Q: What is Aplazo’s value proposition, and what led you to create this platform?

A: APLAZO is a leading fintech platform that enables consumers to immediately receive products and pay in installments without requiring a credit card. More than a buy now, pay later (BNPL) service, our core mission is to empower financial access, opportunity, and freedom, by connecting people and businesses

Before founding APLAZO, credit card penetration among consumers in Mexico was only about 11%, and access to personal loans was about 25%–30%. Traditional banks focus disproportionately on higher-income segments, leaving lower-income individuals underserved. Of those who own a credit card, 60%–70% use them to pay in installments. But 90% of Mexicans lack access to installment financing. That was the genesis of APLAZO: building a simple, inclusive digital experience allowing those without credit cards to pay in equal installments at affiliated merchants. It is about credit inclusion responsibly and transparently.

Q: How has APLAZO’s mission evolved as the BNPL model has grown in Mexico?

A: While APLAZO has undoubtedly experienced strong growth since our launch in 2020, our mission remains intact. We continue to enhance credit inclusion, now even simpler and transparent. Of the clients that join every month, 70%‑80% have never had access to formal credit. Credit adoption has grown, but we still see enormous untapped opportunity.

Q: How has Mexico’s cultural and economic landscape enabled the success of this credit model?

A: In Mexico, between 60 million and 80 million adults need access to credit. Penetration remains low, so the opportunity is massive. The key challenge is providing sustainable and responsible lending. Many adults have little to no credit history. Fintechs like APLAZO, thanks to lower cost structures and technology, can offer credit where banks hesitate. We leverage data and AI to personalize credit offers to match each customer’s situation, providing fair, sustainable loans and treating risk responsibly.

Q: APLAZO recently launched a partnership with Ebanx and other alliances. How do these collaborations support your growth in Mexico?

A: Partnerships are crucial. Ebanx, for example, is a payments platform serving many major retailers. Integrating with Ebanx enables merchants to easily launch APLAZO as a payment option in their e-commerce or physical points of sale. This accelerates merchant adoption and expands consumer reach quickly. We prioritize partnerships that scale responsibly and broaden inclusion.

Q: Given that repayment issues are a challenge in Mexico, how does APLAZO promote responsible borrowing and reduce delinquency?

A: We fundamentally believe that if a loan goes unpaid, it is our responsibility, because we issued it. That philosophy shapes every process, from origination to collections. We offer lower credit limits, shorter durations, interest rates matched to the credit profile, and automated reminders rather than aggressive collections. Lenders must guide and protect the consumer, not exploit them.

Q: What benefits does APLAZO offer to consumers and retailers?

A: APLAZO’s mission is to provide purchasing power to consumers who may not have the means to pay upfront. We allow them to buy what they need immediately and pay in a simple and comfortable way through biweekly installments. The consumer pays a down payment on the day of purchase and then continues to pay the remaining on 15-day installments. This simplicity benefits the consumer greatly. That is why over 250,000 people download the app every month. We hold a rating of more than 4.9 out of 5 stars across different App Stores — a clear reflection of how satisfied users are with our product and service. We are the number one BNPL in these reviews.

For the retailer, it results in significant advantages. First, the retailer sees an increase in the average ticket size, as our average purchase value is about +70% higher compared to other payment methods, especially cash. The second major benefit is improved conversion rates, particularly from window shoppers, those who are interested in a product but delay their purchase until they receive their next paycheck or have more cash flow. APLAZO enables those consumers to make the purchase right away. The third benefit is demand generation. We have over 4 million users on our platform who visit the app daily to browse a network of affiliated merchants. This demand is controlled by Aplazo and becomes an added value for our retail partners. Once a merchant is integrated, they instantly gain access to this pool of pre-approved shoppers who can buy from their store in just two clicks.

Q: What impact has APLAZO had in different retail sectors?

A: Adoption has been widespread. However, due to our internal strategy, we have initially focused more on certain categories like apparel and footwear. These sectors represent the bulk of our volume. That said, the added value of APLAZO’s service is evident across industries. Our model proves effective regardless of the retail segment.

Q: What opportunities does Mexico offer for BNPL models and how will they change the retail market?

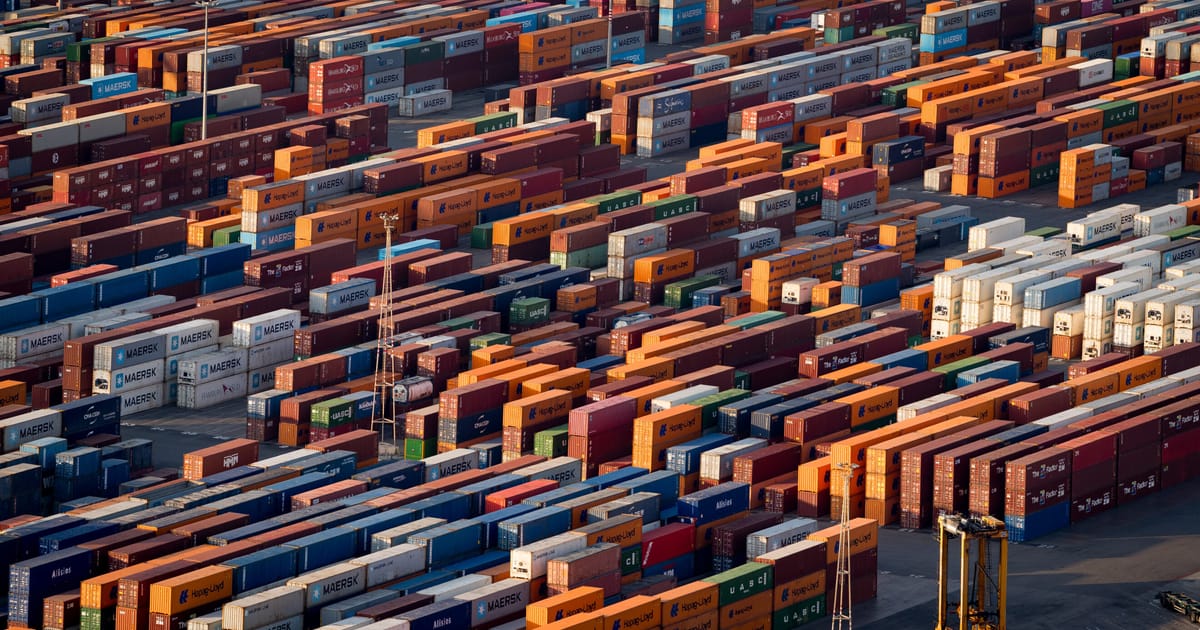

A: Our goal is to change the paradigm around how people shop, access credit, and experience credit inclusion. Mexico’s retail market is enormous, with some sources valuing it at about US$900 billion. In more mature markets like the United States or the European Union, BNPL accounts for about 5% of retail volume. That translates to a potential US$50 billion opportunity in Mexico.

We are laser-focused on redefining how credit works, making it more accessible and transparent. Traditional banking has its limitations in terms of accessibility and transparency, and we aim to be the alternative that changes that.

Q: What are APLAZO’s main priorities for the rest of 2025 and 2026?

A: Our main priority is to continue consolidating our platform so millions of consumers can access credit in an easy, inclusive, flexible, and transparent way. We are focusing on securing partnerships with large and SMB’s brands in the market, which will be crucial to scaling our impact and reaching millions of potential consumers.

We also aim to engage with retailers we have not yet partnered with. The market is vast, and there are still many opportunities out there. At the same time, we are continually improving our platform by listening to consumer feedback. Understanding their needs allows us to build a product that truly supports them. We strive to create a platform that is even more just, transparent, and beneficial, enhancing credit inclusion across Mexico.

APLAZO is a Mexican buy now, pay later financing platform that allows consumers to receive products immediately without requiring a credit card.