Global Beer Market Outlook: Tradition Meets Transformation

Beer remains one of the world’s most consumed alcoholic beverages, deeply embedded in social, cultural, and economic traditions across continents. Brewed from simple ingredients—water, malted grains, hops, and yeast—beer has evolved over centuries into a global industry that blends heritage with innovation.

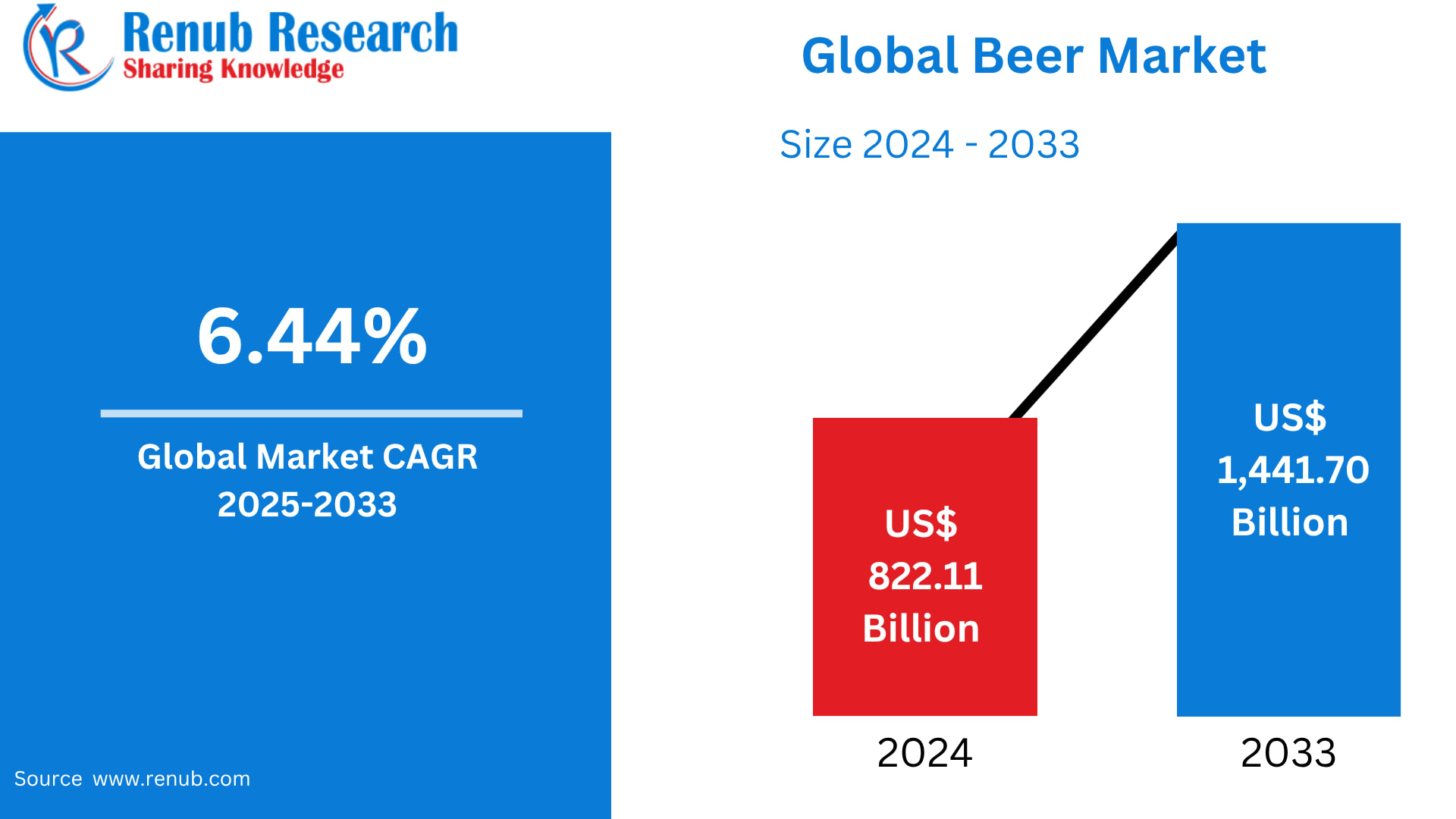

According to Renub Research, the Global Beer Market is expected to grow from US$ 822.11 billion in 2024 to US$ 1,441.70 billion by 2033, registering a strong CAGR of 6.44% during 2025–2033. This growth reflects not just rising consumption but a profound shift in how beer is produced, marketed, and consumed worldwide.

From premium lagers in Europe and craft beers in North America to strong beers in India and non-alcoholic malt beverages in the Middle East, beer is undergoing a global renaissance. Changing lifestyles, urbanization, premiumization, and innovation in flavors and alcohol content are reshaping consumer preferences and driving sustained market expansion.

Beer as a Social and Economic Staple

Beer is not merely a beverage—it is a social connector. It is consumed at sports events, festivals, restaurants, pubs, family celebrations, and increasingly at home. Its relatively low alcohol content compared to spirits makes it an accessible and socially acceptable drink across cultures.

Globally, beer consumption remains strongest in China, the United States, Brazil, and Germany, while emerging economies are fast closing the gap. The rise of young adult consumers, particularly in urban areas, is injecting new energy into beer demand. At the same time, breweries are innovating rapidly to keep pace with evolving tastes.

Key Drivers of Growth in the Global Beer Market

1. Surge in Demand for Craft and Premium Beers

One of the strongest growth engines in the beer market is the premiumization trend. Consumers are increasingly willing to pay more for superior quality, unique flavors, and authentic brewing experiences. Craft and specialty beers—often produced in small batches—are gaining popularity among young adults who value originality and storytelling behind brands.

In April 2024, Molson Coors launched Madrí Excepcional in Canada, a premium European-style lager developed with Spain’s La Sagra brewery. With a smooth finish and urban branding inspired by Madrid, the product exemplifies how premium beer is becoming lifestyle-driven rather than just consumption-based.

Premium and super-premium beers are projected to account for 70% of global beer consumption by 2025, highlighting how value growth is increasingly outpacing volume growth.

2. Urbanization and Rising Middle-Class Populations

Urbanization is transforming consumption patterns. Over 4 billion people now live in cities, and this number is expected to reach nearly 70% of the global population by 2050. Urban lifestyles encourage social drinking, dining out, and experimentation with beverages.

Emerging markets such as India, Brazil, China, Indonesia, and Vietnam are seeing rising disposable incomes and exposure to global drinking cultures. Beer, once limited to elite or niche groups in these regions, is becoming a mainstream social drink.

3. Product Innovation and Flavored Offerings

Innovation is reshaping the beer aisle. Brewers are introducing:

Flavored beers (fruit, spice, botanical)

Low-calorie and low-carb beers

Alcohol-free and low-alcohol variants

Seasonal and limited-edition brews

Sustainable packaging options

These innovations are attracting health-conscious consumers and first-time drinkers who previously avoided beer. Younger consumers, in particular, are gravitating toward lighter, flavored, and functional beers that align with wellness trends.

Challenges Facing the Global Beer Industry

1. Health Awareness and Alcohol Reduction Trends

Despite growth, beer faces headwinds from increasing health awareness. Consumers in developed markets are reducing alcohol intake or switching to non-alcoholic alternatives. Governments and health organizations continue to emphasize moderation, which affects per capita consumption in mature markets such as Western Europe and North America.

However, this challenge has also created opportunity, with alcohol-free beer emerging as one of the fastest-growing segments globally.

2. Regulatory and Taxation Pressure

Alcohol remains one of the most heavily regulated consumer products. High excise duties, advertising restrictions, and licensing regulations affect pricing, profitability, and brand visibility. Frequent changes in tax policies—especially in Asia and Latin America—add uncertainty for brewers and distributors.

Segment-Wise Market Insights

Premium Beer Market: Quality Over Quantity

Premium beers are positioned as lifestyle products, offering refined taste, better ingredients, and sophisticated branding. Rising disposable incomes and the growing influence of Western drinking habits are boosting premium beer demand in Asia-Pacific, Latin America, and the Middle East.

Specialty Beer Market: Niche, Seasonal, and Experiential

Specialty beers—often flavored, seasonal, or limited-edition—appeal to adventurous consumers. Craft festivals, taprooms, and local brewery tours have fueled interest in these products. This segment thrives on storytelling, locality, and experimentation.

Metal Can Beer Market: Sustainability and Convenience

Metal cans are rapidly gaining share due to their lightweight, recyclability, portability, and longer shelf life. They are ideal for outdoor events, sports venues, and festivals. Technological improvements in can lining have eliminated flavor concerns, making cans a preferred choice even for premium beers.

Glass Beer Market: Tradition and Premium Appeal

Glass bottles remain the symbol of quality and tradition. They are widely used in restaurants, bars, and premium segments. Returnable glass systems and recycling initiatives continue to support this segment despite logistics challenges.

Macro-Brewery vs. Micro-Brewery Dynamics

Macro-breweries dominate global volumes with extensive distribution networks and brand recognition.

Micro-breweries lead innovation, flavor experimentation, and local engagement.

Large brewers are increasingly acquiring craft brands or launching their own craft-style labels to retain relevance.

Alcohol Content Trends

High-alcohol beers attract consumers seeking intensity and richness

Low-alcohol beers appeal to moderation-focused drinkers

Alcohol-free beers are booming in health-conscious and regulated markets

This diversification ensures beer remains relevant across consumer segments.

Regional Market Highlights

United States Beer Market

The U.S. remains one of the most dynamic beer markets globally. While total volumes have stabilized, innovation continues to drive value growth. Craft beer, flavored beer, and non-alcoholic beer are expanding rapidly.

In August 2024, Dad Strength Brewing launched the U.S.’s first brewery focused on mid-strength beers (2.5–2.9% ABV), reflecting the growing moderation trend.

France Beer Market

Once dominated by wine, France is seeing strong growth in beer consumption among young urban professionals. Craft and imported beers are gaining traction, and beer is increasingly seen as a fashionable social drink.

India Beer Market

India’s beer market is one of the fastest-growing globally, supported by a young population and urbanization. Mild lagers dominate, but strong beers and flavored beers are gaining popularity.

In April 2023, BIRA 91 launched limited-edition beers aligned with major IPL cricket teams, blending sports culture with brand engagement.

Brazil Beer Market

Beer is Brazil’s most popular alcoholic beverage, deeply connected to football and carnival culture. Premium and flavored beers are seeing rapid growth, while craft breweries are gradually expanding their presence.

Saudi Arabia Beer Market

Although alcoholic beer is prohibited, non-alcoholic malt-based beers are growing rapidly. Young consumers and expatriates are driving demand for halal-compliant, flavored, and premium non-alcoholic beers.

Global Beer Market Segmentation

By Product Type

Standard Lager

Premium Lager

Specialty Beer

Others

By Packaging

Glass

PET Bottle

Metal Can

Others

By Production

Macro-Brewery

Micro-Brewery

Others

By Alcohol Content

High

Low

Alcohol Free

By Flavor

Unflavored

Flavored

By Distribution Channel

Supermarkets & Hypermarkets

On-Trades

Specialty Stores

Convenience Stores

Others

Key Players Shaping the Global Beer Industry

Leading companies continue to invest in innovation, sustainability, and regional expansion:

Asahi Group Holdings, Ltd.

Molson Coors Beverage Company

Tetra Laval Group

Beijing Yanjing Beer Group Corporation

Diageo plc

Dogfish Head Craft Brewery Inc.

Sierra Nevada Brewing Co.

Grupo Modelo

Oettinger Brauerei GmbH

Kirin Holdings Company Limited

Each company has been analyzed across five viewpoints: Overview, Key Personnel, Recent Developments, SWOT Analysis, and Revenue Performance, highlighting their strategic positioning in the global beer landscape.

Final Thoughts: A Market Built on Evolution and Experience

The global beer market is no longer defined solely by volume—it is driven by experience, identity, and choice. As consumers demand better quality, healthier options, and meaningful brands, brewers are responding with unprecedented innovation.

With Renub Research forecasting the market to reach US$ 1.44 trillion by 2033, beer’s future is as dynamic as its past. Whether through premium lagers, craft experiments, non-alcoholic options, or sustainable packaging, beer is reinventing itself for a new generation—one glass, can, or bottle at a time.