They called it a second office. It had a pier, two ponds, a luxury pool, and landscaping that probably cost more than her annual salary.

In the anti-work subreddit, a 25-year-old woman shared her frustration in a post titled “My Bosses Claim They’re Broke, But Have Enough Money For A Second Mansion.” After quitting her job, she noticed they had listed the new hire’s salary at over $15,000 less than what she had earned — even though she had been unable to afford basic car repairs or medical care. That alone was demeaning. But what finally pushed her over the edge was the invoice.

Don’t Miss:

The Mansion, the Myth, the Business Expense

“For months they’ve talked about this second ‘office’ they have in a different state,” she wrote, explaining that the company was so small they didn’t even use their full main office. Then one day, her bosses printed out a bill from a pool cleaning company tied to that second location. Curious, she looked up the address. “It’s not an office,” she said. “It’s a waterfront mansion with a large pool, several acres of land, two ponds, and its own pier.”

She added that these are “the same people who consistently try to underpay their employees, and become outraged when someone notices they aren’t getting paid enough.” She said they “try to play the ‘small business owner barely scraping by’ role to get out of properly compensating people,” all while owning two homes, driving luxury vehicles, and keeping “a couple million dollars in the bank.”

Trending: This investment firm leverages expert insights and a $1.85 billion track record to help accredited investors capitalize on 2026 multifamily market trends—read the full forecast now.

Rich People Poor Isn’t the Same

Redditors shared her frustration, echoing similar stories of being misled, underpaid, and watching employers live far beyond what they claim. One user wrote, “So the system is working just as they designed it to, right?” Another described being on a work call with a boss who said a new contract might bankrupt them — then forgot to mute their mic while brokering a second yacht.

Several users suggested reporting the mansion write-off to the IRS, with one pointing out that the pool cleaning invoice could be enough to trigger an investigation. Others zeroed in on the deeper pattern of manipulation. One user wrote, “Rich people poor is not the same as poor people poor,” and explained the difference: When wealthy people feel financial strain, they don’t downsize. They refinance, lay people off, cut salaries, or pause bonuses. Their lifestyle remains untouched — someone else just ends up paying for it.

That same commenter added, “They won’t accept the sort of poverty they are fine with others experiencing.” To them, luxuries are mandatory. Sacrifices are for employees. They also wrote that the best thing anyone can do is remember that “bosses are not your friends. Companies are not your family. No matter what they say, they will happily sacrifice you. So do what you need to do to get ahead while doing as little harm as possible.”

See Also: Explore Jeff Bezos-backed Arrived Homes and see how investors are earning passive rental income — now with a limited-time 1% bonus match for new investors.

What resonated wasn’t just the deception — it was the design. People recognized the pattern. The image of scarcity used to justify underpayment, the wealth shielded behind paperwork and polite excuses, and the expectation that workers should be grateful for less.

When the System Feels Rigged, Ownership Hits Different

For anyone who’s tired of watching others game the system while being told there’s no budget for basic dignity, one option is to build something of your own. Platforms like Arrived allow individuals to buy into income-generating rental homes with as little as $100. It’s a way to create passive income and gain a small piece of real equity — without pretending your guest bathroom is a business write-off.

Because the game doesn’t end until you stop playing by someone else’s rules.

Read Next: Professional traders demand transparency — see why Kraken Pro has become one of crypto’s most trusted advanced trading platforms.

Building Wealth Across More Than Just the Market

Building a resilient portfolio means thinking beyond a single asset or market trend. Economic cycles shift, sectors rise and fall, and no one investment performs well in every environment. That’s why many investors look to diversify with platforms that provide access to real estate, fixed-income opportunities, professional financial guidance, precious metals, and even self-directed retirement accounts. By spreading exposure across multiple asset classes, it becomes easier to manage risk, capture steady returns, and create long-term wealth that isn’t tied to the fortunes of just one company or industry.

Rad AI

Rad AI’s award-winning artificial intelligence technology helps transform data chaos into actionable insights, enabling the creation of high-performing content with measurable ROI. Their Regulation A+ offering allows investors to participate at $0.85 per share with a minimum investment of $1,000, providing an opportunity to diversify portfolios into early-stage AI innovation. For investors seeking exposure to the rapidly growing AI and tech sector, Rad AI offers a chance to get in on the ground floor of a data-driven growth story.

Arrived

Backed by Jeff Bezos, Arrived Homes makes real estate investing accessible with a low barrier to entry. Investors can buy fractional shares of single-family rentals and vacation homes starting with as little as $100. This allows everyday investors to diversify into real estate, collect rental income, and build long-term wealth without needing to manage properties directly.

Lightstone

Lightstone DIRECT gives accredited investors direct access to institutional-grade real estate, going beyond typical crowdfunding platforms. By cutting out middlemen, it aligns investor and manager interests while providing exposure to a $12B+ portfolio spanning multifamily, industrial, hospitality, retail, office, and life science properties. This approach allows investors to diversify their portfolios across multiple property types and markets, gaining professional-grade real estate exposure without the fees or misalignment common on other platforms.

Domain

Domain Money helps professionals and households earning $100,000+ take control of their finances with personalized, CFP professional-led guidance. By offering tailored financial planning, Domain empowers users to make smarter, more confident decisions across investments, retirement, taxes, and overall wealth strategy.

Masterworks

Masterworks enables investors to diversify into blue-chip art, an alternative asset class with historically low correlation to stocks and bonds. Through fractional ownership of museum-quality works by artists like Banksy, Basquiat, and Picasso, investors gain access without the high costs or complexities of owning art outright. With hundreds of offerings and strong historical exits on select works, Masterworks adds a scarce, globally traded asset to portfolios seeking long-term diversification.

Bam Capital

BAM Capital offers accredited investors a way to diversify beyond public markets through institutional-grade multifamily real estate. With over $1.85 billion in completed transactions and guidance from Senior Economic Advisor Tony Landa, the firm targets income and long-term growth as supply tightens and renter demand remains strong—especially in Midwest markets. Its income-focused and growth-oriented funds provide exposure to real assets designed to be less tied to stock market volatility.

Kraken

As digital assets become a larger part of diversified portfolios, traders increasingly look for platforms that offer transparency, efficiency, and control. Kraken Pro is an advanced trading interface from Kraken, one of the world’s leading cryptocurrency exchanges, designed for users who want more sophisticated tools without added complexity. With low, volume-based fees, a streamlined interface for managing spot, margin, and futures trading, and a strong focus on security and regulatory compliance, Kraken Pro provides a way to gain diversified crypto exposure through a clear, professional-grade trading experience.

Rex Shares

REX Shares designs specialized ETFs for investors who want more precision than traditional broad-market funds can offer. Its lineup spans options-based income strategies, leveraged and inverse exposures, spot-linked crypto ETFs, and thematic funds tied to structural trends. By targeting specific income objectives, volatility profiles, or market themes, these ETFs can be used alongside core holdings to introduce differentiated return drivers and reduce reliance on a single market outcome, while maintaining the liquidity and transparency of the ETF structure.

Mode Mobile

Mode Mobile is redefining how people earn money through everyday smartphone use. Its EarnPhone and app ecosystem allow users to earn and save by playing games, listening to music, and reading news—turning screen time into income. With over 50 million beta users and a low $99 barrier to adoption, Mode Mobile has proven extreme competitiveness in the mobile market. Accredited investors can participate in the company’s growth at $0.50 per share, gaining exposure to a platform with a total addressable market exceeding $1 trillion and plans for a Nasdaq IPO. For investors looking to diversify into innovative consumer tech and mobile monetization, Mode Mobile offers a unique opportunity to tap into a fast-growing, user-driven digital economy.

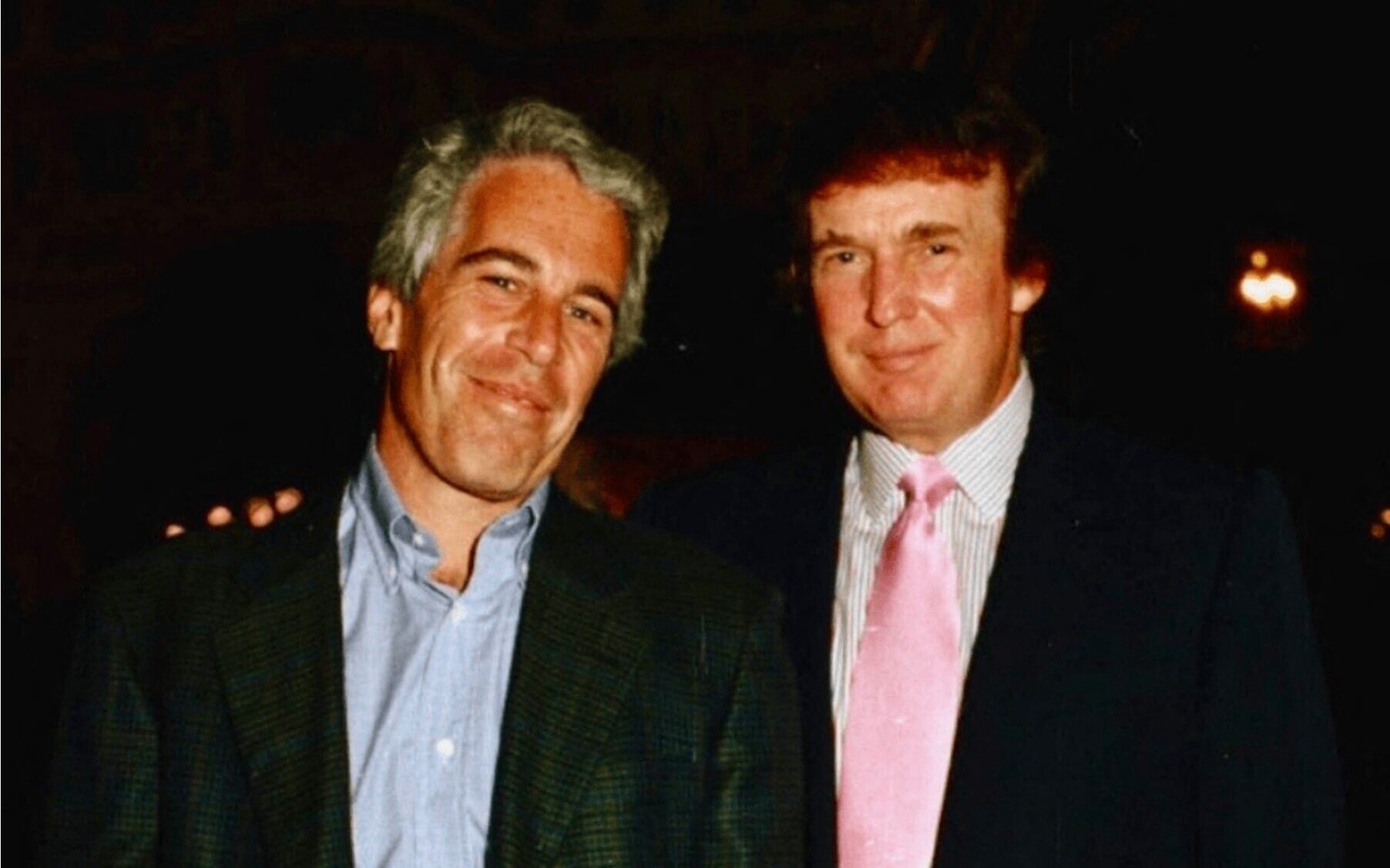

Image: Shutterstock

UNLOCKED: 5 NEW TRADES EVERY WEEK. Click now to get top trade ideas daily, plus unlimited access to cutting-edge tools and strategies to gain an edge in the markets.

Get the latest stock analysis from Benzinga:

This article Woman, 25, Says Boss Plays the 'Small Business Owner Barely Scraping By' Card to Justify Low Pay, but Owns 2 Waterfront Mansions originally appeared on Benzinga.com