Global online retail is cooling after the pandemic surge. Shoppers are more selective, shipping costs normalized, and promotional intensity is back. The result: a global e-commerce slowdown that exposes how differently Amazon (NASDAQ:) and Alibaba (NYSE:) are built.

This Amazon vs. Alibaba e-commerce slowdown 2025 analysis looks at what’s changing — and why the gap in outcomes keeps widening.

It also introduces a Versus AMZN vs. BABA framework that investors now use to gauge how the two tech superpowers handle decelerating demand.

Amazon: Diversification Cushions The Hit

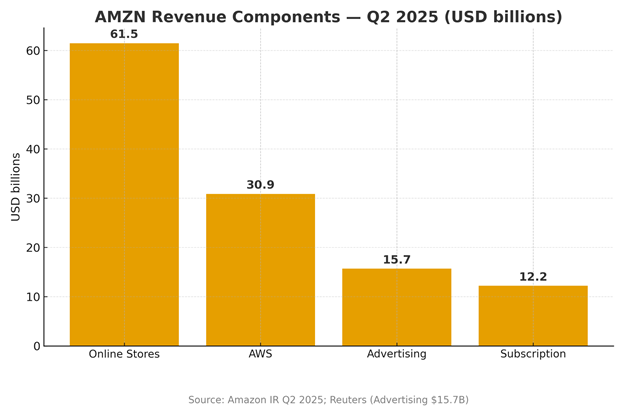

Amazon still relies on retail, but its profit engine is elsewhere. AWS contributes outsized operating income relative to its revenue share; advertising continues to grow briskly; Prime subscriptions deepen engagement and reduce churn.

That mix gives management room to prioritize margin and efficiency even when unit volumes slow. In practice, the slowdown affects Amazon less because non-retail lines — cloud, ads, and subscriptions — are less cyclical than discretionary goods.

Amazon’s diversified revenue cushions retail volatility.

Alibaba: Core Commerce Under More Pressure

In China, consumer caution and intense price competition weigh on marketplace take-rates and logistics costs. Alibaba is investing to defend share (including faster delivery) while pushing cloud and AI as the next growth leg.

Cloud is expanding, but it must scale profitably to offset slower retail. Net-net, the slowdown affects Alibaba more because its earnings remain tied closely to domestic commerce and to a policy environment that can shift quickly.

Two Models, Two Outcomes

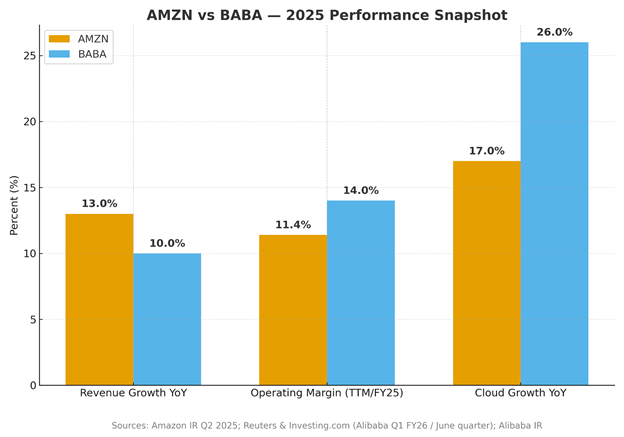

An AMZN vs. Baba business model comparison highlights the structural split:

- U.S. model (Amazon): diversified services (cloud / ads / subscriptions) and owned logistics — capital-heavy but margin-flexible.

- China model (Alibaba): volume-driven commerce with rising fulfillment intensity, plus a strategic pivot to cloud / AI that’s promising but still earlier-stage.

Those differences mirror broader China vs. US e-commerce market trends 2025: U.S. platforms are deeper in high-margin services; Chinese platforms face saturated penetration, price wars, and cautious households.

Versus Pair AMZN vs. BABA shows widening performance gap.

Versus Trade: a New Way to Read Market Divergence

The slowing retail cycle has inspired traders to treat these giants as a Versus trade — pairing them to measure relative strength across two economies and two regulatory models.

This Versus Pairs AMZN vs. BABA setup captures a broader idea: when investors buy one and hedge the other, they’re not just expressing company views but entire economic narratives.

U.S. demand resilience, interest-rate expectations, and cloud profitability often drive the long-AMZN leg; Chinese consumption, policy intervention, and domestic stimulus guide the short-BABA or neutral side.

In effect, the Versus AMZN vs. BABA relationship has become a real-time indicator of confidence in U.S. versus Asian tech. It turns abstract macro debates — growth vs. regulation, services vs. goods — into visible market positioning.

Investor Takeaway

Directionally, Amazon’s low-double-digit topline, supported by AWS and advertising, contrasts with Alibaba’s single- to low-double-digit growth amid heavier competition at home.

Cloud is a bright spot for both, but Amazon’s mix already monetizes at scale. That’s why the Amazon vs. Alibaba spread shows up not just in quarterly results but in valuation resilience.

For positioning, the global e-commerce slowdown favors businesses with profit pools beyond retail baskets.

Traders using Versus Pairs AMZN vs. BABA can visually track which ecosystem adapts faster to weaker discretionary spending and evolving policy risk.

Bottom Line

As e-commerce matures, diversified profit engines beat scale alone.

Or, put simply — same headwinds, different airplanes.

And in this Versus AMZN vs. BABA era, the lesson for investors is clear: resilience isn’t about who sells more, but who evolves first.