- Vita Coco Company (NasdaqGS:COCO) is being highlighted for its role as a global leader in functional hydration, supported by a flexible, scalable business model.

- Recent coverage explored how new tax rules that favor business investment could influence Vita Coco’s future capital deployment and expansion plans.

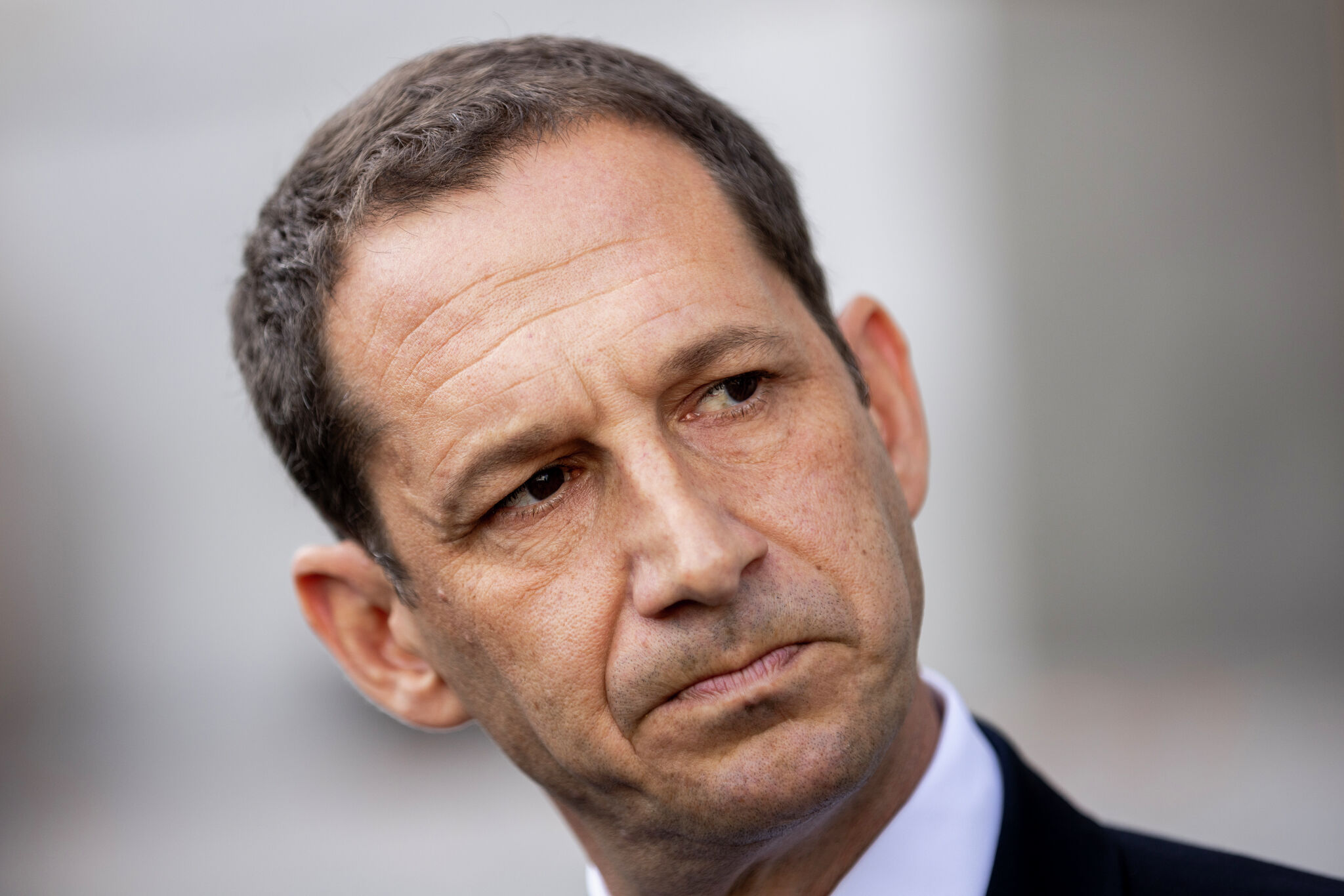

- Co Founder Mike Kirban shared insights on brand building, competing against larger beverage players, and key milestones such as the company’s IPO.

Vita Coco operates in the functional hydration space, with a brand that is closely tied to coconut water and related beverages. For investors tracking beverage companies, the focus on supply chain resilience and global reach stands out, particularly as consumer interest in wellness oriented drinks remains an important theme. The latest developments provide additional detail on how the business is organized to support that positioning.

On the policy side, the new tax rules related to business investment may influence how Vita Coco evaluates projects, from capacity additions to new market entry. Combined with leadership commentary from Mike Kirban, this creates a useful moment for investors to reassess how the company approaches growth opportunities, capital allocation, and long term competitive positioning.

Stay updated on the most important news stories for Vita Coco Company by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Vita Coco Company.

Why Vita Coco Company could be great value

For investors, the key takeaway is how Vita Coco’s asset light, globally diversified model and focus on functional hydration position it to potentially use future tax reform as a tool for reinvestment rather than a one off windfall. If higher first year deductions on equipment and other qualifying assets do take effect, a company that already relies on flexible sourcing and outsourced production can weigh whether to step up spend on capacity, distribution infrastructure, or new formats without committing to heavy, permanent fixed assets.

How this ties into the Vita Coco Company narrative

The news around tax reform and expansion comments from Co Founder Mike Kirban sit neatly alongside existing investor narratives that focus on new product categories, geographic expansion, and health focused beverages. For readers tracking those themes, this is essentially an update on the toolkit Vita Coco might have to pursue more product experiments, extend its reach in markets like Europe and Asia, and reinforce its wellness positioning versus larger players such as Coca Cola, PepsiCo, and Keurig Dr Pepper.

Vita Coco: balancing rewards and risks

- Tax incentives for capital spending could give Vita Coco more flexibility to fund distribution improvements or production partnerships without committing as much after tax cash.

- Leadership experience in competing with larger beverage companies and taking the business public may support disciplined capital allocation if more investment opportunities open up.

- Greater use of tax accelerated investment can increase execution risk if projects in new markets or categories do not perform as expected.

- Investors still need to weigh structural risks already flagged for the business, including competition, cost pressures, and category concentration in coconut based drinks.

What to watch next

Looking ahead, it will be important to see whether management links any future guidance, conference commentary, or capital expenditure plans to these tax changes and how that fits with its expansion story relative to peers. If you want more context on how different shareholders and analysts frame Vita Coco’s long term story, check out the community narratives on its company page at Simply Wall St, where you can see how others are thinking about growth, risks, and valuation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Try a Demo Portfolio for Free

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com