If you have Bloom Energy in your portfolio or you are watching from the sidelines, it is hard not to notice this stock’s wild ride lately. Just in the past 30 days, shares have surged by 31.1%, even though last week saw a downturn of almost 12%. Year to date, Bloom Energy is up by an eye-catching 334.0%, and over the last year, it has soared a staggering 1003.6%. Those kinds of numbers are hard to ignore, and it is no wonder so many investors are wondering if this growth is real or if it is getting ahead of itself.

There have been some noteworthy developments fueling recent moves. Bloom Energy’s recent high-profile partnerships and expansion into new international markets have put a spotlight on the company in the broader renewables sector. Many investors have interpreted these moves as a sign that Bloom is carving out a more significant role in the global transition to clean energy, changing the way risk and growth are being perceived for this stock.

Despite all this momentum, the real question is whether Bloom Energy is actually undervalued or if the market’s optimism has pushed it too far. Using a value scoring system that gives one point for each of six standard undervaluation checks, Bloom scores only a 2. That means it is undervalued based on just two out of the six metrics we usually assess, so there is definitely more to unpack here.

Let us dive into how these different valuation approaches stack up, and why there might be an even smarter, more nuanced way to judge whether Bloom’s run can continue.

Bloom Energy scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Bloom Energy Discounted Cash Flow (DCF) Analysis

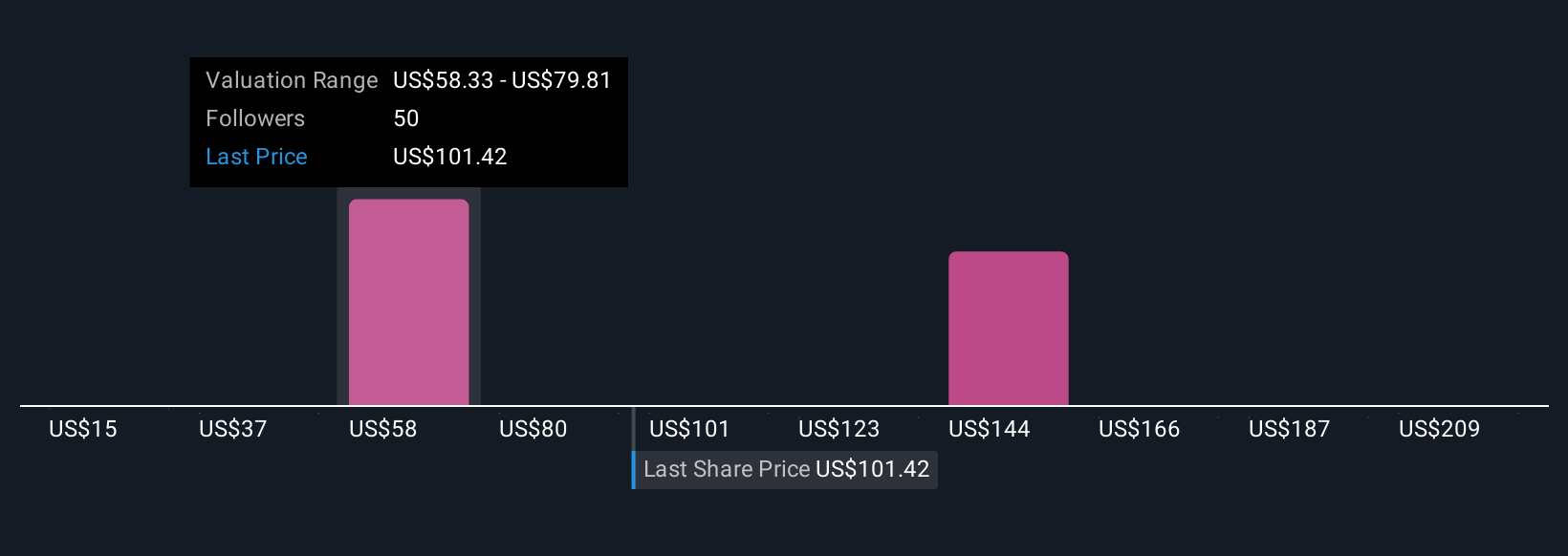

A Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to their present value. This helps investors understand what a business might truly be worth when looking past current market sentiment and focusing on the fundamentals.

For Bloom Energy, the latest reported Free Cash Flow is just over $1.2 million. While that number is relatively modest today, analysts expect aggressive growth within the next decade. Projections show Free Cash Flow reaching approximately $1.45 billion by the end of 2029, underlining the market’s expectation that Bloom Energy will scale rapidly in the large and growing renewables sector. The estimates for the first five years rely on analyst insights, while the following years are extrapolated based on the company’s current momentum and broader industry trends.

Based on these robust future cash flow projections and using a two-stage Free Cash Flow to Equity model, Bloom Energy’s intrinsic value is calculated at $165.42 per share. This is 38.7% higher than its current trading price, suggesting a significant intrinsic discount.

Result: UNDERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Bloom Energy.

Our Discounted Cash Flow (DCF) analysis suggests Bloom Energy is undervalued by 38.7%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

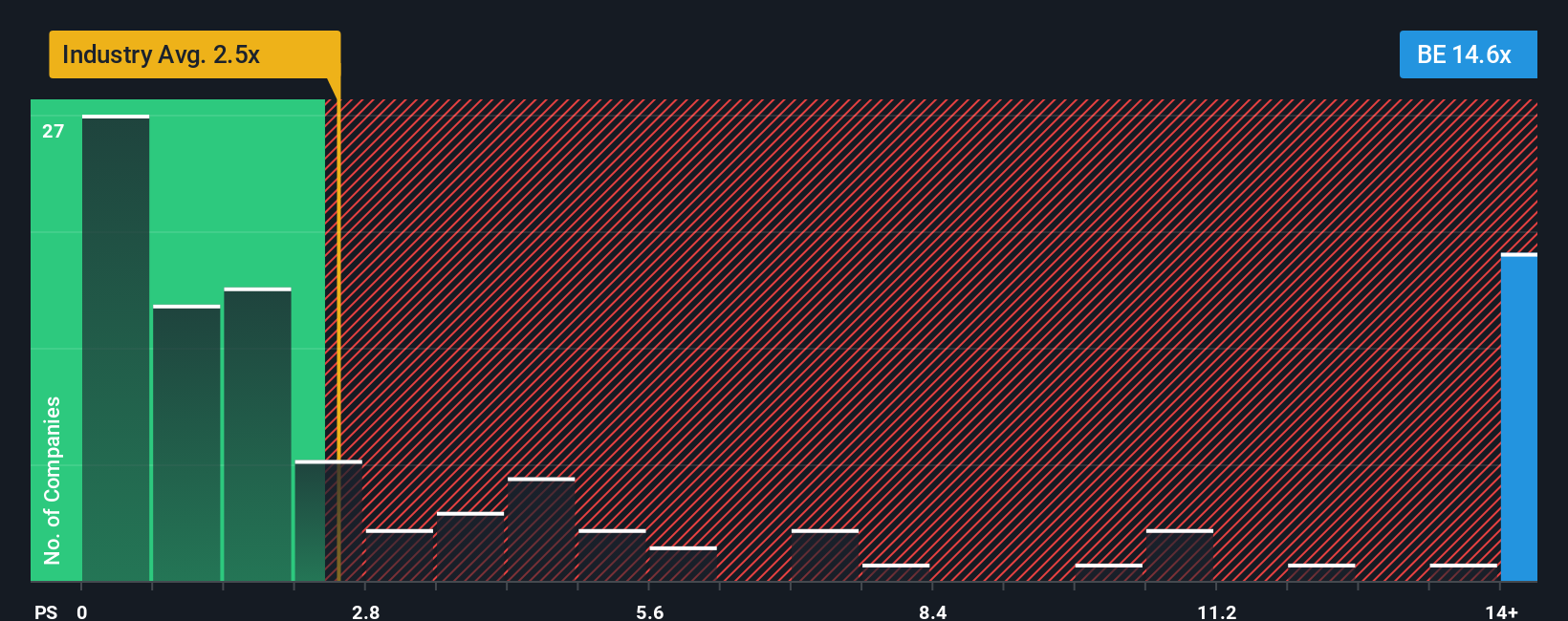

Approach 2: Bloom Energy Price vs Sales

For companies that are still in the growth stage and not yet consistently profitable, Price-to-Sales (P/S) is often the most insightful valuation metric. Unlike earnings-based multiples, the P/S ratio is less affected by short-term fluctuations in profitability and gives investors a fairer sense of how the market is valuing each dollar of revenue. This is particularly relevant for Bloom Energy, which continues to invest heavily in growth to capture more of the clean energy sector.

Growth expectations and risk play a big role in what is considered a “normal” or “fair” P/S ratio. If a company is expected to keep growing faster than its peers and has a robust market opportunity, investors are usually willing to pay a higher multiple. Conversely, higher perceived risks or lower growth can warrant a lower multiple.

At the moment, Bloom Energy trades at a Price-to-Sales ratio of 14.56x. That is significantly higher than both the Electrical industry average, which sits at 2.43x, and the peer average of 5.51x. This reflects optimism about Bloom’s growth prospects. To put this in clearer perspective, Simply Wall St’s proprietary Fair Ratio, which factors in earnings growth, profit margins, risks, market cap, and industry context, comes in at 6.76x. This Fair Ratio is a much more nuanced benchmark than raw peer or industry comparisons because it adapts to Bloom’s unique business situation and the bigger picture trends around it.

Comparing Bloom Energy’s current P/S ratio of 14.56x to its Fair Ratio of 6.76x, the stock appears to be trading well above what would be considered fair value on this measure alone.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Bloom Energy Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. In simple terms, a Narrative is your own investment story about a company. It connects your expectations around Bloom Energy’s future revenue, profit margins, and fair value to the bigger picture of where you think the business is headed.

With Narratives, you are not just looking at numbers in isolation; you are tying those numbers to your unique outlook and assumptions. This approach lets you create a dynamic link from Bloom Energy’s real-world developments to your investing decisions, showing how your fair value stacks up against the current market price. Even better, Narratives on Simply Wall St’s Community page are accessible and easy to use, helping millions of investors refine their views as new information, such as earnings or news, comes to light.

For example, if one investor believes that Bloom’s growth in AI-driven data center power and recurring service revenue will drive aggressive future earnings, they might set a high fair value close to the most bullish target of $48. Conversely, a more cautious investor who is concerned about competition from zero-emissions alternatives might choose a fair value nearer the bearish estimate of $10. Narratives let you easily choose, adjust, and update your perspective, empowering you to make smarter, more confident buy and sell decisions as the story evolves.

Do you think there’s more to the story for Bloom Energy? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if Bloom Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free Analysis

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com