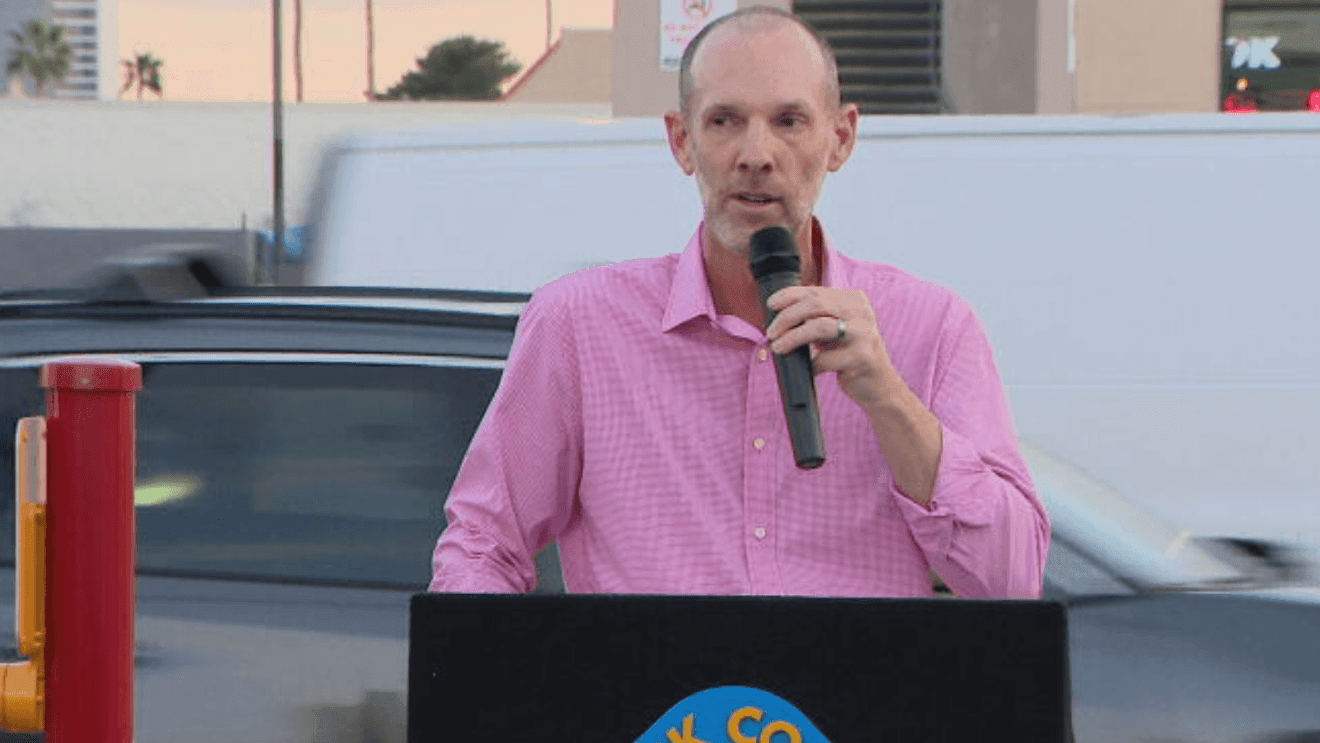

In April 2025, the Department of Accountancy’s professor Mark Cowan presented his paper, “When the Deadline Falls: The Promise and Problems of Equitable Tolling in Taxation,” at the Pacific Northwest Chapter of the Academy of Legal Studies in Business Regional Meeting in Boise, Idaho.

The event, hosted for the first time in the Micron Business and Economics Building, gave Cowan the opportunity to share his research on an evolving tax deadline.

“If a taxpayer is assessed additional tax on an audit, they have only 90 days to file a petition for the Tax Court to hear their case,” Cowan said. “This is critical because if a taxpayer can’t get their case into Tax Court, they must pay the disputed tax and sue for a refund in other federal courts. Many taxpayers can’t afford to pay the disputed tax before challenging it.”

The deadline to file a petition with the U.S. Tax Court is now being interpreted as non jurisdictional (meaning the court lacks the authority to make a ruling). This shift allows taxpayers to argue that their lateness can be excused under equitable tolling. Cowan’s research aims to develop guidelines for the Tax Court to determine which excuses for late filing merit equitable tolling.

Cowan’s presentation aimed to be fun and engaging, showcasing just how ridiculous some of the excuses made can be. “During the presentation, I reviewed recent litigation, the excuses that were involved, and asked the group whether they thought the excuses were valid reasons for filing late.”

He praised both the event and his colleagues, “We had a great discussion. I always enjoy discussing legal and policy issues with colleagues in the Academy of Legal Studies in Business.”