AI Won’t Save Your Business. Your Brand Might.

As AI erases product differentiation, brand emerges as the most durable competitive advantage on the balance sheet.

Kantar

A Fortune 500 CMO called me last week with a familiar problem dressed in new language. Her CEO had mandated that every department demonstrate “AI transformation” within 90 days or face budget cuts. Marketing, she was told, would need to justify its existence in an AI-first world.

“What’s our moat when AI can do everything we do?” she asked.

I told her to flip the question: What’s your moat when AI can do everything everyone does?

The answer, supported by 20 years of empirical data, is hiding in plain sight.

Brand equity remains perhaps one of the only sustainable competitive advantages that AI cannot replicate, commoditize or disintermediate.

The $10.7 Trillion Proof Point

First, a definition. Brand equity is the sum of all associations, experiences, and predispositions that consumers have developed toward a brand. It’s that persistent nudge steering purchase decisions before buyers even consider alternatives.

So do brands still matter in an AI-first world?

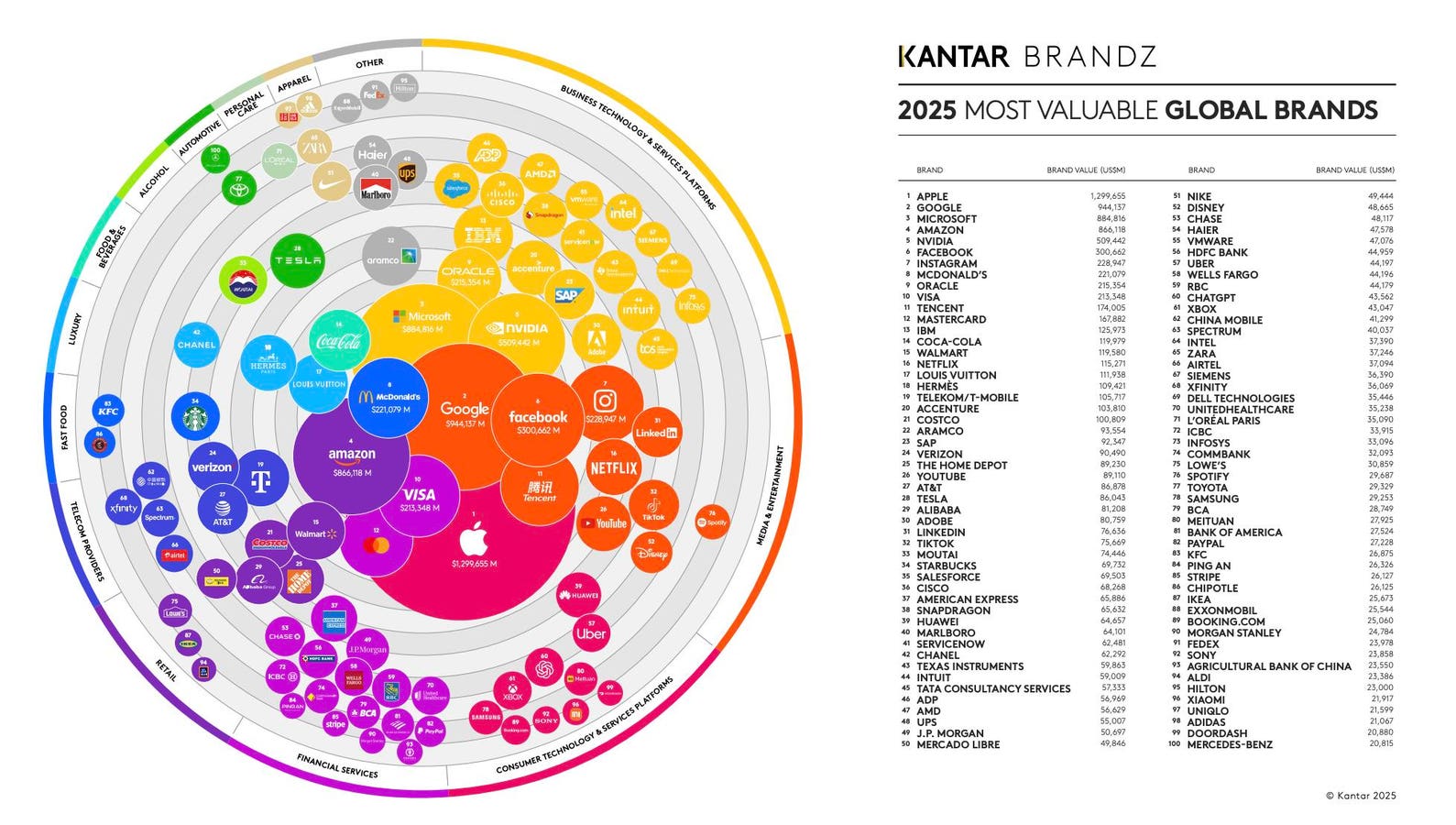

Last year, Kantar released the 20th anniversary edition of its BrandZ ranking of the Most Valuable Global Brands. Its one of the most comprehensive reports that makes the argument for brand value as a strategic asset. The Global Top 100 brands reached a record $10.7 trillion in total value, a 29% year-over-year increase driven largely by tech-enabled disruptor brands.

Apple holds the top position for the fourth consecutive year at $1.3 trillion in brand value alone, up 28% from 2024. Google ($944 billion), Microsoft ($885 billion), Amazon ($866 billion), and Nvidia ($509 billion) complete the top five.

Apple alone represents 12% of the entire Top 100’s value. When the report came out, it was one of the few trillion-dollar brand in existence (today there are 11). Apple was a company that ranked just #29 when BrandZ launched in 2006, before the iPhone transformed consumer technology.

The data reveals a striking pattern: brands that disrupted their categories or reinvented themselves have accounted for 71% of the incremental $9.3 trillion of value created in the Global Top 100 since 2006. Innovation and brand building aren’t separate strategies. They’re the same strategy.

The AI Commoditization Paradox

The conventional wisdom holds that AI will provide competitive advantage to early adopters. MIT Sloan Management Review recently challenged this assumption.

“Far from being a source of differentiation, artificial intelligence will be a source of homogenization,” wrote researchers David Wingate, Barclay Burns, and Jay Barney.

Their logic is irrefutable. Algorithms and training data are being commoditized. Hardware competition is fierce. Talent is increasingly plentiful. Open-source models reliably erode corporate offerings. Every serious technical advance in history from personal computers to the internet to genetic sequencing have all ultimately become equally accessible to every company.

AI will follow the same trajectory. This isn’t speculation.

In June 2023, OpenAI’s Sam Altman dismissed the possibility that a small team with $10 million could build a competitive large language model. Barely two years later, the Chinese AI startup DeepSeek built exactly that on a modest budget. Altman himself called it “impressive.” The moat he once described as impassable took less than 24 months to breach.

If AI won’t provide sustainable competitive advantage, what will? The most proprietary asset of all: the associations, memories, and predispositions that live in consumers’ minds – their relationship with your brand. Unlike algorithms, that relationship cannot be copied, reverse-engineered or open-sourced.

The 435% Financial Weapon

Brand equity isn’t a feel-good marketing concept. It’s a financial weapon with a two-decade track record.

From 2006 to 2025, the Kantar BrandZ Strong Brands Portfolio delivered 435% cumulative share price growth, compared to 353% for the S&P 500 and just 171% for the MSCI World Index. Strong brands didn’t just outperform – they outperformed with lower volatility and faster recovery from market shocks.

Amid the noise of AI disruption and economic volatility, one truth cuts through: strong brands deliver superior shareholder returns.

Kantar

During both the 2008 financial crisis and the COVID-19 pandemic, the strongest brands fell less, recovered faster, and ended up higher than market indices. Resilience, it turns out, is its own form of value creation.

“Even through economic crises, the world’s most valuable brands have consistently outperformed the S&P 500 and MSCI World Index over 20 years,” said Martin Guerrieria, Head of Kantar BrandZ. “This is irrefutable proof of marketing’s value.”

The performance gap isn’t marginal. It’s 264 percentage points over two decades. That’s the difference between doubling your investment and quintupling it.

U.S. brands now comprise 82% of the total value of the Global Top 100, up from 63% in 2006. European brands have fallen from 26% to just 7% over the same period. The companies that invested in brand building captured disproportionate value. Those that didn’t became footnotes.

Measuring What Matters: The MASB-Certified Framework

Here’s where it gets practical.

In January 2025, the Marketing Accountability Standards Board (MASB) certified Kantar’s Meaningful Different Salient (MDS) Framework – independently validating its connection between brand metrics and financial performance.

Unlike brand measurement approaches that rely on subjective assessments, MDS comprises seven metrics derived from 4.5 million consumer interviews across 54 markets covering 22,000 brands in 538 categories: Meaningfulness, Difference, Salience, Demand Power, Pricing Power, Activation Power, and Future Power.

“The links from these metrics to market share, price premiums, penetration, revenue growth, financial brand value, and stock price were all demonstrated,” noted MASB Executive Director Frank Findley.

Three questions that predict your brand’s financial future: Are you Meaningful enough to choose? Different enough to remember? Salient enough to come to mind first?

Kantar

What does this mean in practice? Kantar’s Blueprint for Brand Growth, built on analysis of 6.5 billion consumer data points over a decade, found that brands meaningfully different to more people command up to 5x market penetration compared to brands low in meaningful difference. They can also justify up to 2x the average category price point.

Being Meaningful means meeting functional needs while connecting emotionally. Being Different means standing apart – leading on innovation and setting trends. Being Salient means coming to mind quickly during purchase decisions. All three together create the predisposition that converts to purchase, premium pricing, and sustained growth.

Three Evidence-Based Growth Accelerators

The Blueprint translates MDS principles into three actionable levers, each with quantified impact for the AI era:

Predispose More People: Invest in creativity, advertising, and experiences that build both meaningful difference and mental availability. When optimally executed, this drives 9x higher volume share, 2x higher average selling price, and 4x likelihood of growing market share in the future.

Be More Present: Optimize distribution, customer journey, range, pricing, and promotions to convert predisposition into purchase. Brands present in most buying occasions win 7x more buyers than those present in only half.

Find New Space: Identify incremental motivations, occasions, and tangential categories to stretch into. Innovation focused on new spaces doubles a brand’s chance of growth. Increasing usage occasions by just 10% results in 17% revenue growth.

These aren’t theoretical frameworks. They’re derived from the largest combination of attitudinal and behavioral data ever assembled for brand analysis.

The ChatGPT Warning

Consider OpenAI’s ChatGPT, which debuted in the BrandZ Global Top 100 at position 60 in May 2025 with an estimated brand value of $44 billion – the highest newcomer since Nvidia in 2021 and the youngest company ever to make the list.

The company racing to build artificial general intelligence is investing heavily in the most fundamentally human asset – its brand.

OpenAI

This is first-mover advantage in action. ChatGPT has become the Kleenex of AI assistants, its brand so dominant that competitors must explain they’re “like ChatGPT but…”.

But the Kantar BrandZ report includes a warning: “With generative AI competition accelerating, OpenAI will need to invest in its brand to preserve its first-mover momentum.”

The same commoditization dynamics that will erode other advantages will eventually commoditize AI capabilities themselves. When that happens, not if, brand equity will determine who captures value.

We’re already seeing the pattern. Google and Microsoft have invested billions to respond to ChatGPT’s initial advantage. Chinese competitors like DeepSeek have demonstrated that technical capabilities can be matched quickly. The question isn’t whether AI capabilities will converge. They will. The question is which brands will retain customer relationships when they do.

Five Questions for the AI Era

Before your next meeting, consider these questions:

1. How does your brand’s value growth compare to category competitors? The BrandZ Top 100 grew 29% year-over-year. Are you keeping pace, or ceding ground?

2. Can you quantify your brand’s Demand Power, Pricing Power, and Future Power? These three MASB-certified metrics directly link to market share, price premiums, and revenue growth. If you can’t measure them, you can’t manage them.

3. How does your brand perform on Meaningful Difference versus category competitors? The gap between high and low meaningful difference is a 5x penetration advantage. Where do you stand?

4. If AI commoditizes your current competitive advantages within 24 months, what remains? Proprietary data, brand authority, and irreplaceable human capabilities are the only sustainable moats. How much have you invested in each?

5. Does your board treat marketing as an operating expense or a capital investment? Strong brands outperformed the S&P 500 by 82 percentage points over two decades. That’s not an expense. That’s a return.

The Real AI Strategy

That Fortune 500 CMO I mentioned? She reframed her 90-day mandate. Instead of demonstrating “AI transformation,” she presented her CEO with a different proposition: How do we use AI efficiency gains to strengthen our brand moat rather than simply cutting costs?

Companies that redeploy AI savings toward brand building will emerge stronger. Those that treat AI purely as a cost-reduction tool will discover they’ve automated away their only sustainable advantage.

The data is unambiguous. The methodology is MASB-certified. The 20-year track record is public. Brand equity isn’t a soft metric but rather a $10.7 trillion asset class among just the top 100 brands alone, one that outperforms markets, survives crises, and cannot be commoditized by artificial intelligence.

In a world where AI can do everything, the question isn’t what technology can do for you. It’s what relationship you’ve built with consumers that technology cannot replicate.

That relationship has a name: your brand.

And it might be the only thing worth investing in.