Nebius Group N.V. NBIS is scaling aggressively to capture the surging demand for AI compute, positioning itself as a fast-emerging player in the global AI infrastructure market. The company recently reported more than doubling its revenues from the first quarter and becoming EBITDA positive in its core AI infrastructure business ahead of projections. Nebius’ rapid expansion of data centers is key to its growth story.

By the end of this year, the company expects to secure 220 megawatts of connected power, either active or ready for GPU deployment. This expansion includes major data centers in New Jersey and Finland. Two additional greenfield data center projects in the US are nearing completion, signaling the company’s commitment to scale aggressively and meet the surge in AI compute demand. Overall, Nebius is on track to secure more than 1 gigawatt of power by the end of 2026.

Also, Nebius announced plans to launch its first major GPU cluster facility in the UK, located just outside London. The site is expected to come online in the early fourth quarter, marking a significant milestone in the company’s global expansion. Nebius anticipates being the first provider to deliver Nvidia’s B300 GPUs to the U.K. market.

Moreover, the company recently closed a deal with Microsoft CorporationMSFT for $17.4 billion, which involves NBIS providing dedicated GPU capacity to the latter from the new data center in Vineland, NJ, beginning later this year through 2031.

The company is focusing on building a global footprint, with capacity in the United States, Europe and the Middle East. In June, Nebius launched NVIDIA GB200 capacity in Europe and deployed Blackwell Ultra GPUs in the UK. In the first quarter of 2025, the company added three new regions, including a strategic data center in Israel.

With Blackwell GPUs entering the market at scale and data center capacity ramping up significantly, it expects a sharp increase in sales by year-end. Driven by these factors, Nebius has updated its year-end annualized run rate (ARR) guidance from the previous $700 million–$1 billion range to a new $900 million–$1.1 billion range.

However, scaling aggressively (multiple data centers in various regions) involves execution risk. Moreover, stiff competition and broader macroeconomic uncertainties could pose challenges to NBIS’ growth trajectory. Nebius competes with technology giants like Microsoft and CoreWeave, Inc.CRWV.

Taking a Look at NBIS’ Competitors

Microsoft remains a dominant force in technology, leading cloud infrastructure through Azure while rapidly expanding in AI infrastructure. Its deep partnership with OpenAI has established Azure as a leading platform for AI workloads, reinforced by AI integration across Office, GitHub and Dynamics. The company has transformed every Azure region into an AI-first environment equipped with liquid cooling technology, adding more than 2 gigawatts (GW) of new data center capacity over the past year and operating more than 400 data centers across 70 regions worldwide. Microsoft projects Azure growth of 37% for fiscal first-quarter 2026.

CoreWeave continues to scale its data center infrastructure at a rapid pace. By the end of the second quarter, the company had 470 megawatts (MW) of active power and expanded its total contracted capacity to 2.2 GW, targeting more than 900 MW of active power by year-end. Its aggressive expansion includes a $6 billion data center investment in Lancaster, PA, and a joint venture project in Kenilworth, NJ, to meet rising demand. It has launched RTX PRO 6000 Blackwell GPU instances, offering faster AI performance and cost-efficient scalability. CRWV continues to ramp up investments in data centers and server infrastructure to keep pace with the ongoing traction in customer demand.

NBIS’ Price Performance, Valuation and Estimates

Shares of Nebius have surged 351% year to date compared with the Internet – Software and Services industry’s growth of 43.1%.

Image Source: Zacks Investment Research

In terms of price/book, NBIS’ shares are trading at 7.8X, up from the Internet Software Services industry’s ratio of 4.66X.

Image Source: Zacks Investment Research

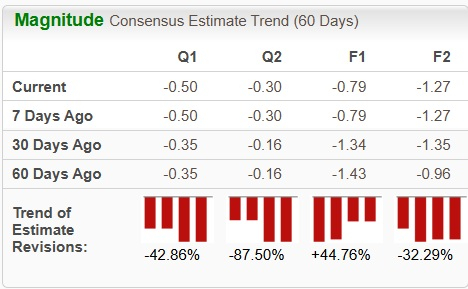

The Zacks Consensus Estimate for NBIS’ 2025 earnings has seen an upward revision over the past 30 days.

Image Source: Zacks Investment Research

NBIS currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in the coming year. While not all picks can be winners, previous recommendations have soared +112%, +171%, +209% and +232%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Microsoft Corporation (MSFT): Free Stock Analysis Report

Nebius Group N.V. (NBIS): Free Stock Analysis Report

CoreWeave Inc. (CRWV): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).