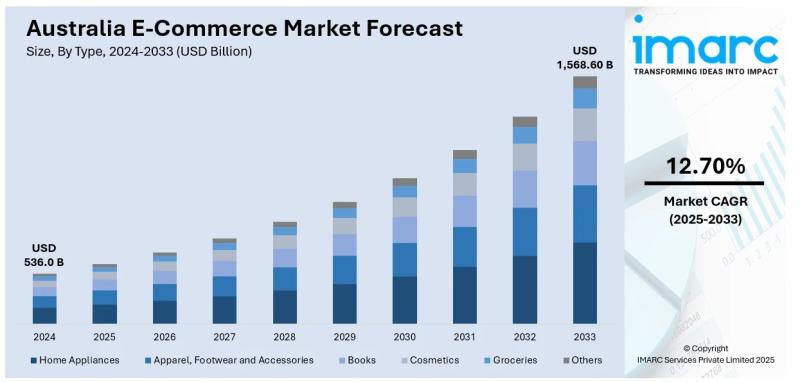

The latest report by IMARC Group, titled “Australia E-Commerce Market Report by Type (Home Appliances, Apparel, Footwear and Accessories, Books, Cosmetics, Groceries, Others), Transaction (Business-to-Consumer, Business-to-Business, Consumer-to-Consumer, Others), and Region 2025-2033,” offers a comprehensive analysis of the Australia e-commerce market growth. The report includes competitor and regional analysis, along with a detailed breakdown of the market segmentation. The Australia e-commerce market size reached USD 536.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 1,568.60 Billion by 2033, exhibiting a CAGR of 12.70% during 2025-2033.

Base Year: 2024

Forecast Years: 2025-2033

Historical Years: 2019-2024

Market Size in 2024: USD 536.0 Billion

Market Forecast in 2033: USD 1,568.60 Billion

Market Growth Rate (2025-2033): 12.70%

Australia E-Commerce Market Overview

The Australia e-commerce market is experiencing robust growth driven by increasing smartphone adoption for mobile commerce, rapid integration of artificial intelligence and machine learning technologies, expanding digital payment infrastructure, growing social media shopping influence, and strengthening cross-border e-commerce participation. The market expansion is supported by technological advancements in personalized recommendation algorithms, augmented reality shopping experiences, automated logistics systems, and increasing recognition of e-commerce platforms as essential retail channels offering convenience, variety, and competitive pricing. Advanced e-commerce solutions are transforming Australia’s retail landscape through seamless omnichannel experiences, same-day delivery capabilities, subscription-based business models, and data-driven customer engagement strategies positioning online platforms as dominant retail channels reshaping consumer purchasing behaviors and industry dynamics.

Australia’s e-commerce foundation demonstrates strong digital fundamentals across diverse applications including retail shopping, grocery delivery, fashion purchases, electronics sales, subscription services, and marketplace transactions. The country’s high internet penetration rates, sophisticated digital payment adoption, tech-savvy consumer population, and commitment to convenience-oriented lifestyles create substantial demand for e-commerce platforms capable of delivering fast, reliable, and personalized shopping experiences. The proliferation of mobile shopping applications, social commerce integration, last-mile delivery innovations, and automated fulfillment centers is creating favorable market conditions, requiring significant investments in logistics infrastructure, technology platforms, cybersecurity systems, and customer service capabilities. Australia’s urbanized population, combined with expanding regional e-commerce accessibility and growing cross-border shopping preferences, makes it an increasingly attractive market for innovative e-commerce platform development and digital retail expansion.

Request For Sample Report:

https://www.imarcgroup.com/australia-e-commerce-market/requestsample

Australia E-Commerce Market Trends

• Mobile commerce acceleration: Growing reliance on smartphones for online shopping driven by mobile-optimized websites, dedicated shopping applications, mobile payment solutions, and seamless user interfaces enabling consumers to purchase goods anytime and anywhere with unprecedented convenience.

• AI and personalization integration: Increasing implementation of artificial intelligence algorithms, machine learning technologies, predictive analytics, and chatbot support systems delivering personalized product recommendations, instant customer service, and tailored shopping experiences improving conversion rates and satisfaction.

• Social commerce expansion: Rising utilization of Instagram Shopping, Facebook Marketplace, TikTok shopping features, and influencer-driven sales channels enabling direct purchasing through social media platforms shortening the path from product discovery to transaction completion.

• Fast delivery innovations: Expanding deployment of same-day delivery services, next-day shipping options, click-and-collect facilities, and automated fulfillment centers meeting heightened consumer expectations for speed, reliability, and transparent tracking throughout delivery processes.

• Subscription model growth: Strengthening adoption of subscription-based services across groceries, personal care, health supplements, and pet supplies offering automated recurring deliveries, personalized recommendations, flexible management options, and customer convenience driving loyalty and retention.

• Sustainability consciousness: Growing demand for eco-friendly packaging, carbon-neutral shipping, ethical sourcing transparency, and sustainable retail practices particularly among younger consumers prioritizing environmental responsibility and corporate values alignment in purchasing decisions.

Market Drivers

• Digital payment adoption: Implementation of digital wallets, contactless payments, instant payment systems, and secure transaction technologies valued at USD 118.0 Billion in 2024 enabling seamless checkout experiences reducing friction and encouraging online purchasing behaviors.

• Smartphone market penetration: Growing mobile device ownership and usage driving mobile commerce adoption with smartphones enabling convenient access to online shopping platforms, mobile payment capabilities, and location-based services supporting purchasing decisions.

• Internet accessibility expansion: Increasing internet penetration rates, improved broadband infrastructure, enhanced mobile network coverage, and affordable connectivity options enabling wider population access to e-commerce platforms across urban and regional areas.

• Convenience-oriented lifestyles: Rising consumer preference for time-saving shopping solutions, home delivery services, 24/7 product accessibility, and comprehensive online product information eliminating travel requirements and physical store limitations.

• Social media influence: Growing impact of Instagram, Facebook, TikTok, and influencer marketing driving product discovery, brand awareness, customer engagement, and direct purchasing through integrated social commerce features and targeted advertising campaigns.

• Competitive pricing advantages: Increasing online platform capabilities to offer competitive prices, discount promotions, price comparison tools, and exclusive online deals attracting price-conscious consumers and driving market share gains from traditional retail.

Challenges and Opportunities

Challenges:

• High delivery costs driven by Australia’s vast geography and sparse population outside major urban centers creating expensive logistics, longer shipping times, limited courier services, and elevated fulfillment expenses particularly challenging for small retailers

• Returns and reverse logistics complications involving expensive return shipping, lack of standardized processes, varying customer experiences, and operational inefficiencies particularly impacting apparel and electronics sectors with elevated return rates

• Customer acquisition costs escalating due to intensifying competition on Google and Meta platforms, rising paid advertising expenses, diminishing organic social media reach, and saturated digital marketing channels challenging profitability for emerging brands

• Regional accessibility disparities with limited logistics infrastructure in rural and remote areas creating delivery challenges, higher costs, and service gaps restricting market penetration beyond metropolitan regions

• Cybersecurity and data privacy concerns requiring robust security measures, regulatory compliance, fraud prevention systems, and customer trust maintenance amid growing digital transaction volumes and sophisticated cyber threats

Opportunities:

• Regional expansion potential targeting underserved rural and remote populations lacking physical retail access through enhanced delivery networks, local pickup options, strategic courier partnerships, and regional-focused marketing creating new customer segments

• Niche and specialty products growth enabling unique brands to reach specific audiences through online platforms without physical retail costs, leveraging social media storytelling, authenticity messaging, and community building for customer loyalty

• Cross-border e-commerce expansion accessing international markets through global marketplaces, localized platforms, simplified logistics solutions, and duty-inclusive pricing models enabling Australian retailers to reach Asia-Pacific and global consumers

• Augmented reality integration enhancing shopping experiences through virtual try-on capabilities, 3D product visualization, interactive demonstrations, and immersive technologies reducing return rates while improving customer confidence and satisfaction

• Subscription and recurring revenue models developing predictable income streams through automated replenishment services, membership programs, curated boxes, and flexible delivery schedules creating sustained customer relationships and lifetime value optimization

Australia E-Commerce Market Segmentation

By Type:

• Home Appliances

o Kitchen Appliances

o Cleaning Appliances

o Climate Control

o Small Appliances

o Smart Home Devices

o Entertainment Electronics

• Apparel, Footwear and Accessories

o Women’s Fashion

o Men’s Fashion

o Children’s Clothing

o Athletic Wear

o Footwear

o Fashion Accessories

• Books

o Physical Books

o E-Books

o Audiobooks

o Educational Materials

o Professional Publications

o Children’s Books

• Cosmetics

o Skincare Products

o Makeup

o Haircare

o Fragrances

o Personal Care

o Beauty Tools

• Groceries

o Fresh Produce

o Packaged Foods

o Beverages

o Frozen Foods

o Household Essentials

o Specialty Foods

• Others

o Electronics

o Sports Equipment

o Home Décor

o Toys and Games

o Health Supplements

o Pet Supplies

By Transaction:

• Business-to-Consumer (B2C)

o Online Retail Stores

o Brand Direct Sales

o Marketplace Platforms

o Subscription Services

• Business-to-Business (B2B)

o Wholesale Platforms

o SaaS Solutions

o Bulk Procurement

o Supply Chain Management

• Consumer-to-Consumer (C2C)

o Secondhand Marketplaces

o Peer-to-Peer Platforms

o Auction Sites

o Local Trading Apps

• Others

o Government-to-Consumer

o Business-to-Government

o Hybrid Models

o Collaborative Platforms

By Region:

• Australia Capital Territory & New South Wales

• Victoria & Tasmania

• Queensland

• Northern Territory & Southern Australia

• Western Australia

Browse Full Report:

https://www.imarcgroup.com/australia-e-commerce-market

Australia E-Commerce Market News (2024-2025)

• March 2025: Australia Post eCommerce Report revealed online marketplaces drove 39% of online spend growth in 2024, attracting $16 billion with Baby Boomers’ online spend increasing 17.6% and Builders up 22.9% year-over-year demonstrating generational adoption expansion.

• March 2025: Coles credited Witron supply-chain technology for USD 120 million sales lift in H1 FY 2025, demonstrating return on investment from high-throughput automated distribution systems during seasonal demand spikes supporting e-commerce fulfillment efficiency.

• November 2024: Amazon opened USD 90 million fulfillment center in Western Sydney expanding logistics infrastructure and delivery capabilities supporting faster shipping times and increased product availability for Australian online shoppers across metropolitan regions.

• August 2025: WooliesX e-commerce segment (EComX) reported 17.4% sales increase to $7.3 billion demonstrating sustained online grocery shopping growth and successful digital transformation initiatives by major Australian supermarket chains.

• 2024: EssilorLuxottica established partnership with e-commerce brand Pattern to improve online marketplace presence in Australia for Ray-Ban and Oakley brands demonstrating multinational corporations’ strategic focus on digital channel expansion.

• 2024: Dark-store automation deployed by Coles and Woolworths enabled metropolitan delivery windows under two hours, reinforcing grocery category as fastest-growing daily-needs segment and setting new speed benchmarks for Australian e-commerce.

Key Highlights of the Report

• Market Performance (2019-2024)

• Market Outlook (2025-2033)

• Industry Catalysts and Challenges

• Segment-wise historical and future forecasts

• Competitive Landscape and Key Player Analysis

• Type and Transaction Analysis

Ask analyst for your customized sample:

https://www.imarcgroup.com/request?type=report&id=21967&flag=F

Q&A Section

Q1: What drives growth in the Australia e-commerce market?

A1: Market growth is driven by digital payment adoption with infrastructure valued at USD 118.0 Billion enabling seamless transactions, smartphone market penetration facilitating mobile commerce convenience, internet accessibility expansion improving population connectivity across regions, convenience-oriented lifestyles prioritizing time-saving shopping solutions and home delivery, social media influence driving product discovery and direct purchasing through integrated features, and competitive pricing advantages offering discounts, comparison tools, and exclusive online deals attracting price-conscious consumers.

Q2: What are the latest trends in this market?

A2: Key trends include mobile commerce acceleration driven by smartphone shopping and mobile payment solutions, AI and personalization integration delivering customized recommendations and instant customer service, social commerce expansion enabling direct purchasing through Instagram, Facebook, and TikTok platforms, fast delivery innovations offering same-day shipping and click-and-collect options, subscription model growth providing automated recurring deliveries across multiple categories, and sustainability consciousness demanding eco-friendly packaging and carbon-neutral shipping practices.

Q3: What challenges do companies face?

A3: Major challenges include high delivery costs resulting from Australia’s vast geography and sparse population creating expensive logistics particularly challenging for small retailers, returns and reverse logistics complications involving expensive shipping and lack of standardized processes, customer acquisition costs escalating due to intensifying digital advertising competition and rising platform expenses, regional accessibility disparities limiting logistics infrastructure in rural areas, and cybersecurity and data privacy concerns requiring robust security measures and regulatory compliance.

Q4: What opportunities are emerging?

A4: Emerging opportunities include regional expansion potential targeting underserved rural populations through enhanced delivery networks and local partnerships, niche and specialty products growth enabling unique brands to reach specific audiences without physical retail costs, cross-border e-commerce expansion accessing international markets through global platforms and simplified logistics, augmented reality integration enhancing shopping experiences through virtual try-on capabilities reducing returns, and subscription and recurring revenue models developing predictable income streams through automated replenishment services.

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91-120-433-0800

United States: +1-201-971-6302

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses. IMARC’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

This release was published on openPR.