The D.C. Policy Center’s Rivlin Initiative for Economic Policy and Competitiveness recently completed the third round of its Quarterly Business Sentiments Survey for 2025. Conducted online for two weeks in mid-July, this round asked participants about their recent businesses’ recent experiences, six-month economic expectations, and the effects of recent federal policies. The survey’s objective is to provide detailed information on the business community’s experiences to local policymakers, the media, and the public.

A total of 317 participants completed the survey.[1] Most respondents—often executives or owners—came from businesses in the professional, scientific, and technical services sector (17 percent), the restaurant sector (12 percent), and the nonprofit sector (11 percent). Nearly half represented businesses that have been operating for more than a decade (49 percent) and most had a staff of no more than 20 people (85 percent). While this round captured an important snapshot of the region’s business climate, the results should be interpreted with the standard limitations of online surveys in mind.[2]

Finding # 1: Past three months reveal signs of strain among surveyed businesses

In the past three months, a majority of respondents reported that their associated businesses experienced “minimal or no change” in revenue, staffing, and retail or office space. However, among those who did report a change, the data paint a concerning picture. A greater share of respondents reported decreases rather than increases in staffing, with the same pattern observed for revenue and office or retail space. For context, in the first round of 2025, 25 percent of respondents reported a decrease in revenue. That number jumped to 37 percent in the second round of 2025, and has remained high—36 percent—in the current round.

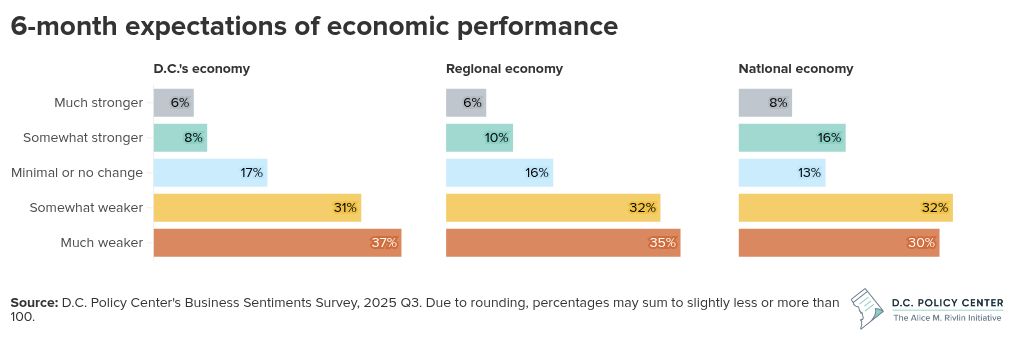

Finding # 2: Survey respondents express limited optimism about the local, regional, and national economies.

Similar to the second round of 2025, third-round respondents registered pessimistic six-month expectations about the local, regional, and national economies. Almost 70 percent of respondents expected that the District’s and regional economies would be “somewhat” or “much weaker” in the next six months. Expectations for the national economy were only marginally better—with a little over 60 percent of respondents anticipating some degree of weakening.

The pessimistic six-month economic expectations are not surprising. Recent federal policies – including higher tariffs and cuts to the federal government’s workforce – will not only negatively affect the District’s economy, but also the regional and national economies. Tariffs, in particular, which act as a tax on imports, risk stoking higher inflation.

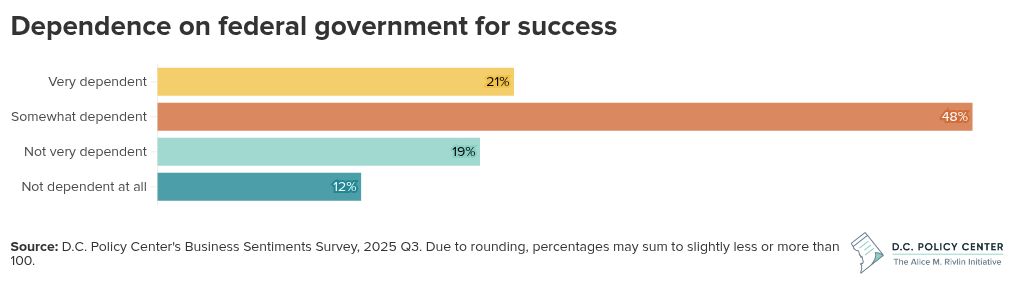

Finding # 3: Many D.C. region businesses depend on the federal government for success.

Among respondents who answered the subset of questions about the effects of recent federal policies, 88 percent said their affiliated business’s success was, to some degree, directly or indirectly dependent on the federal government. Within this group, 21 percent described their affiliated business as “very dependent,” 48 percent as “somewhat dependent,” and 19 percent as “not very dependent.”

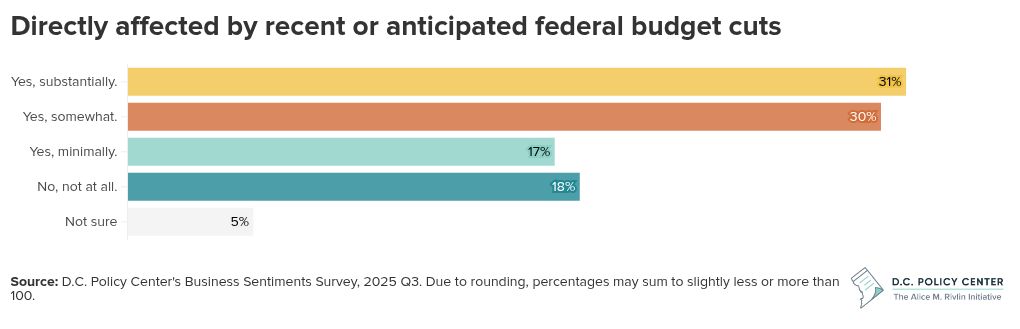

Finding # 4: 61 percent of D.C. region businesses were somewhat or substantially affected by federal budget cuts.

A substantial majority of respondents reported that their affiliated business was affected by anticipated or recent federal budget cuts. Sixty-one percent said their business was “substantially” or “somewhat” affected, 17 percent reported being “minimally” affected, and 18 percent reported being “not at all” affected.

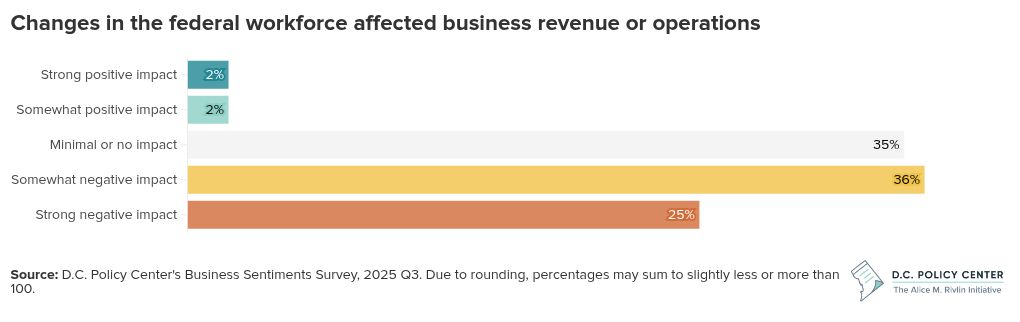

Finding # 5: Federal workforce changes negatively affected a majority of surveyed businesses

Roughly 6 in 10 survey respondents reported that anticipated or actual changes to the federal workforce—such as agency relocations or layoffs—negatively affected their affiliated business’s operations or revenue. Only 4 percent, in contrast, indicated that the changes had a positive effect. The remaining 35 percent reported that the changes had minimal or no impact.

Data from FRED show that the number of federal government jobs in the District declined by a little over 2 percent between January and June 2025. Over the same period, the D.C. metro region experienced a more substantial decline of almost 4.7 percent in federal government jobs.

Conclusion

The third round of the Quarterly Business Sentiments Survey highlights a business community under pressure. In particular, the findings underscore how closely the region’s businesses remain tied to the federal government and the importance of growth-oriented policies for the District.

With a declining federal footprint, policymakers should prioritize measures—including, but not limited to, expanding the housing supply—that make the city a more attractive place to live, work, and invest. These policies would also have a valuable secondary effect: by attracting imaginative, entrepreneurial residents, they would increase the likelihood that innovation-led growth—which typically emerges organically —drives the District’s economy.

[1] The raw and weighted sample size was 317 (Findings # 1 and 2). Similar to earlier rounds, most participants were invited to take the survey through email outreach to businesses registered in the District of Columbia. To align the results with the industry composition of businesses in the D.C. region, raw responses were weighted using QCEW data from the fourth quarter of 2024. The weighted sample size for Findings #3, #4, and #5 was 221.113. The raw sample size for these findings was 222. Results reported for all five findings are based on weighted responses.

[2] For example, the sentiments of survey respondents may differ from the sentiments of those who chose not to complete the survey.