It’s a bittersweet payday for hundreds of thousands of federal employees.

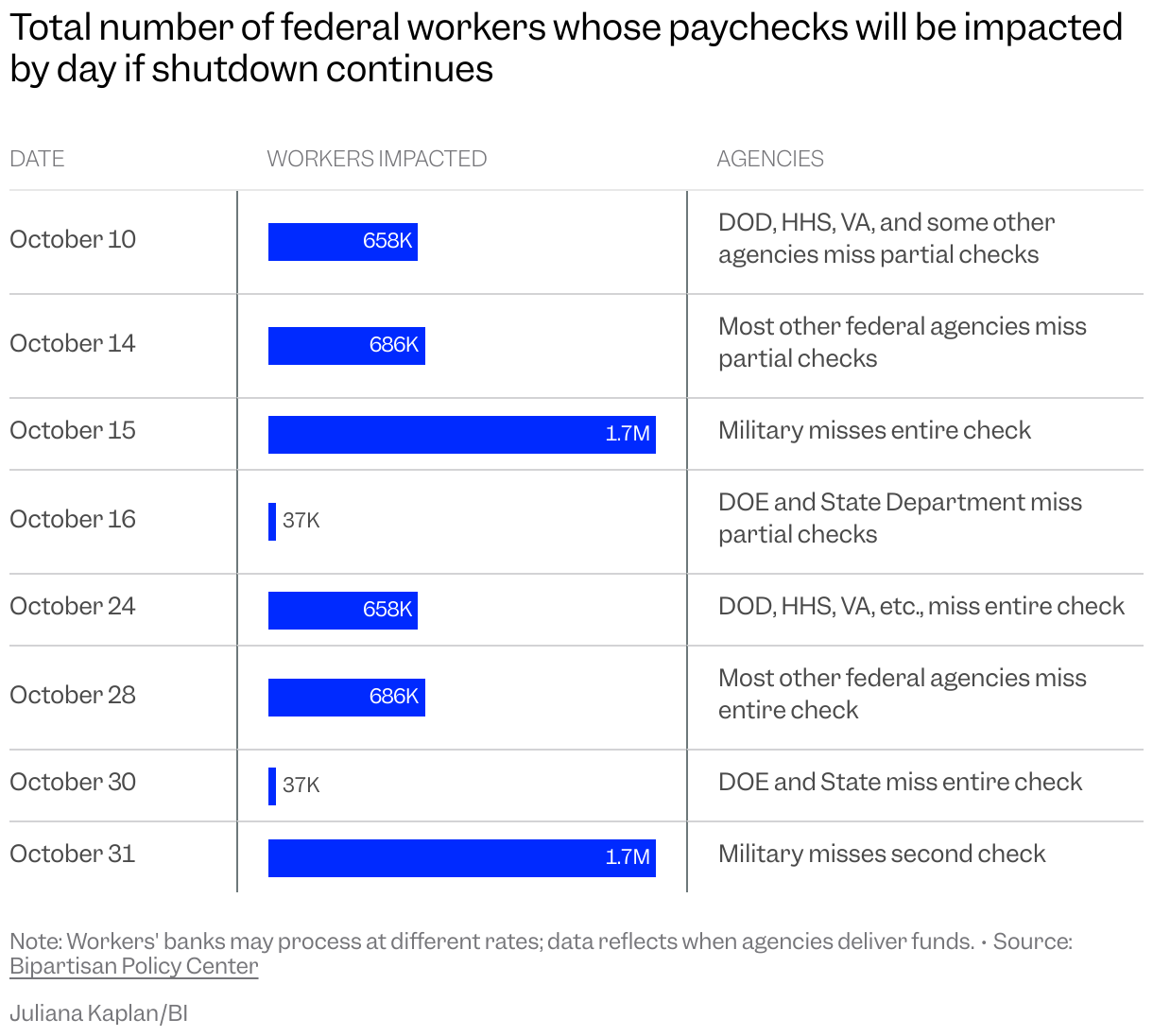

Paychecks start going out today to 658,000 workers, with more to follow next week. As the government shutdown drags on, they will be lighter than usual — and the last ones until Congress reaches a funding deal. Even the guarantee of back pay is in question.

“A lot of us are living paycheck to paycheck, like most Americans, but even more so now we have to be cognizant of where every penny is going,” Mark Cochran, a furloughed National Park Service employee in Pennsylvania and AFGE Local 3145 president, said. “So we’re going to have to drastically cut our spending, because we don’t know where or when our next paycheck is going to happen.”

Business Insider spoke with 11 federal workers across departments and geographies, including in the military. Some are furloughed, and others are reporting to work without pay.

While the shutdown has already interrupted key economic labor data and reduced government services, Americans haven’t felt much impact. That’s about to change.

What a missed paycheck means for federal workers

This year, mass firings, deferred resignations, and a shutdown have jolted what were once thought of as stable roles; now, some workers are worried that they won’t be able to afford necessities, or are holding off on other spending.

Jill Hornick, a Social Security field office employee for over 30 years and the administrative director of AFGE Local 1395, said that she was looking into organizing food drives for her fellow federal workers. “If it goes long enough, I won’t be able to afford to pay for my medical expenses or medications,” another SSA worker said.

Today’s lighter paychecks are due to pay periods’ dates: the most recent pay cycle began on September 22, when the government was still funded, but ended on October 4, which fell during the appropriations lapse. Because the shutdown began on October 1, workers will not get paid for October 1 through October 3. Cumulatively, the wages not paid out in today’s partial checks add up to the equivalent of about 197,000 missed full paychecks across the government, according to the Bipartisan Policy Center.

If the shutdown continues over the next several weeks, it’ll be the start of a chain of smaller or outright missed checks.

Pay periods for active-duty military and some reservists span the first two weeks of October. Come October 15, thousands of military members will receive no pay for their prior two weeks of work; they were last paid on October 1.

One active duty Marine Corps sergeant told Business Insider that, even with a full paycheck, some fellow soldiers struggle to feed their families. According to a 2020 DoD report, around 24% of active-duty service members had recently experienced food insecurity.

“There are a lot of Marines who sign up because they want to help support their families, and they’re sending money back home to mom and dad to take care of siblings. They’re sending money, and money’s not coming in anymore,” the sergeant said.

Theoretically, that economic pain should be temporary; workers are traditionally given back pay when the shutdown comes to a close. But now that’s also in question: The Trump administration is arguing that furloughed workers might not be entitled to back pay, despite 2019 legislation that seemingly guarantees that pay.

“The Democrats’ decision to shut down the government over free health care for illegal aliens is hurting all Americans,” Abigail Jackson, a White House spokesperson, said in a statement. “The Trump Administration is encouraging the Democrats to stop the pain and reopen the government with the bipartisan funding proposal they supported just 6 months ago and 13 times under Biden — but Chuck Schumer thinks every day of the shutdown ‘gets better.'”

Other workers are putting off larger expenses or shaking up how they’re thinking about their spending. One Department of the Interior worker said that they had already begun planning for a potential shutdown or reduction in force in February, pulling back on their contributions to retirement accounts to focus instead on paying off their mortgage. Another NOAA worker said that they were trying to secure a mortgage loan approval to potentially buy a new house; that fell through because of their missing paycheck. And a NASA employee in a dual-federal-worker household said that they’re hitting pause on servicing their car and roof, even though both require repairs.

“People are scared. They don’t know how they’re going to pay their bills. They don’t know how they’re going to put food on the table,” Hornick said. “People are asking about unemployment. They’re asking about whether they can file for food stamps.”

Some are also turning to external sources of help: USAA, which caters to military households and offers interest-free loans equivalent to paychecks for impacted federal workers, said that in the 24 hours since they opened the program, they’ve approved and funded nearly $85 million for around 23,000 loans. The Maryland Department of Labor received more than 300 applications between October 6 and the morning of October 9 for their federal worker loans. And the Navy Federal Credit Union, which offers a similar program, said that they’re “seeing a significant uptick in participation.”

“We’re being forced arbitrarily to do work in the office and will likely go into credit card or loan debt to do it,” a NASA employee who’s working without pay said. “When we miss a payment or don’t pay off our credit cards because we don’t have a paycheck, that interest accrued is money our employers are taking away from us.”