MARKET OVERVIEW

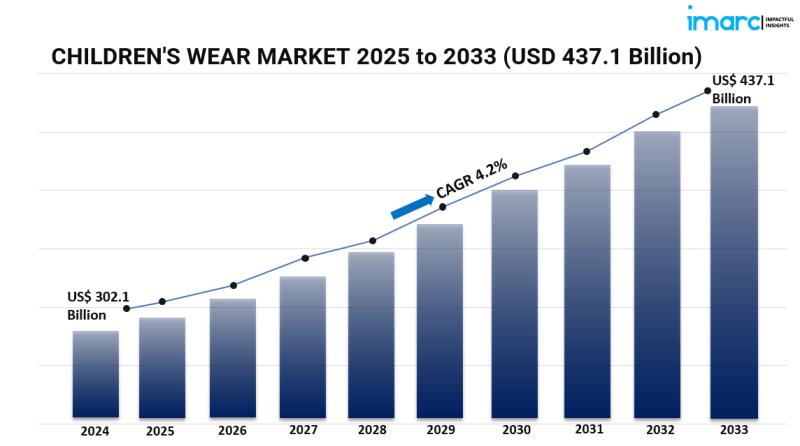

The global children’s wear market reached a size of USD 302.1 billion in 2024. It is projected to grow with a CAGR of 4.2% during the forecast period from 2025 to 2033, reaching USD 437.1 billion by 2033. Factors driving growth include fashion trend influence through social media and celebrity endorsements, demand for sustainable and health-conscious apparel, and advances in clothing design and technology.

STUDY ASSUMPTION YEARS

• Base Year: 2024

• Historical Years: 2019-2024

• Forecast Period: 2025-2033

CHILDREN’S WEAR MARKET KEY TAKEAWAYS

• Current Market Size: USD 302.1 Billion in 2024

• CAGR: 4.2% (2025-2033)

• Forecast Period: 2025-2033

• Growing parental focus on children’s fashion and quality clothing boosts market demand.

• Increasing need for customized and personalized clothing items worldwide drives growth.

• Asia Pacific region dominates due to urbanization, rising incomes, and changing lifestyles.

• Challenges include rising production costs, supply chain disruptions, and evolving user preferences.

• Opportunities lie in sustainable practices, digital shopping experiences, and market expansion through partnerships.

Request for sample copy of this report: https://www.imarcgroup.com/children-wear-market/requestsample

MARKET GROWTH FACTORS

The children’s wear market is propelled by a steady increase in parental spending on high-quality and stylish clothing for their children. Parents’ willingness to focus on fashion and style for kids, coupled with trend influences from social media and celebrities, cultivates sustained demand for diverse children’s apparel. Technological advancements and fashion innovations keep the market dynamic and responsive to consumer needs.

Customization and personalization in children’s apparel are significant growth drivers. There is a rising global preference for clothes tailored to individual tastes, which fuels market expansion. Companies are developing new styles and materials to meet diverse consumer preferences, enhancing brand appeal and market penetration.

Asia Pacific leads the market due to factors such as rapid urbanization, increased disposable income, and evolving cultural attitudes favoring premium and international brands. This region’s growing middle class with greater purchasing power encourages multinational brands to expand presence, leveraging localized marketing and product strategies to capture substantial market share.

MARKET SEGMENTATION

Breakup by Product Category:

• Apparel

• Footwear

• Others

Apparel leads the market, driven by the essential role of clothing in daily life, continuous fashion trends, and the demand for stylish, comfortable outfits for various occasions.

Breakup by Consumer Group:

• Infant (0-12 Months)

• Toddler (1-3yrs)

• Preschool (3-5yrs)

• Gradeschooler (5-12yrs)

Infant (0-12 months) dominates due to frequent clothing replacement needs from rapid growth and emphasis on comfort and functionality.

Breakup by Gender:

• Boys

• Girls

• Unisex

Girls represent the largest segment because of a wide variety of fashion choices and stronger demand for stylish clothing.

Breakup by Distribution Channel:

• Offline

• Online

Online is predominant given the rise of e-commerce platforms, increasing internet and smartphone usage, convenience, and the ability to compare products easily.

Breakup by Region:

• North America (United States, Canada)

• Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

• Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

• Latin America (Brazil, Mexico, Others)

• Middle East and Africa

Asia Pacific leads the regional markets supported by urbanization, growing middle class, and rising disposable incomes, along with favorable cultural shifts toward international and premium brands.

REGIONAL INSIGHTS

Asia Pacific is the dominant region, accounting for the largest share of the children’s wear market. This leadership is due to rapid urbanization, increasing disposable incomes, and a growing middle class with enhanced purchasing power. The region’s evolving cultural attitudes towards fashion have encouraged multinational brands to intensify their market presence via localized strategies and product offerings.

RECENT DEVELOPMENTS & NEWS

• November 2023: Carter’s Inc. announced the opening of a new storefront in Beckley, West Virginia, in 2024, providing affordable and reliable children’s clothing.

• October 2023: The Children’s Place Inc. launched the Gymboree XO Mandy Moore collection, inspired by parenting experiences and catering to millennial families with 45 timeless, high-quality children’s clothing pieces.

• January 2023: NIKE Inc. introduced the Jordan Brand 23/7 shoe for kids featuring step-in design and diverse colorways inspired by iconic Jordan moments.

• October 2023: Mackly partnered with Viacom18 to launch a ‘PAW Patrol’ kids’ wear collection in India, offering unisex garments inspired by the animated series to foster creativity and confidence.

KEY PLAYERS

• Adidas AG

• Benetton Group Srl

• Carter’s, Inc.

• Cotton On Clothing Pty Ltd

• DIESEL USA Inc.

• Dolce&Gabbana S.r.l.

• Esprit Global Image GmbH

• Fruit of the Loom, Inc.

• Kimberly-Clark Corporation

• Levi Strauss & Co.

• Mothercare plc

• NIKE, Inc.

• The Children’s Place, Inc.

• Gap Inc.

• V.F. Corporation

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Request for a customization: https://www.imarcgroup.com/request?type=report&id=1973&flag=E

CONTACT US

IMARC Group,

134 N 4th St., Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201-971-6302

ABOUT US

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.