The rise of e-commerce and the momentum of nearshoring are transforming Mexico’s logistics sector, pushing warehouses and distribution centers to adopt faster, more precise operations. Industry specialists warn that simply adding square footage is no longer enough to stay competitive, however. Today, efficiency, speed, and flexibility define success in supply chain management.

“The challenge is not building more warehouses but addressing operational flaws such as shipment delays, order errors and weak inventory controls,” said Manuel Farías, Deputy Director of Storage Systems, PM STEELE, a Mexican company with 75 years in the market.

PM STEELE advocates gradual automation backed by warehouse management systems (WMS) to improve order flow and connect processes more effectively. The company emphasizes modular design, intelligent inventory control and human talent as pillars of modern logistics.

International Data Corporation (IDC) previously reported that 58% of surveyed companies planned to allocate at least one-fourth of their IT budgets to automation solutions. Despite inflation, tariffs and economic fluctuations, experts agree that companies must invest in flexible logistics strategies to remain resilient in a volatile market.

“Transformation does not happen overnight,” PM STEELE stated. “Step-by-step automation, from unloading and inventory counting to process coordination, is the most effective way to keep operations under control.”

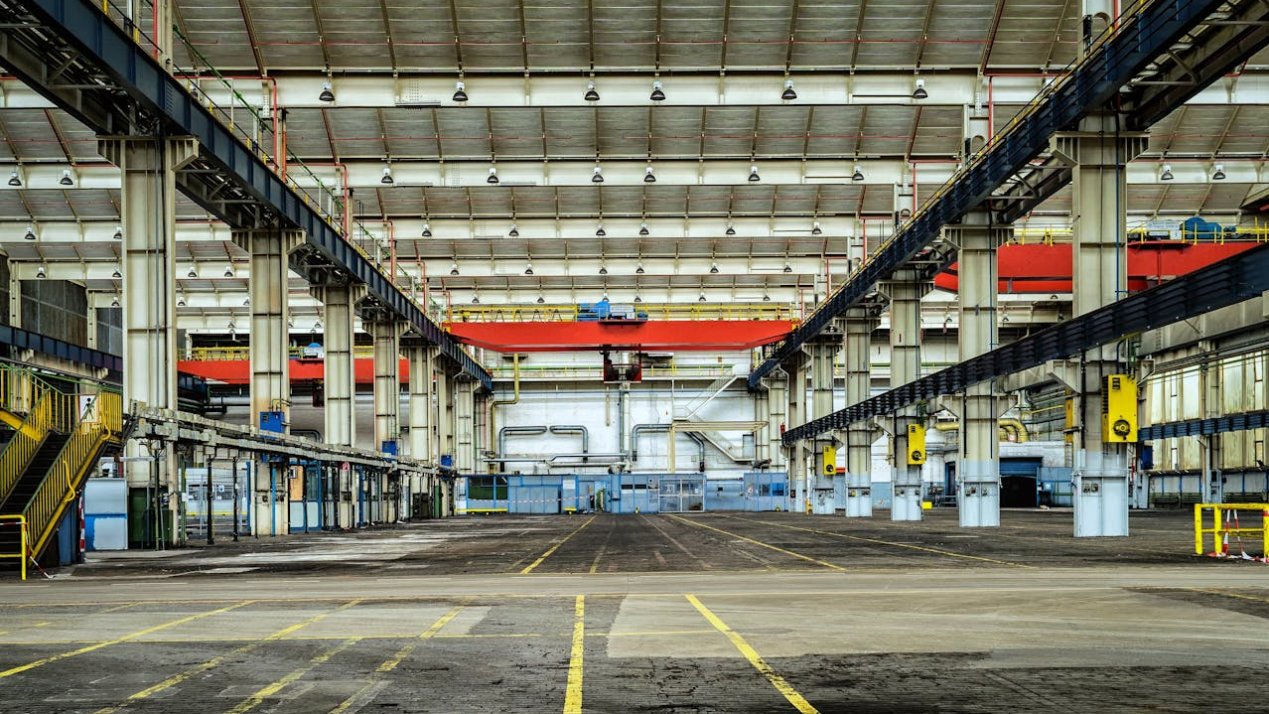

Warehouses in Mexico have shifted from being passive storage spaces to dynamic hubs that must adjust resources in real time and guarantee on-time deliveries. Efficiency and adaptability are no longer competitive advantages, but requirements for survival.

The industry’s focus on innovation will continue into 2026, with logistics solutions showcased at Road 2 Logistics Automotive, scheduled for June 3–4 in Leon, Guanajuato.

Nearshoring Still a Driving Force?

MBN reported that though the nearshoring boom has softened, the structural trend toward it persists. “The relocation of supply chains remains Mexico’s long-term advantage,” says Claudia Santistevan, President, AMEFAM, to MBN. She emphasizes that foreign investors remain optimistic, citing Mexico’s labor quality and strategic location.

“My assessment of investment in industrial parks in Mexico is that it is a mixed scenario. There is a pause as companies are assessing whether to invest, even on a smaller scale. But the reality is that at some point, one needs to invest as it is not possible to stay virtual forever. The market has stabilized, and the need for a physical space is back,” says Santistevan.

“The main industrial hubs are experiencing a shortage of Class A space, which has driven up rental prices and accelerated leasing decision times. However, it cannot be described as a generalized oversupply. Rather, the market is going through an adjustment phase in response to the high expectations generated by nearshoring,” says Mauricio Pascacio, Head of Storage Systems, PM STEELE.

Pascacio also says that factors such as electoral uncertainty in the United States, global logistical bottlenecks, and energy constraints have tempered some expansion plans. Nevertheless, the structural trend of supply chain relocation remains in place, and Nearshoring Mexico continues to hold key competitive advantages.