The idea of using secondhand products was once not widely embraced, but today, the secondhand market is thriving in China, signaling a shift in consumer behavior and opening up new opportunities. This market, which was once seen as a niche, is now becoming a significant part of the economy, especially with the support of digital platforms and a shift in societal attitudes.

What is driving the secondhand market in China

The secondhand market in China has been expanding quickly. The market is valued at RMB 1.68 trillion (USD 240 billion) in 2024. The market is expected to reach RMB 2.88 trillion (USD 412 billion) by 2025. This rapid growth is not only driven by budget constraints or affordability but also reinforced by government support for the circular economy. The key driver today is a shift in consumer preferences toward sustainability in China, uniqueness, and maintaining affordability.

Before reliable platforms became common, cultural stigma held back the secondhand market in China. Many buyers worried about cleanliness, fakes, and how others would judge them. As trusted platforms grew and verification improved, those concerns eased. The market has since shifted from “buying used because you have to” to a “thrifty” lifestyle choice, with more people looking for sustainable options and unique items that match their values.

This change is further supported by the proliferation of digital platforms like Xianyu, Zhuan Zhuan, and Dewu, which have made buying secondhand products easier and more convenient. These platforms are integral in driving the growth of the market, offering users a seamless and secure shopping experience.

Main players in second-hand e-commerce in China

Alibaba’s Idle Fish and Tencent-backed Zhuanzhuan (转转) entered second-hand e-commerce in China many years ago. However, in recent years, faced with such a potential market, more and more vertical second-hand platforms have appeared as well.

Idle Fish

Idle Fish was launched as a second-hand channel on Taobao in 2012, and spun off as an independent mobile app two years later. By the end of 2019, Idle Fish had achieved more than 100 billion RMB in annual revenue.

Even though Idle Fish is a standalone app, it takes many advantages from Taobao. Second-hand items directly show on Taobao’s search results. Also, on the Taobao buyer’s order information page, the “one-click resale” directly jumps to Idle Fish. From new products to second-hand resale, the connection between Taobao and Idle Fish is very natural for users.

Through Idle Fish, consumers can find a variety of second-hand, recycled, refurbished, and for-rent goods. Idle Fish calls itself not only a second-hand e-commerce platform but also a C2C community. Idle Fish’s online communities, Fish Ponds, are based on interest, location, institutions, and other categories, which are similar to offline second-hand scenarios. It allows users to sell, buy, and exchange unwanted products.

Gen Z and millennials are the main users of Chinese second-hand e-commerce platforms like Idle Fish

According to a report from Idle Fish, 52% of its users were Gen Z and millennials in 2018. They are the most active in online communities, with 20% more than other users. Every Gen Z and millennial user joins four fish ponds on average, where they are able to find their own community of interest, interact with each other, and have access to find limited or unique editions, to satisfy their hobby. Second-hand cameras, anime models, and traditional costumes are the most popular communities on Idle Fish. Users are gathering because of hobbies.

In the fish ponds, Gen Z and millennials also focus on content relevant to their own life. For instance, a Fish Pond called “say goodbye to my ex”, where users sell gifts from their ex-boyfriends or girlfriends, has nearly 80,000 users.

Apart from second-hand items trading, more forms have also been derived from Idle Fish to meet people’s diversified demands, including house leasing, product leasing, and trade-in services.

Zhuanzhuan

Like Idle Fish, Zhuanzhuan also comes from an upgrade of second-hand channels on 58.com. After an investment of $200 million from Tencent, it got support from the WeChat platform.

Although Zhuanzhuan is an integrated Chinese second-hand e-commerce platform, it works as a C2B2C model – a combination of C2C and B2C. For the high-priced products, like smartphones and laptops, Zhuanzhuan set a quality standard with Foxconn, through the provision of quality inspections and transaction guarantee services to ensure the quality on the platform. As for the low-priced products, like clothing and books, users can choose to an individual or from the platform.

The C2B2C model meets the different needs of sellers and buyers. The second-hand products collected by Zhuanzhuan will be under standardized management, including recycling, cleaning, disinfection, and a series of renewals. Buyers also benefit from having the opportunity to buy gently used goods for half the normal price.

Key market segments in the secondhand market in China

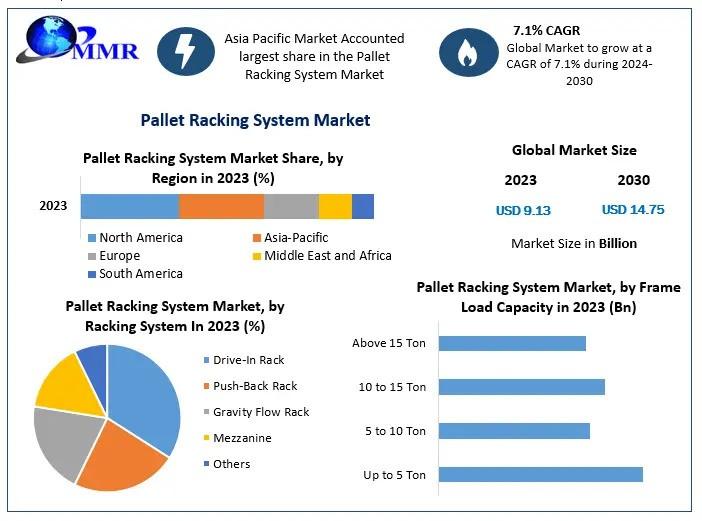

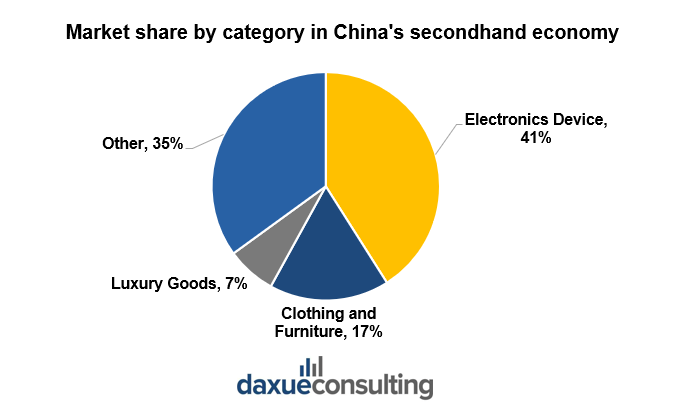

Electronics is the clear leader in the secondhand Market in China, taking roughly 41% of the total. A main reason is the fast pace at which technology moves. New phones and gadgets quickly become out of date, and plenty of people upgrade even when their current device still works fine. That creates a constant stream of used products. On the buyer side, many are happy to go for an older model, such as an earlier iPhone model, because it’s much cheaper and still performs well.

Clothing and furniture come next at about 17%, and the secondhand luxury market in China sits at around 7%. The rest of the market (about 35%) is spread across smaller categories like books, antiques, and collectibles. Luxury resale keeps picking up as more shoppers look for recognizable brands without paying full retail prices. Overall, higher-end electronics and luxury items tend to do well in resale because the value drop after the first purchase makes them far more affordable, while the “premium” feel is still there.

Who’s buying: Young, urban, and always online

The primary consumers of the secondhand market in China are young buyers, particularly Gen Z and millennials, aged 18-35. These tech-savvy individuals account for around 65% of the total consumer base in the secondhand market. Predominantly located in top-tier cities like Beijing, Shanghai, and Shenzhen, this demographic is also expanding in second-tier cities. Many of these consumers hold bachelor’s degrees, reflecting a higher level of education.

Gen Z is the main customer group in the secondhand market in China. They face economic pressures and are interested in sustainability and product uniqueness. Chinese Gen Z tends to treat luxury as a way to show personality, not just status. That’s why resale and pre-owned luxury goods are attractive: they can get the look and quality they want at a lower price, while still keeping a sense of individuality.

As digital natives, they also move quickly through tech trends. Many upgrade phones, tablets, and other devices often, which shortens product life cycles and makes them a major source of supply for the secondhand market. Buying pre-owned items can also signal environmental awareness. This is another value that fits well with Gen Z’s image and priorities. China’s huge consumer base helps secondhand goods circulate smoothly, keeping supply relatively steady as demand grows. On top of that, the large number of good-condition and unusual items has made “treasure hunting” part of the fun, which further pushes the market forward.

The role of digital platforms in the secondhand market in China

Digital platforms have changed how people in China buy and sell secondhand goods. Instead of relying on offline markets, many users now just list items and shop through apps. Xianyu is the biggest name in this space and is often described as the leading C2C platform, taking a large share of secondhand e-commerce (72% to total secondhand e-commerce market RMB 645.02 billion. It has gained popularity in part due to the wide range of items available, including electronics, clothing, and furniture, and because the shopping experience is similar to traditional online shopping. Zhuan Zhuan focuses more on used electronics and luxury resale, so it leans on authentication to reduce worries about fakes and quality. Dewu is in a different lane, concentrating on fashion and sportswear for buyers who care about trends and authenticity.

Online platforms may be where most secondhand deals happen now, but offline markets haven’t disappeared. Plenty of shoppers still want to pick things up, check the condition, and make sure they’re not getting tricked by a photo. This is a good example of a huge, busy, and packed with stalls selling all kinds of stuff, from vintage pieces and old books to secondhand phones. For younger buyers, it’s not only about saving money. It’s also the fun of wandering around and finding something no one else has.

The expansion of offline presence for trust and convenience

As secondhand shopping grows, platforms are running into the same problem over and over: people like the convenience, but they don’t always trust what they can’t see. That’s pushed some online players to open physical locations. Super ZhuanZhuan and Xianyu Recycleshop started rolling out offline stores in 2024 and 2025, adding services like inspections, trade-ins, and refurbishing. For buyers, it’s a simple comfort where someone has checked the item, and the condition is clearer before money changes hands.

These stores also solve the “photo problem.” Online listings are quick, but they don’t tell you how a device feels in your hand, whether the buttons are worn, or if the screen has tiny scratches, you only notice under light. In-store, customers can test products and decide on the spot. The idea isn’t to replace the apps—it’s to back them up with a place where people can verify quality in person. That mix of online speed and offline reassurance makes secondhand buying easier for cautious shoppers and helps bring more people into the market.

Opportunities and challenges for businesses

The secondhand market in China is large and growing rapidly, driven by sustainability, the thrift trend, and economic pressure. Entering this market brings both opportunities and challenges that new players should consider before making a major move.

| Challenges | Opportunities |

| 1) The growth of the secondhand market may reduce sales of new products, especially for luxury goods and high-end electronics. | 1) Businesses can enter a growing market by creating their own secondhand sales channels or trade-in programs. |

| 2) Counterfeit products in secondhand markets can damage brand trust and reputation. | 2) Offering official resale options can strengthen brand loyalty and keep customers within the brand ecosystem. |

| 3) Brands must invest in authentication, quality control, and official guarantees, which can increase costs. | 3) Secondhand sales support the circular economy and improve a brand’s sustainable image. |

| 4) Managing both new and secondhand sales at the same time can be complex for businesses. | 4) Retailers can partner with trusted platforms to operate verification centers, increasing in-store footfall. |

Conclusion: A thriving market with great potential

Secondhand Market in China has moved far beyond “used stuff for people on tight budgets.” It’s growing fast, and the reasons are pretty clear: platforms made resale easier, younger shoppers got comfortable buying pre-owned, and sustainability stopped being a niche idea. For Gen Z, secondhand shopping is not only about saving money but also about finding unique items and making more mindful consumption choices.

For businesses, this is a real opening. Trade-ins, resale channels, refurbishment, and verification services aren’t side projects anymore; they’re becoming part of how the market works. Still, it comes with headaches. Counterfeits don’t disappear just because the market is booming, and resale growth can create tension for brands that rely on first-hand sales. The companies that do well will be the ones that treat trust as the product: clear standards, solid authentication, and a customer experience that doesn’t feel like a gamble.

Breaking cultural barriers: How digital evolution is powering the boom of the secondhand market in China

- The secondhand market in China is growing fast, with an estimated value expected to reach USD 412 billion by 2025. The growth is not only driven by affordability, but also by a cultural shift towards sustainability, with more consumers seeking unique, green products.

- Gen Z and millennials are the main consumers, attracted by sustainable products and unique products that express their identity and value, not social status.

- Electronics and luxury goods are key driving categories due to fast supply and high demand

- Digital platforms like Xianyu and Zhuan Zhuan bring trustworthiness and convenience to buyers.

- Businesses have opportunities to join this market through a new revenue stream and channel, but must also manage challenges such as counterfeit products and balancing between new and secondhand sales.