Vail Daily archive

Business experts say 2025 was a mixed bag for Colorado’s business climate.

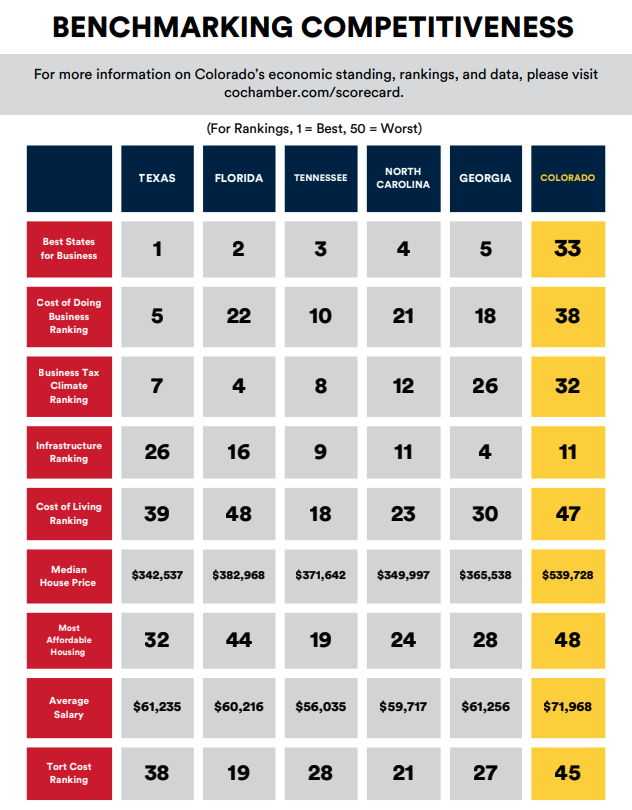

Rankings from business leader surveys, state and federal organizations and news sites paint a murky picture for the region’s competitiveness as economic factors like housing affordability and excessive regulations on employers plummet. Now, business leaders are eyeing the upcoming legislative session as an opportunity to correct course.

According to the chamber’s Colorado Scorecard for 2025, a dashboard that annually tracks metrics related to the state’s economy and key industries, Colorado’s “best economy” ranking fell from fourth to sixth, pushing the state out of the top five in the nation.

Roughly 45% of business leaders participating in a chamber survey this year indicated they plan to invest out of state — a metric that Colorado Chamber of Commerce President and CEO Loren Furman said is sounding warning alarms for the chamber.

“Our members across the state that either operate here in Colorado or operate in other states are not investing in their operations anymore, or they’re moving to other states,” Furman said. “They’re just deciding not to continue to invest here, and that’s a scary outlook for us.”

Support Local Journalism

The Colorado Chamber of Commerce released its 2026 legislative agenda on Tuesday, highlighting its plans to support — and oppose — legislation on topics ranging from the state’s cost of living to protecting members of the workforce.

Climbing cost of living stunts Colorado’s business growth

One factor contributing to Colorado’s weakening competitiveness is the cost of living, especially when it comes to finding and affording housing for both out-of-state and in-state talent.

Cost-of-living measures, a consistent roadblock for Colorado, declined across nearly every category on the scorecard. The state’s ranking fell by 11 spots between 2023 and 2024, landing at 46th in the country, then fell once more to 47th in 2025. Colorado’s ranking for housing affordability dropped to the 48th spot the same year.

Poverty and homelessness in Colorado also increased among both adults and children in 2024 for the second and third years in a row, respectively. Furman said the state’s rising cost of living has become impossible to overlook as employers struggle to compete for talent and grow their businesses.

Roughly 50% of Colorado business leaders surveyed by the chamber blame housing attainability as a significant barrier to attracting and retaining workforce talent, which only hinders the state’s competitiveness.

Annual homeowners’ insurance, another significant expense for Coloradans, saw rates increase by an average of $1,912 in 2025 — a 47% rise from the previous year — according to 2024 data from Insurify. Colorado’s yearly cost of $5,984 makes it the 4th most expensive state in the nation.

Two of the most significant factors contributing to this jump in insurance costs are increasing wildfire risk and hail damage, which have boosted claims in recent years. Homeowners in high-risk zones on the Western Slope have experienced a mix of skyrocketing premiums and outright cancellations due to these risks, forcing some residents to dip into their savings or go uninsured.

“We’re one of the top states for hail problems,” Furman said. “That is a huge contributing factor to the cost of repairs for homes and roofs.”

The Chamber’s residential resiliency package for the 2026 legislative session includes a proposal to leverage existing funding sources to help homeowners cover risk-reduction measures, including hail impact-resistant roofing and wildfire mitigation, Furman said. These risk-reduction measures are meant to spare homeowners the higher cost of roof repair if their homes experience significant damage.

“We are really focused in on this issue because of the cost of housing,” Furman said. “The funding is available through a grant program that’s currently only available to local governments, so we want to make sure that those dollars are getting to homeowners for helping them with roofing resiliency.”

A second component of the package creates tax-exempt savings accounts to support future damage expenses — an idea that came from the way other states deal with hurricane damages.

Too many regulations — again

The overregulation of businesses in Colorado has been at the forefront of the chamber’s efforts since 2024, when data identified Colorado as the sixth most regulated state in the country.

The chamber’s 2024 regulatory impact analysis found that Colorado has nearly 200,000 state regulations that apply across multiple industries — or 1.3 million business restrictions when combined with federal laws.

According to the analysis, roughly 45% of Colorado’s existing regulatory restrictions were deemed excessive. Even a 10% increase in industry-specific regulations correlates with notable declines in business startups and employment rates.

Despite the chamber’s long list of legislative goals, Furman said the priority remains state-level regulatory reform, building on work from the previous legislative session. She labelled the approach as “the second phase of our regulatory relief package,” adding that the chamber will be unveiling this proactive legislation in the new year.

The goal of the second phase is to require more transparency and review of state agency programs, ensure efficiency, and oppose regulations that would be overly burdensome on employers.

“Our big priority is just making sure that we have a competitive and healthy business climate,” Furman said. “We’re really pushing for a bill that is going to do more to review the current laws and regulations that are on the books right now. Are they still cost-effective? Are they still being used? Are they duplicative?”

During the 2025 legislative session that ended in May, the Chamber fought against bills like the Labor Peace Act bill, which Furman said will likely come back this session.

The bill, vetoed by Gov. Jared Polis in May, sought to abolish a requirement established in the 1943 Colorado Labor Peace Act that 75% of workers at a company must vote in favor of union security for all workers. Unions in Colorado argued there were too many barriers to collect fees from employees they were representing, even if they weren’t formally part of the union.

Another failed bill the chamber expects to see again in 2026 would require employers to implement protections for workers exposed to extreme hot and cold temperatures, including rest breaks and temperature-related injury and illness prevention plans.

“We’ll always be on the defence on a number of issues,” Furman said. “We always want to make sure that any bills that are going to create new costs or new administrative burdens for businesses, that legislators understand what those long term impacts are for businesses.”

The 2025 scorecard also found that Colorado’s performance worsened across all tax burden rankings, from corporate to individual.

“We have to address any kind of elimination of certain tax credits or tax exemptions because we have so few tools in the toolbox for Colorado to offer to businesses to come here and stay here,” Furman said. “Anytime there are bills that erode those types of incentives, we’re going to be opposed to them.”

Furman said the chamber plans to publish an updated report on Colorado’s regulatory climate in January, which will reveal whether the state has improved or worsened its ranking since the issue began making headlines.

“I honestly don’t anticipate there’s going to be a huge shift in that number. In fact, it could get worse, just based on more legislation that has passed within the last year,” Furman said. “But we can’t say that without any kind of confirmation yet.”

On a brighter note…

The scorecard isn’t all bad. Colorado saw improvements in quality-of-life indicators, health rankings and some economic metrics. The state jumped from the 16th-best state for business in 2024 to 11th, according to a CNBC report published in July, while the cost of doing business improved slightly by one rank.

Furman credited the improvement in Colorado’s workforce rankings to the Regional Talent Summit Act passed in 2024, an effort led by the chamber that created seven summits across different regions of the state.

“We had employers and educators at the same table coming up with ways (to offer) curriculum to support where skill sets are needed,” Furman said.

All tourism categories on the chamber’s scorecard saw improvements, meaning an increase in travel spending, tourism-generated employment and the number of visitors. Funding for higher education also saw some progress in 2025, now ranking 9th nationally.