Key opportunities in the e-commerce BNPL market include leveraging the growing popularity of online shopping and digital wallets, expanding merchant adoption, deploying innovative solutions like Installments-as-a-Service, integrating AI-driven personalized payment plans, and capitalizing on the rapid growth expected in Asia-Pacific.

E-Commerce Buy Now Pay Later Market

Dublin, Oct. 06, 2025 (GLOBE NEWSWIRE) — The “E-Commerce Buy Now Pay Later Market Report 2025” has been added to ResearchAndMarkets.com’s offering.

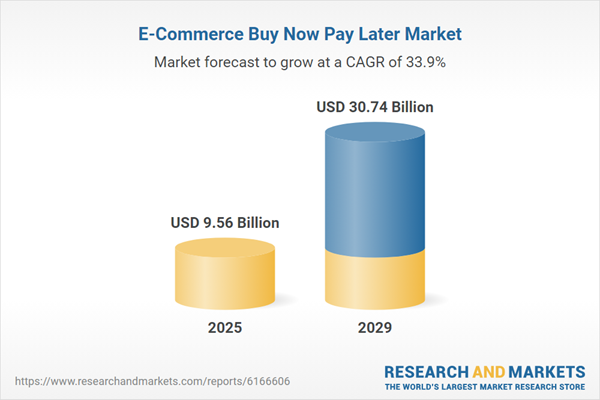

The e-commerce buy now pay later market size has grown exponentially in recent years. It will grow from $7.16 billion in 2024 to $9.56 billion in 2025 at a compound annual growth rate (CAGR) of 33.6%. The growth in the historic period can be attributed to an increase in the number of smartphone users, an increase in the number of e-commerce companies, a rise in the number of businesses, an increase in transaction volumes, and an increasing demand for flexible payment options.

The e-commerce buy now pay later market size is expected to see exponential growth in the next few years. It will grow to $30.74 billion in 2029 at a compound annual growth rate (CAGR) of 33.9%. The growth in the forecast period can be attributed to increasing merchant adoption, increasing adoption of online shopping, rising adoption of digital wallets, increasing demand for credit alternatives, and increasing cross-border e-commerce transactions.

Major trends in the forecast period include biometric authentication for enhanced security, advanced fraud detection systems, integration with e-commerce platforms, integration with mobile payment solutions, and artificial intelligence and machine learning-powered personalized payment plans.

The forecast of 33.9% growth over the next five years reflects a modest reduction of 0.2% from the previous estimate for this market. This reduction is primarily due to the impact of tariffs between the US and other countries. This is likely to directly affect the US through reduced merchant adoption, as real-time credit decisioning engines and repayment scheduling tools, predominantly developed in Sweden and Australia, face higher licensing fees that increase operational costs for providers. The effect will also be felt more widely due to reciprocal tariffs and the negative effect on the global economy and trade due to increased trade tensions and restrictions.

The growing popularity of online shopping is expected to drive the expansion of the e-commerce buy now pay later (BNPL) market in the coming years. Online shopping involves purchasing products or services over the Internet through e-commerce websites or platforms. Its rising adoption is largely attributed to the convenience it offers, enabling consumers to shop at any time and from any location, thus saving time and effort. BNPL services are particularly appealing to online shoppers as they provide flexible, interest-free installment options, enhancing both affordability and convenience. This, in turn, increases digital transactions and improves conversion rates for online retailers. For example, in February 2025, the United States Census Bureau, a US-based government agency, reported that e-commerce sales in 2024 reached an estimated $1.19 trillion, reflecting an 8.1% increase over 2023. Therefore, the growing trend of online shopping is a key driver behind the expansion of the e-commerce BNPL market.

Leading companies in the e-commerce BNPL space are increasingly offering innovative solutions such as Installments-as-a-Service to attract more consumers, provide greater payment flexibility, and enhance the shopping experience. This approach helps improve customer retention and accelerates sales. Installments-as-a-Service is a fintech solution that allows merchants and e-commerce platforms to provide installment payment options without the need to build or maintain the supporting infrastructure. For instance, in March 2023, Splitit, a U.S.-based payment solutions company, launched an Installments-as-a-Service integration with SAP Commerce Cloud, a cloud-based e-commerce platform focused on delivering scalable and personalized experiences. This integration allows merchants to seamlessly embed Splitit’s BNPL functionality into their checkout systems. SAP Commerce Cloud joins Splitit’s growing list of platform integrations, which already includes Shopify, Magento, Salesforce Commerce Cloud, Wix, WooCommerce, and BigCommerce. The Installments-as-a-Service offering is tailored to support BNPL services across B2B (Business-to-Business), B2C (Business-to-Consumer), and B2B2C (Business-to-Business-to-Consumer) markets.

In February 2022, Block Inc., a U.S.-based technology and financial services firm, acquired Afterpay for $24.53 billion. The purpose of this acquisition was to enhance Block’s suite of financial products, broaden consumer access, increase revenue opportunities for sellers, and strengthen its Square and Cash App ecosystems. Afterpay Limited, based in Australia, is a fintech company known for offering BNPL services in the e-commerce sector.

Major players in the e-commerce buy now pay later market are Amazon.com Inc., Allianz Trade, Bread Financial Holdings Inc., Bajaj Finserv Ltd., Paypal Holdings Inc., Klarna Group Plc, Affirm Holdings Inc., Zip Co Limited, PureSoftware Ltd, Sezzle Inc, Vodeno, Addi, AU Group, Zilch Technology Limited, Zebit Inc, LazyPay Private Limited, Hokodo, Payright Limited, FuturePay Holdings Inc, Flex Money Technologies Pvt Ltd.

The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.