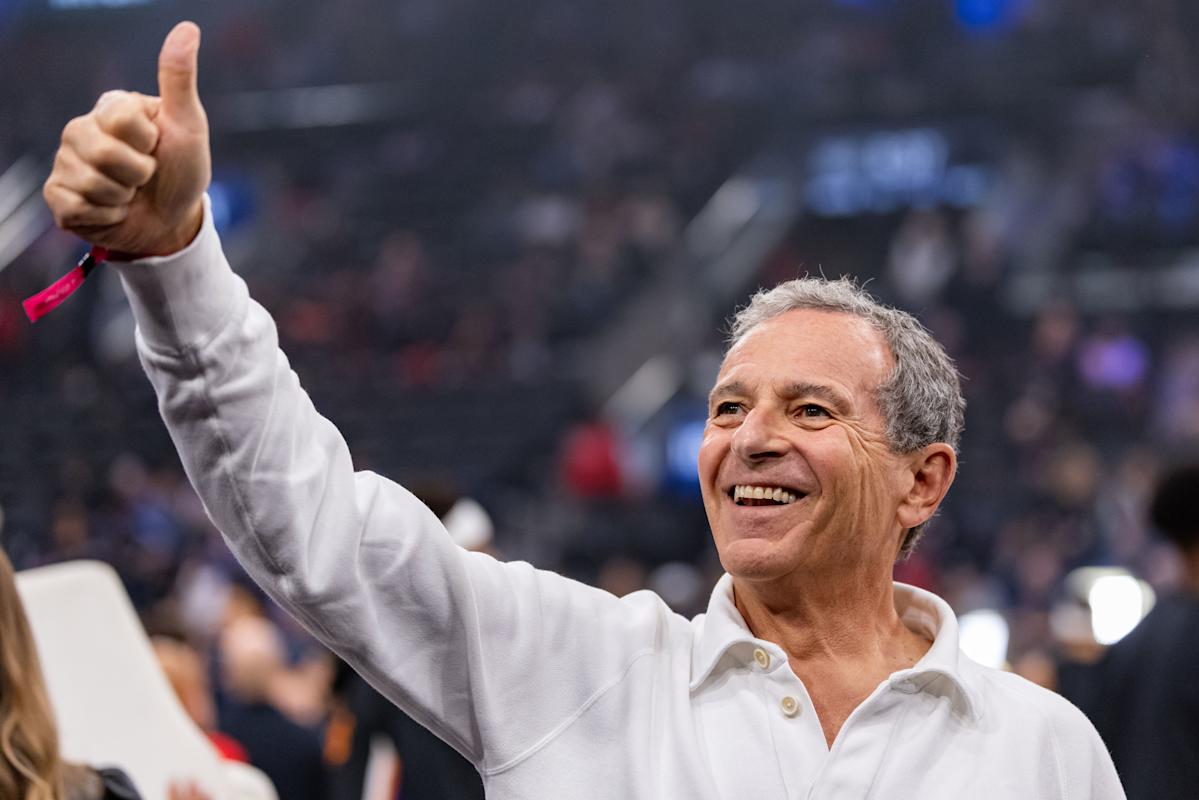

Disney (DIS) is set to report fiscal fourth quarter results before the bell on Thursday as investors look for signs that CEO Bob Iger’s turnaround plan, built on cost cuts, price hikes, and a streaming pivot, is beginning to deliver more durable profit growth.

Wall Street expects a step back in earnings this quarter and a slower pace of revenue growth as Disney contends with weaker theatrical comparisons, lingering linear TV pressures, and the delayed debut of its latest cruise ship.

Still, strength across parks, cruises, and streaming should help offset some of those declines.

Here’s what to expect, according to Bloomberg consensus estimates:

-

Total revenue: $22.83 billion versus $22.57 billion in Q4 2024

-

Adjusted EPS: $1.07 versus $1.14 in Q4 2024

-

Entertainment revenue: $10.49 billion versus $10.83 billion in Q4 2024

-

Parks and Experiences revenue: $8.80 billion versus $8.24 billion in Q4 2024

-

Sports revenue: $3.98 billion versus $3.91 billion in Q4 2024

-

Disney+ subscribers: 130.1 million versus 125.3 million in Q4 2024

Disney’s experiences division, which includes the parks, remains the company’s strongest profit driver.

Analysts highlight steady domestic attendance despite new competition from Universal’s Epic Universe, while cruises remain a key growth driver as new ships set sail and last year’s hurricane headwinds fade.

The Disney Adventure cruise, originally slated to debut next month, has been pushed to March 2026, trimming near-term profit but leaving long-term growth intact, according to analysts.

Meanwhile, the company’s direct-to-consumer streaming unit — which includes Disney+ and Hulu — is expected to show another quarter of operating profitability, underscoring Iger’s shift from subscriber growth to margin expansion. The two streaming platforms are set to officially merge next year.

The update comes on the back of fresh price hikes for Disney+ and Hulu, which took effect Oct. 21 and marked the company’s fourth straight year of increases as management targets more than $1.3 billion in streaming operating income in the fiscal year that ended in September.

Morgan Stanley expects that figure to climb toward $2.8 billion in full-year 2026 as higher average revenue per user (ARPU) and the integration of Hulu and Disney+ tech stacks drive efficiencies.

Still, analysts will watch for any lingering fallout from the September suspension of “Jimmy Kimmel Live!” after controversial comments by the host sparked affiliate boycotts and online calls to cancel Disney subscriptions. Bank of America believes the episode likely caused little churn in Q4 and only a modest impact in early 2026, thanks to billing timing and Kimmel’s rapid reinstatement.