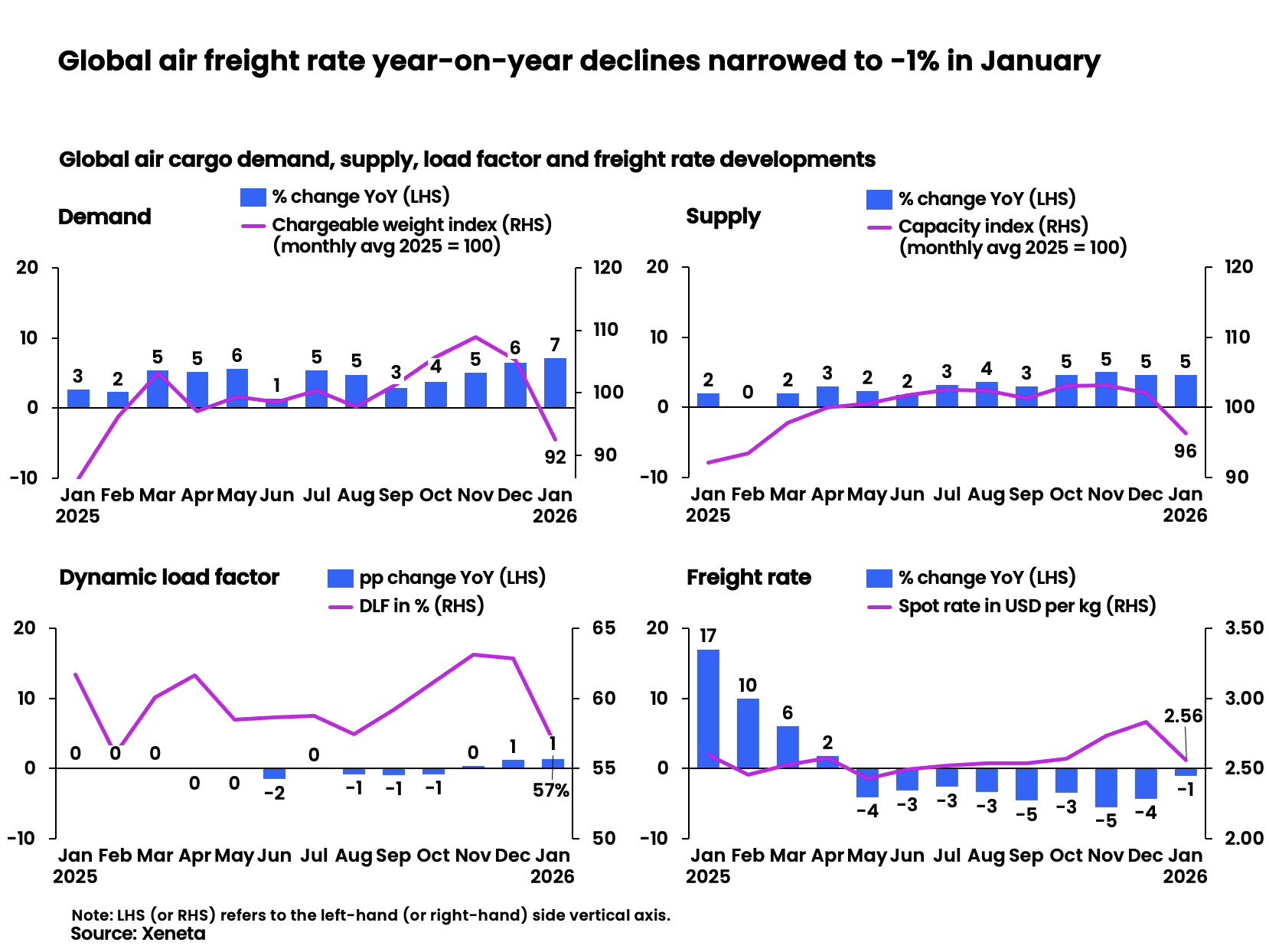

Air cargo volumes rose 7% year on year in January, but demand isn’t as healthy as it first appears, Xeneta has warned.

The industry analyst said that January’s boost in demand and an easing of recent freight rate declines was supported by an early Lunar New Year, but any optimism was dampened by the first year-on-year fall in e-commerce exports from China since January 2022.

The growth in global chargeable weight in the opening month of 2026 was the strongest increase since January 2025, and ahead of the 5% year-on-year growth in capacity supply.

With volumes rising faster than capacity, the global dynamic load factor edged up one percentage point to 57%. Dynamic load factor is Xeneta’s measurement of capacity utilisation based on volume and weight of cargo flown alongside available capacity.

Recent pricing declines also recovered, with global air cargo spot rates down just -1% year on year to $2.56 per kg in January.

However, Niall van de Wouw, Xeneta’s chief airfreight officer pointed out that Lunar New Year distorts normal market conditions and there has been a downturn in e-commerce volumes out of China and Hong Kong.

“Asia is such a big exporter of airfreight, it is difficult to draw any conclusions on what the market is signalling in January because of the Lunar New Year and the fluctuations it causes,” he said.

“In 2025, the festivities began on 28 January but this year, they begin on 15 February, so much of January’s strength in air cargo volumes is likely calendar-related rather than a clear indicator of improvements in underlying demand.”

Similarly, he said the picture for global air cargo spot rates in January may be a truer reflection of world economic events than demand for capacity.

Airfreight rates are typically quoted in local currencies, so a weaker dollar can make a world average – converted back into dollars – look firmer than it truly is.

He further stated that the outlook for demand and air cargo rates is unlikely to become clearer until the end of the first quarter, but there has been a decrease in e-commerce volumes ex China and Hong Kong that will definitely influence airfreight volumes.

The latest China Customs data for December shows low-value and e-commerce exports falling 9% year on year, the first decline since January 2022, following two months of flat growth.

This could potentially have a huge impact on the air cargo market, which has been elevated by cross-border e-commerce since late 2023 – and which relies on e-commerce for some 20-25% of its total annual volumes globally.

Following the end of the US de minimis exemption last year, China to US e-commerce exports were down more than 50% for a third consecutive month in December. For full year 2025, e-commerce exports fell 28% versus the prior year.

The move by China’s major e-commerce platforms to grow their share of the European market, to offset higher costs impacting volumes into the US, had offered a more positive outlook, but this, too, is now looking exposed, according to Xeneta.

The growth of China to Europe e-commerce volumes slowed to roughly 8% in December compared to a growth rate of 54% over the first 11 months of 2025.

And, when excluding Russia, e-commerce sales from China to the rest of Europe declined 23% year-on-year.

“In October, we said air cargo’s e-commerce growth engine was showing signs of slowing down, but that this could be just a blip,” said van de Wouw.

“We saw this again in November, and we said if it happened for a third consecutive month in December, this would signal a trend. This is now the situation.

“If it remains flat or declines further, it will certainly affect many organisations’ growth plans, including those with commitments to freighter conversions that will be relying on the high level of e-commerce demand we have seen in recent years.”

Regulation is undoubtedly a factor adding friction to e-commerce trade. US de minimis bans, the EU’s proposed processing fee, and new rules in Japan and Thailand all threaten to dull one of airfreight’s most reliable sources of demand, Xeneta pointed out.

Elsewhere, Xeneta predicts that a rapid modal shift from air back to ocean still looks unlikely in Q1 2026, and continued Red Sea shipping uncertainty may help to ensure the demand gap in airfreight volumes caused by fewer e-commerce shipments doesn’t widen further.

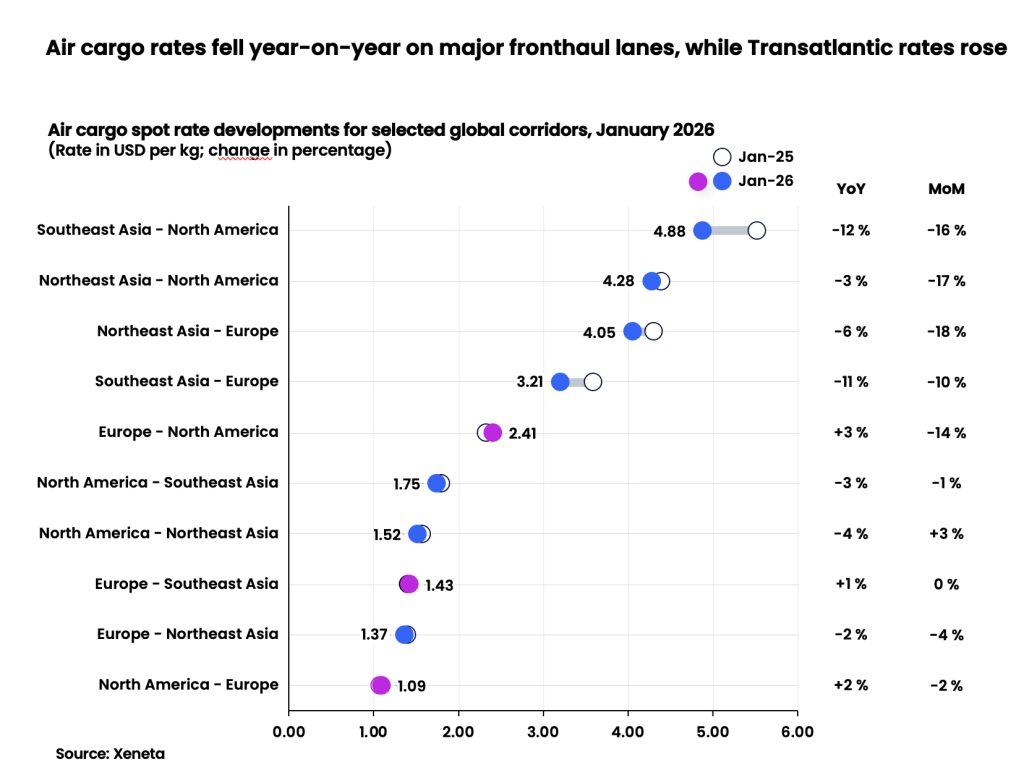

Most air cargo spot rates declined year on year

At the corridor level, most air cargo spot rates continued to decline year-on-year in January, broadly in line with the global market trend, said Xeneta.

The steepest falls were on Southeast Asia to North America and Southeast Asia to Europe, where spot rates dropped by more than 10% year on year as capacity continued to expand.

Month on month, both corridors also fell between 10 and 16%, reflecting their exposure to seasonal demand weakness.

Northeast Asia to Europe recorded the third-largest year-on-year decline, down 6% in January. This suggests capacity growth is outpacing demand, likely influenced in part by softer cross-border e-commerce growth.

By contrast, Northeast Asia to North America saw only a modest 3% year on year decline, largely driven by the agile removal of freighter capacity.

As with outbound Southeast Asia, both outbound Northeast Asia corridors also posted close to a 20% month on month decline as the market temporarily moved into the off-peak period.

Spot rates are expected to show an uplift ahead of the Lunar New Year in mid-February, although there are currently few signs of a pre-Lunar New Year cargo rush.

On the Transatlantic westbound corridor, spot rates unexpectedly rose 3% year on year, despite a 4% year on year decline in chargeable weight.

This divergence may partly reflect the recent US tariff threat – an additional 10% on imports from eight European countries – before it was reversed on 21 January. This demonstrates both the responsiveness and nervousness of shippers trying to protect their product margins.

The withdrawal of the tariff threat by the US administration appears to have prompted a temporary demand bump: in the week ending 25 January, volumes rose 16% week on week, a period that typically sees only low single-digit growth. However, a weaker dollar – making EUR-quoted air freight more expensive – may be a larger factor behind the rate strength.