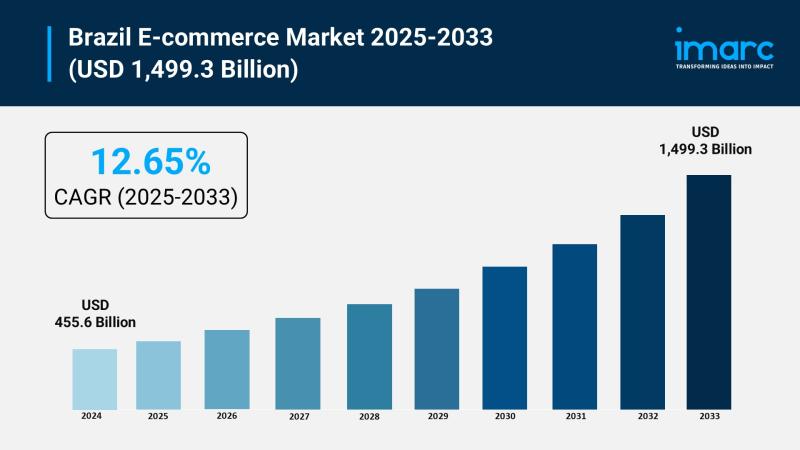

Brazil E-commerce Market Forecast by 2033

Market Size in 2024: USD 455.6 Billion

Market Forecast in 2033: USD 1,499.3 Billion

Market Growth Rate 2025-2033: 12.65%

The Brazil e-commerce market is on a robust expansion trajectory, underpinned by a compound annual growth rate of 12.65% from 2025 to 2033. Starting from a 2024 valuation of USD 455.6 billion, the market is projected to more than double, reaching USD 1,499.3 billion by 2033. This acceleration reflects deepening digital penetration, rising consumer confidence in online transactions, and continuous improvements in logistics infrastructure across the country.

Request a free sample copy of the Brazil E-commerce Market Report 2025-2033: https://www.imarcgroup.com/Brazil-e-commerce-market/requestsample

Brazil E-commerce Market Growth Drivers:

Government Digital Inclusion Initiatives

The Brazilian government’s National Digital Transformation Strategy (E-Digital) has allocated over BRL 4 billion since 2022 to expand broadband access in underserved regions. By mid-2024, the Ministry of Communications reported that 12,000 new kilometers of fiber-optic backbone had connected 7.3 million households in the North and Northeast, surpassing 85% internet penetration for the first time. This public infrastructure push directly enlarges the addressable audience for domestic e-tailers, while the accompanying “Digital Citizenship” program has trained 1.1 million micro-entrepreneurs in basic online storefront management, creating a fresh pipeline of sellers on national marketplaces.

Fintech-Led Payment Innovation

Central Bank data show that instant-payment system Pix processed 44 billion transactions in 2024, a 72% year-over-year jump that now covers 78% of all online checkouts in Brazil. Major retailers Magazine Luiza and Via Varejo have integrated zero-fee Pix installment options, cutting cart abandonment by 19% within six months. Concurrently, regulatory sandbox approvals issued in 2023 allowed 18 new fintechs to offer credit lines embedded at checkout, extending micro-loans to 5.7 million first-time credit consumers who previously shopped only offline. The seamless, low-cost payment experience is converting cash-on-delivery users into recurring digital buyers, sustaining double-digit GMV growth for merchants.

Private-Sector Logistics Expansion

Brazil’s national courier association (ABREL) reports that private players added 3.2 million m2 of fulfillment space between 2022 and 2024, with 62% located outside the traditional São Paulo-Rio axis. Mercado Libre alone opened five new distribution centers in the Central-West, reducing delivery times to inland cities like Campo Grande by 48 hours. Airlines doubled belly-cargo capacity on domestic routes after the 2023 “Freight Friendly Flight” decree slapped reduced landing fees on pre-loaded e-commerce cargo. These capacity gains dropped last-mile cost per package by 11% in 2024, enabling free-shipping thresholds to fall below BRL 79 for 63% of national orders-an elasticity sweet spot that has driven repeat purchase frequency up 28% year-to-date.

Request Customization: https://www.imarcgroup.com/request?type=report&id=14181&flag=E

Brazil E-commerce Market Segmentation:

Breakup by Type:

• B2C E-Commerce

o Beauty and Personal Care

o Consumer Electronics

o Fashion and Apparel

o Food and Beverage

o Furniture and Home

o Others

• B2B E-Commerce

Breakup by Region:

• Southeast

• South

• Northeast

• North

• Central-West

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=14181&flag=C

Brazil E-commerce Market News:

• In March 2025, Mercado Libre announced a BRL 2.3 billion investment to open four additional fulfillment centers in Northern Brazil, targeting same-day delivery for 70% of Prime-like subscribers by Q4.

• Magazine Luiza launched an AI-powered live-commerce channel in April 2025, registering 1.8 million concurrent viewers during its pilot sale of private-label electronics, doubling conversion rates compared with static listings.

• The Brazilian Senate approved the “E-commerce Tax Simplification Bill” in May 2025, unifying ICMS rates at 4% for interstate online sales and promising to reduce checkout prices by an estimated 6-8% starting August.

• Via Varejo partnered with Correios in June 2025 to pilot drone deliveries in rural Minas Gerais, cutting average shipping time from 72 to 24 hours for orders under 2 kg.

Key highlights of the Report:

• Market Performance (2019-2024)

• Market Outlook (2025-2033)

• COVID-19 Impact on the Market

• Porter’s Five Forces Analysis

• Strategic Recommendations

• Historical, Current and Future Market Trends

• Market Drivers and Success Factors

• SWOT Analysis

• Structure of the Market

• Value Chain Analysis

• Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as part of the customization.

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201971-6302

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.