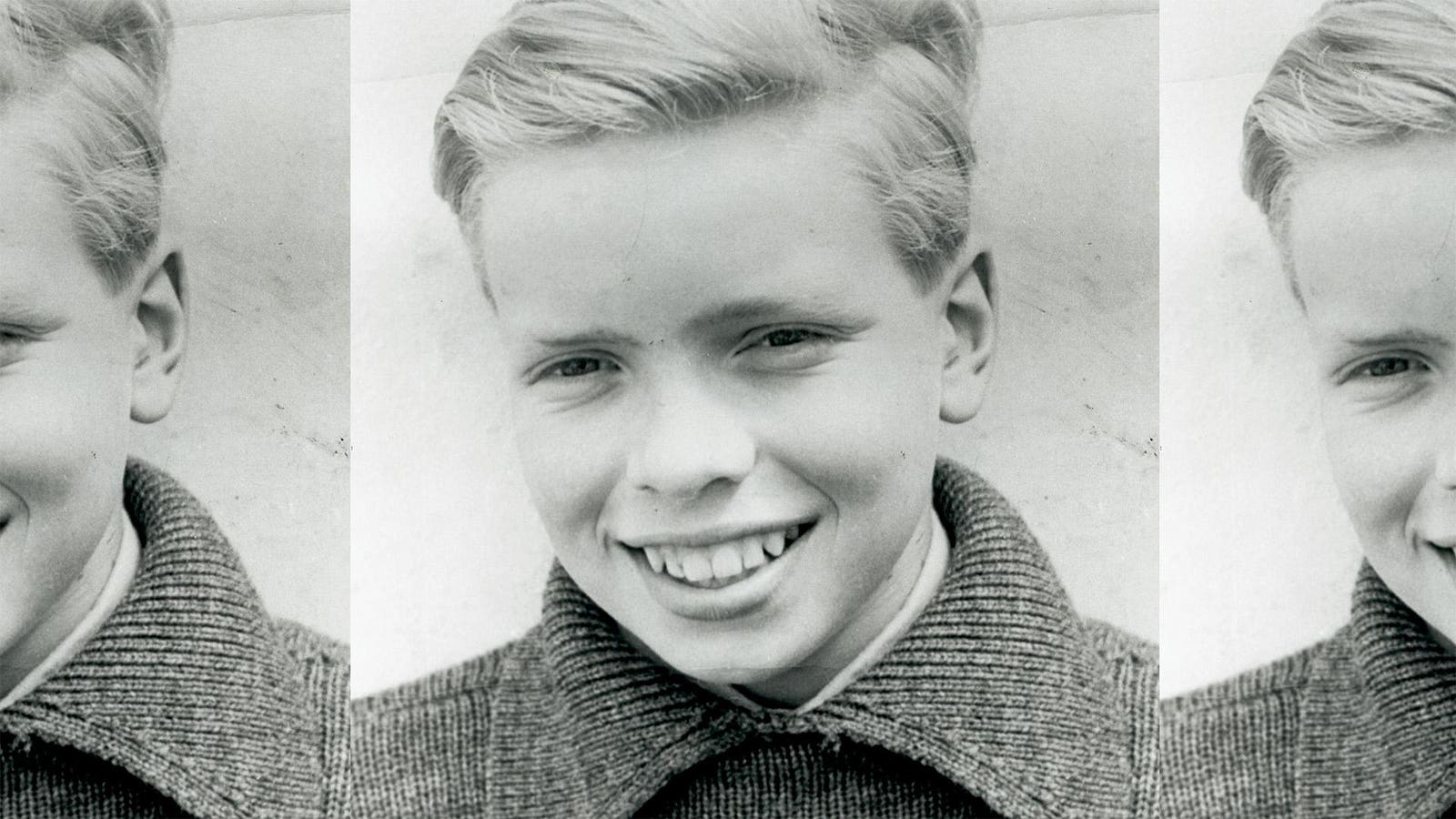

Branson made his first investments starting at age 13, gambling his pocket change on two ventures that failed miserably—but taught him priceless lessons.

Sir Richard Branson was 19 years old when he and his childhood buddy Nik Powell cofounded what later became the international conglomerate known as Virgin Group. It was 1970, and the two teenagers picked the name “Virgin” for their mail-order record company as a cheeky nod to their inexperience in business.

Next came, in rapid succession, Virgin record stores, Virgin Megastore, and Virgin Games, all within the first dozen years. Then, boldly, an airline, Virgin Atlantic, in 1984. Today it services 5.6 million passengers yearly, generating $4.4 billion in revenue. Branson followed it up with the likes of gym chain Virgin Active, sports betting app Virgin BET, Virgin Mobile, Virgin Hotels and space tourism company Virgin Galactic. More than a handful of Branson’s ventures have failed or been sold off over the years, including Virgin Records, which he painfully let go of for $1 billion in 1992 to help keep Virgin Atlantic afloat. In all, today Branson oversees 40 Virgin companies, operating in 35 countries and employing more than 60,000 people.

Now age 75 and worth an estimated $2.8 billion, Branson recalls how his earliest investments—made when he was just a young teen in the English countryside—laid the foundation for all his success and still affect how he runs his sprawling empire today.

Forbes: Can you tell us about your first investment? What was it and when did it happen?

Sir Richard Branson: When I was at school, my friend Nik Powell and I decided to use our pocket money to grow Christmas trees. We thought we’d make a fortune selling them later.

High Flyer: Branson, posing in a leather flying jacket and helmet announcing the launch of Virgin Atlantic, charged into the airline industry in the 1980s—then set his sights on space in 2004, with Virgin Galactic.

Bryn Colton/Getty Images

Forbes: What do you remember most strongly about it?

Branson: I remember it was during the school holidays and Nik and I spent a long time investigating the trees, working out how long it would take for them to grow four feet and how much profit we might be able to make. We agreed to do the work together and share the profits between us.

Forbes: Why did you decide to make that investment?

Branson: My mum, Eve, always had a money-making project on the go and her entrepreneurial enthusiasm rubbed off on me. She made my childhood feel like an adventure and I wanted to see if I could turn pocket money into a real business. The sheer possibility of earning my own money was really exciting.

Forbes: How much did you spend on it and where did you get the funds?

Sir Richard Branson: We used our pocket money to buy the seedlings. Our calculations showed that a bag of seeds cost £5, and we believed we could sell 400 four-foot Christmas trees at £2 each, making us a profit of £795.

It wasn’t a huge amount, but to us at the time it felt like we were making a serious investment.

Forbes: Did you make any money?

Branson: We didn’t make a penny. When we came back from school for the summer holidays, we found that there were only a couple of tiny plants growing, the rest had been eaten by rabbits.

The following Christmas, Nik’s brother was given a budgerigar [a small, long-tailed parrot that was semi-popular as a pet] as a present and that gave us another brilliant business idea–to breed budgies. I persuaded my Dad to build a huge aviary and the birds bred rapidly. However, I had overestimated the local demand for budgies and even after everyone I knew had bought two, we still had lots left. One day, my mother told me the aviary had been invaded by rats which had eaten the budgies. It was only years later that she confessed she had been fed up with cleaning out the aviary so one day had left the cage door open and they all escaped.

Megabillionaire: Branson opened his first Virgin Megastore in the 1970s, and promoted new openings by doing everything from parachuting into a Salt Lake City store in 1992 to dressing up as the Mad Hatter in Boston in 2002.

James Leynse/Corbis/Getty Images

Forbes: What did you learn from your first investment?

Branson: Let’s just say I quickly discovered that “money doesn’t grow on trees.” It was a tough lesson, but a valuable one, that failure isn’t a dead end, it’s simply part of the journey.

While neither of these schemes had the effect of making money, they did teach me that taking risks is essential if you want to build a business, but you’ve also got to think a few steps ahead and prepare for things you can’t control.

The trees were meant to take 18 months to mature, and while we never made it that far, the experience taught me the value of long-term thinking. Good things take time to grow. Patience, persistence and enjoying the ride is what it’s all about.

I also learned the value of a great partner. Nik and I went on to create Student Magazine and Virgin Records together. We remained friends for life and had lots more adventures together.

Forbes: If you could give your 20-year-old self some advice about investing, what would it be?

Branson: I’d tell myself to be bold and say ‘yes’ to opportunities, even when they feel daunting. You rarely have all the knowledge or resources at the start, but you can figure things out along the way.

I’d also remind myself that failure is part of the journey. Every setback, like the Christmas tree venture or the budgie business, teaches you something valuable. Above all, I’d encourage myself to trust my instincts and focus on building businesses that make a positive difference.

When you do what you love and bring value to others, success has a way of following.

First Flight: Virgin Atlantic’s maiden voyage was a June 22, 1984 trip between London Gatwick Airport and Newark International, near New York City. Today the airline offers flights to 28 locations across five continents, including London to Los Angeles, Lagos or Dubai.

Antoine Gyori/Corbis/Getty Images

Forbes: How would you describe your investment strategy today and has it evolved over your career?

Branson: I still believe in making bold decisions, but I’ve learned to protect the downside. In the early days, I would throw everything into an idea, but experience has taught me the importance of managing risk while dreaming big.

Selling Virgin Records to keep Virgin Atlantic alive was a tough decision, but it showed me that sometimes you have to let go of something you love to safeguard the bigger picture. Today, I focus on ideas that excite me, diversifying across industries, and building companies that make a positive impact.

My plan has evolved, but the spirit of adventure is the same.

More from Forbes