If you have been watching Global-E Online’s stock and trying to figure out what your next move should be, you are not alone. The company’s journey has been anything but boring, with some investors feeling a bit whiplashed by the volatility. After rallying over the past few years, Global-E’s share price just logged a 3.7% drop this week, and while the 1-year change sits at -3.3%, there is still that huge 39.3% gain when you look back three years. The downside is that year-to-date, the stock is down 34.2%, making some investors question what the market is really pricing in.

Much of this turbulence feels closely tied to shifting sentiment across the e-commerce and payments industry, as investors try to weigh both massive growth potential and evolving risks. When headlines about global digital spending and cross-border commerce surge, Global-E often gets swept up. But dips in tech stocks or revived concerns over competition can quickly send the stock lower, even if nothing material has changed with the company’s fundamentals.

So, how does Global-E look from a pure valuation standpoint? Running the numbers, Global-E earns a value score of 2 out of 6 based on standard undervaluation checks, which is a sign that the market might not see it as a screaming bargain right now, but nor is it priced purely on hype.

Next, let’s break down the approaches behind that score and see what they really tell us about the investment case for Global-E. Keep reading, because there’s an even more insightful way to make sense of valuation that we will explore by the end of this article.

Global-E Online scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Global-E Online Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates what a business is truly worth by projecting its future cash flows and then discounting those figures back to today. For Global-E Online, this approach draws on the company’s ability to generate free cash in the coming years, helping to reveal whether its shares are cheap or expensive right now.

Looking at the numbers, Global-E produced $149.1 million in free cash flow over the last twelve months. Analyst estimates project this figure to rise sharply, with cash flow expected to reach $385.7 million by 2027. Projections go even further, with ten-year estimates, partly from analysts and then extended by modeling, suggesting free cash could grow above $990 million by 2035.

Based on this growth outlook, the DCF valuation calculates an intrinsic value of $53.30 per share. This is roughly 33.7% higher than where the stock currently trades, implying that shares are significantly undervalued by the market on a long-term cash flow basis.

Result: UNDERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Global-E Online.

Our Discounted Cash Flow (DCF) analysis suggests Global-E Online is undervalued by 33.7%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Global-E Online Price vs Sales

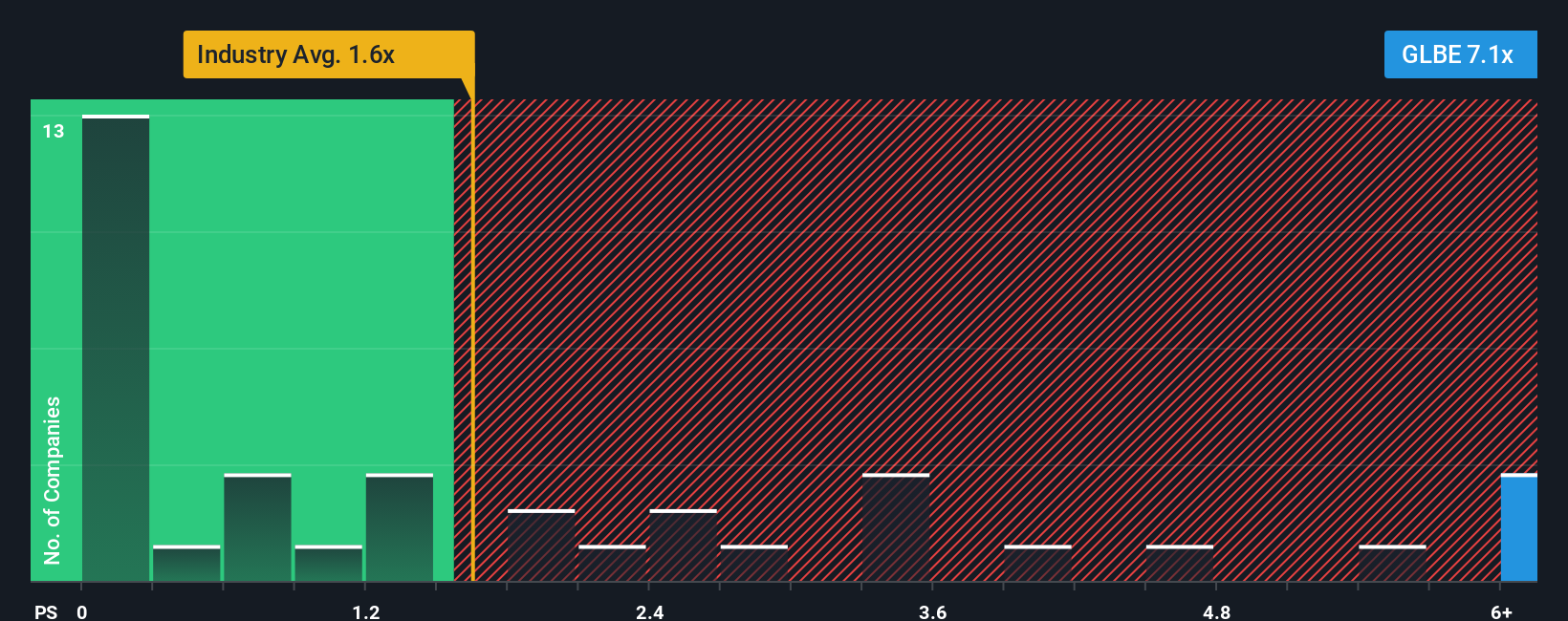

For companies like Global-E Online, which are early in profitability or reinvesting heavily in growth, the price-to-sales (P/S) ratio is often a more reliable gauge of value than price-to-earnings or price-to-book ratios. The P/S ratio focuses on how much investors are willing to pay for each dollar of revenue. This is particularly relevant in high-growth sectors where earnings can be distorted by large investments or where profits are still ramping up.

Growth expectations and perceived risks play a significant role in what makes for a “normal” or “fair” P/S ratio. High-growth, innovative businesses usually command higher P/S multiples compared to mature or slower-growing peers because investors are paying for the potential of future expansion and market opportunity.

Global-E Online currently trades on a P/S ratio of 7.1x. This is considerably higher than the industry average of 1.64x and the average across close peers at 2.14x, reflecting its stronger growth expectations and premium positioning in the sector. However, according to Simply Wall St’s proprietary “Fair Ratio,” which adapts the expected multiple to account for the company’s growth, margins, risks, industry, and market cap, a justified multiple for Global-E is 2.66x. This Fair Ratio goes beyond simple peer comparisons by tailoring the benchmark to what is realistic for Global-E’s unique profile.

Because Global-E’s current P/S ratio is substantially above both peers and its tailored Fair Ratio, the shares appear to be overvalued on this measure.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Global-E Online Narrative

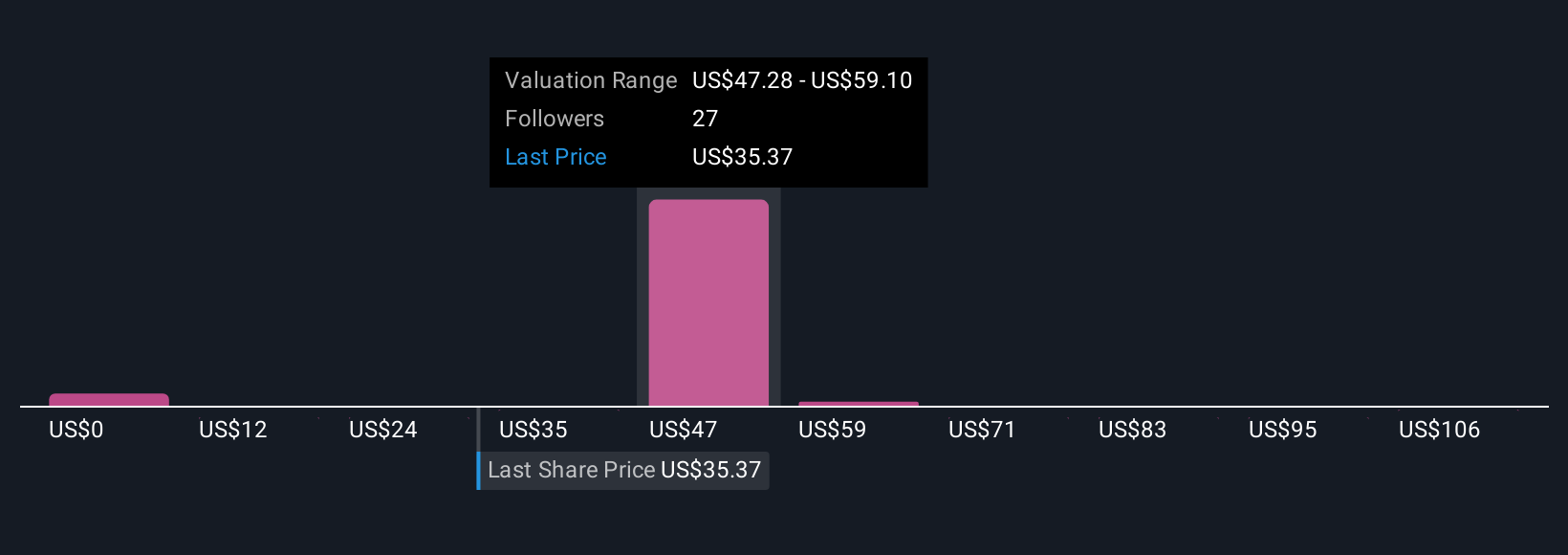

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply your personal perspective on a company: the story you believe about its future. You then connect this perspective to the numbers by forecasting possible revenue, earnings, and margins to arrive at your own fair value estimate.

Narratives do not replace the numbers; they build upon them, linking a company’s evolving story with real financial forecasts and translating that into a fair value. This approach makes it much easier to determine if a stock is genuinely attractive. On Simply Wall St’s Community page, used by millions of investors, anyone can create, update, and share these story-driven forecasts without needing a finance degree.

By comparing the fair value from your Narrative to the current share price, you get a clearer signal on whether to buy, hold, or sell. All Narratives are refreshed automatically when news or earnings change the story, so you are always working with the latest view. For example, some investors now see Global-E’s fair value at $64 based on rapid global growth, while others set it at $32 due to margin and competition concerns.

Do you think there’s more to the story for Global-E Online? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Try a Demo Portfolio for Free

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com