Amazon’s stock has gained steady attention in recent months as investors look for stability and long-term growth amid a volatile tech landscape. The company’s diversified business model, spanning cloud computing, online retail, advertising, and emerging technologies, continues to strengthen its position as one of the most influential players in global markets.

With accelerating demand in artificial intelligence (AI) infrastructure, strong performance in its advertising division, and renewed optimism in its core e-commerce operations, analysts suggest Amazon may still have significant upside potential.

Recent earnings show that Amazon’s momentum remains intact. The company reported $148 billion in revenue for the second quarter of 2025, reflecting growth across its key business segments, while AWS revenue rose about 19% year over year, according to CNBC.

These gains highlight Amazon’s ability to maintain strong financial performance despite an increasingly competitive environment. As the broader market debates the next major growth story in tech, Amazon’s mix of scale, innovation, and financial discipline continues to make a compelling case for investors.

Reason 1: Cloud and AI Infrastructure

Amazon Web Services (AWS) remains the company’s primary profit engine and a critical driver of future growth. The division has continued to expand its global footprint, powering the digital infrastructure behind major corporations, startups, and government agencies.

In the second quarter of 2025, AWS revenue grew about 19% year over year to nearly $26.5 billion, according to CNBC. Analysts expect growth to accelerate as enterprises increase spending on cloud and AI workloads.

Amazon has been actively reshaping its cloud strategy to capture the AI boom. Its investment in Anthropic, an artificial intelligence startup developing advanced language models, strengthens its position in a market increasingly defined by AI-driven computing.

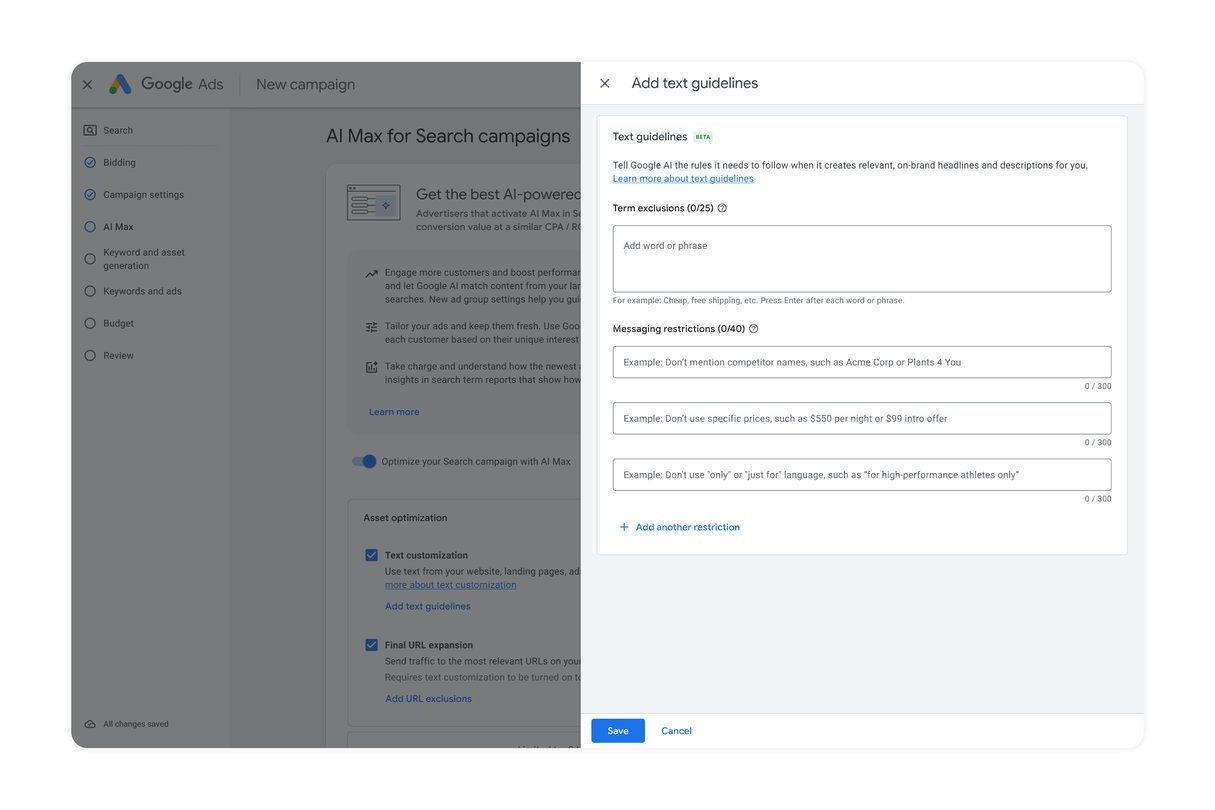

AWS also introduced a series of AI infrastructure products designed to compete with Nvidia’s data-center dominance, improving accessibility for developers who want to build custom AI models. This expansion of both hardware and software capabilities signals Amazon’s commitment to remaining a leader in the next generation of digital infrastructure.

Reason 2: Advertising and E-Commerce Synergies

While AWS drives profitability, Amazon’s advertising business has become a fast-growing revenue source that complements its e-commerce ecosystem. In the most recent quarter, advertising services revenue rose 23% year over year to $15.7 billion, making it one of the company’s most successful segments, as reported by The Motley Fool.

This growth reflects the strength of Amazon’s data-driven platform, where advertisers can directly target millions of active shoppers at the point of purchase.

These gains are deeply tied to the company’s core retail business. As global e-commerce continues to grow, Amazon remains the market leader in online retail, with a projected share of roughly 38% of U.S. e-commerce sales in 2025, according to Insider Intelligence.

This synergy between retail and advertising gives Amazon a unique competitive edge, as ad spending directly supports sales conversions and customer retention. For readers interested in related insights on digital retail and online brand strategies.

Reason 3: Attractive Valuation and Technical Setup

Despite solid performance, many analysts argue that Amazon’s stock remains attractively priced relative to its growth potential. The company’s forward price-to-earnings ratio stands near 40, lower than that of some AI-focused peers such as Nvidia and Microsoft, according to Morningstar. Investors view this valuation as reasonable given Amazon’s strong balance sheet, diversified revenue streams, and consistent double-digit growth in key segments.

From a technical standpoint, Amazon shares have traded above their 200-day moving average since mid-2025, showing steady accumulation from institutional investors. The stock’s recovery from its 2022 lows has been gradual, suggesting room for additional upside if macroeconomic conditions stabilize and interest rate pressures ease. Several market analysts also highlight Amazon’s potential to outperform the broader S&P 500 in the next year as its AI and logistics investments begin to translate into higher margins.

Reason 4: Diversified Bets and Capital Strength

Amazon’s long-term strategy extends far beyond retail and cloud computing. The company is building new growth channels in healthcare, logistics, robotics, and satellite connectivity. Its Project Kuiper satellite network, designed to deliver global internet access, is expected to begin commercial operations in 2026, with early satellite launches already completed this year. In addition, its autonomous vehicle subsidiary Zoox is advancing testing for self-driving taxis in the United States, positioning Amazon to compete in emerging mobility markets.

Financially, Amazon remains in a strong position to fund these initiatives. As noted by Barron’s, the company plans to invest over $100 billion in capital expenditures in 2025, primarily to expand its AI infrastructure and logistics capacity. This significant investment capacity, supported by robust cash flow and manageable debt levels, enables Amazon to pursue ambitious projects while maintaining financial flexibility. Such diversification provides resilience against potential slowdowns in any single business line and underlines Amazon’s long-term growth potential.

Risks

Although Amazon’s long-term outlook appears positive, several risks could limit its near-term gains. The company’s heavy investments in AI infrastructure and logistics expansion have significantly increased its capital expenditures. Analysts note that Amazon expects to spend more than $100 billion in 2025 on these projects, which may compress free cash flow in the short term, according to Barron’s. If growth in Amazon Web Services or advertising slows unexpectedly, profitability could come under pressure.

Competition is also intensifying. Rivals such as Microsoft and Google are expanding their AI cloud offerings, while new entrants are targeting niche areas of cloud computing. Additionally, Amazon faces regulatory scrutiny over antitrust concerns and labor practices, both in the United States and the European Union. Any major legal or policy developments could impact its operations or brand image. Market volatility and uncertain global economic conditions further add to potential downside risks, especially if consumer spending weakens in key markets.

Conclusion

Amazon remains one of the most diversified and resilient technology companies in the world. Its leadership in cloud infrastructure, accelerating advertising growth, and expanding portfolio of future-focused ventures provide a strong foundation for long-term investors. Despite competitive and regulatory challenges, the company’s consistent financial performance and commitment to innovation keep it positioned for steady value creation.

For investors seeking a blend of stability and growth, Amazon’s current valuation and business momentum present a compelling opportunity. The company’s progress in AI, logistics, and digital services will likely shape the next phase of its expansion. Watching upcoming quarterly results, especially in AWS and advertising, will be key to gauging whether this momentum can continue into 2026 and beyond.