Italian 3D printer manufacturer Caracol has secured $40 million in Series B funding to expand its large-scale robotic manufacturing business and accelerate its international growth.

The round was led by Omnes Capital and Move Capital Fund I, with participation from CDP Venture Capital’s Large Ventures Fund, other international funds, and several Italian institutional investors. Existing shareholders Primo Capital, Eureka! Venture, and Neva SGR also took part. The round was oversubscribed, allowing some early investors to exit with returns.

According to the manufacturer, this new funding will help Caracol strengthen its operations across Europe, the United States, and the Middle East, while entering new markets in Asia-Pacific, including Japan. Part of the investment will go toward advancing the company’s manufacturing platforms, with a focus on software, automation, and AI to improve production control and efficiency.

“This Series B represents a generational step for Caracol,” said Francesco De Stefano, CEO and co-founder of Caracol. “In just a few years we’ve built strong global traction, doubling revenues year after year. This round validates our vision and the outstanding execution of our team, while bringing on board some of the world’s leading deep-tech investors.”

Caracol strengthens U.S. presence with Austin facility

A key step in this global expansion is the launch of Caracol’s new U.S. headquarters and production facility in Austin, Texas. The 6,000 sq. ft site will serve as a hub for assembling, testing, and delivering robotic manufacturing systems for the North American market. It also includes a production and applications center supporting customer projects in aerospace, automotive, construction, and design.

Austin was chosen after a review of several U.S. cities, with investors highlighting its strong industrial ecosystem and proximity to aerospace and defense supply chains. The facility is designed to handle the assembly of up to 100 robotic systems each year, signaling Caracol’s intent to scale quickly in North America.

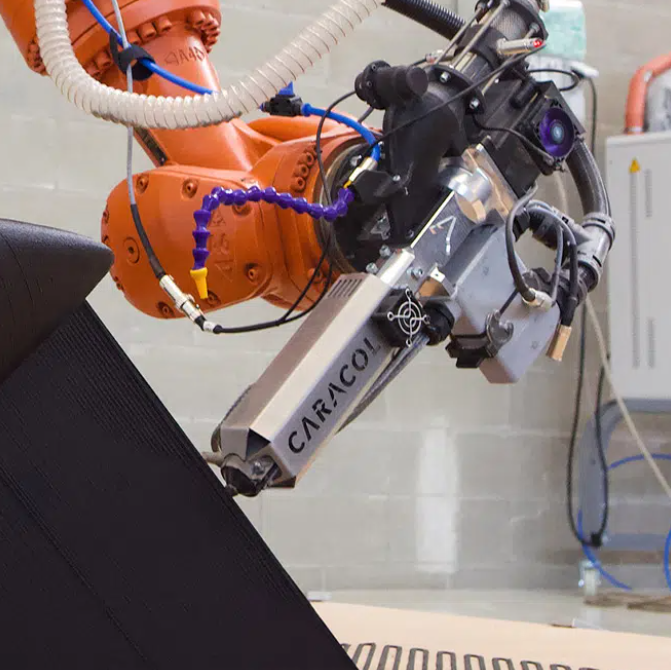

Caracol’s technology is used across sectors where scale, cost, and lead time are critical. The company says its large-format AM systems can cut production times by up to 80% compared with traditional methods, while reducing material waste and enabling the creation of complex, large-scale parts.

Founded in 2015 near Milan, Caracol began as a design firm before moving into industrial tooling and manufacturing. Its Heron AM platform focuses on polymer composites, and the newer Vipra AM platform produces metal parts using wire-arc additive manufacturing (WAAM).

Both systems are driven by Eidos, Caracol’s proprietary software that integrates sensors, cameras, and simulation tools to refine each build. The technology can also switch between additive and subtractive processes, allowing the same robotic cell to both print and mill parts.

Caracol also reported steady Y/Y revenue growth through H1 2025, with the U.S. now accounting for around 40% of total revenue. To support that momentum, the company recently acquired AM technology from Germany’s Hans Weber Maschinenfabrik, strengthening its supply base in the DACH region. It has also achieved ISO 14001 certification for environmental management and applies the same sustainability standards at its Austin site, emphasizing recycling and circular material use.

Advisors on the Series B transaction included Growth Capital, Fieldfisher, Legance, Portolano Cavallo, and Target Law.

Investor interest in additive manufacturing

Investment in additive manufacturing has been steady, drawing sustained interest from global backers. The market has not returned to the level of activity seen before the pandemic, but investor behavior has become more selective, focusing on practical, sustainable ventures rather than speculative tech trends.

Heat exchanger 3D printing specialist Conflux Technology secured $11 million in Series B funding to expand production of its 3D printed heat exchangers and enhance their efficiency. Backed by Breakthrough Victoria with participation from AM Ventures and Acorn Capital, the round was aimed at advancing the company’s automated Conflux Production Systems (CPS), which are designed to make heat exchanger manufacturing faster and more reliable.

The funding also supported joint efforts with Odys Aviation on a heat recuperator expected to lower aircraft fuel use by over 40%, ongoing work with Rocket Factory Augsburg on Monel K 500 exchangers produced through EOS M300-4 DMLS, and research with Deakin University on new aluminum alloys to improve AM performance.

Elsewhere, Canadian 3D printing powder developer Equispheres raised about CAD 20 million in the initial close of its Series B round to expand production of metal powders used in AM. The financing was led by Martinrea International with advisory support from INFOR Financial and Stifel Nicolaus Canada.

The company planned to use the funds to install new reactors that increase output, upgrade its facilities, and work with industry partners on developing new materials. These initiatives were intended to make metal 3D printing more cost-efficient and meet rising demand in large-scale aluminum applications.

Help choose the 2025 3D Printing Industry Awards winners – sign up for the Expert Committee now!

To stay up to date with the latest 3D printing news, don’t forget to subscribe to the 3D Printing Industry newsletter or follow us on LinkedIn.

While you’re here, why not subscribe to our Youtube channel? Featuring discussion, debriefs, video shorts, and webinar replays.

Featured image shows (from L-R) Francesco De Stefano, CEO of Caracol, Ludwig Weber, Managing Director at Weber, Dr. Markus Weber, Managing Director at Weber, and Paolo Cassis COO of Caracol. Image via Caracol.