Business

Mass. companies cite escalating costs as their top concern, overshadowing otherwise resilient economic activity.

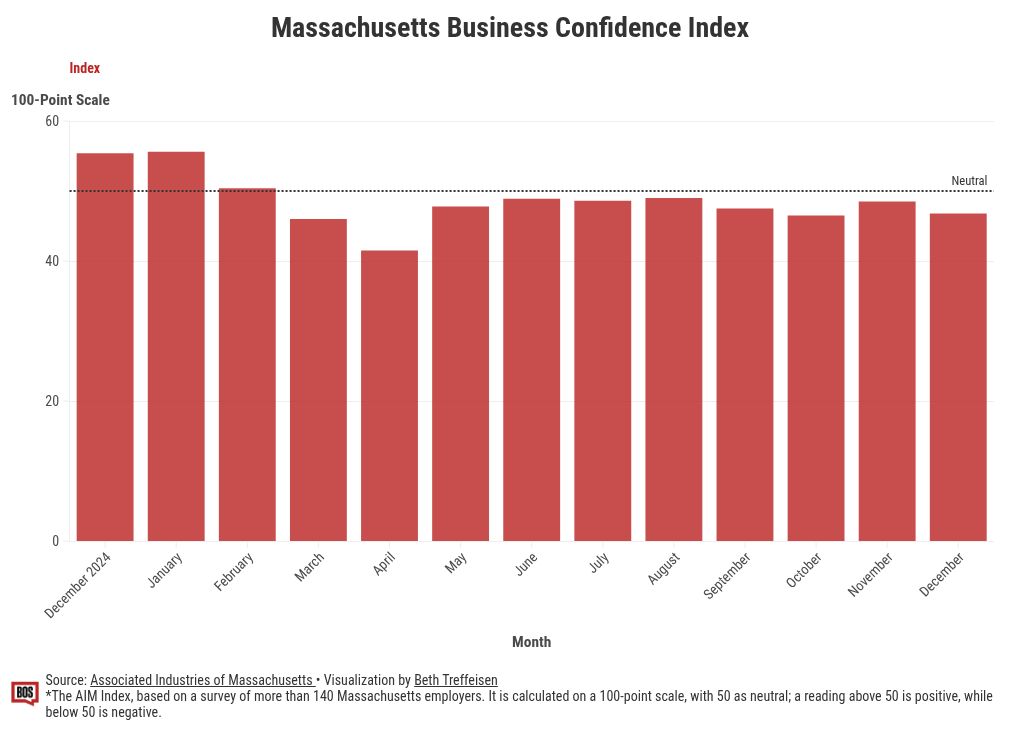

Business confidence in Massachusetts slid again in December, marking the tenth straight month that employers reported pessimism — the most prolonged downturn since the early months of the pandemic.

Companies across the state say rising operating costs continue to squeeze their outlook, according to the latest Associated Industries of Massachusetts Business Confidence Index.

Confidence in both the state and U.S. economies has dropped more than 15 points from a year ago, even as consumer spending holds steady and business investment shows resilience.

“Consumer spending has remained relatively resilient, supported by steady job growth, rising real wages in some sectors, and strong balance sheets among higher-income households,” said Sara Johnson, chair of the AIM Board of Economic Advisors.

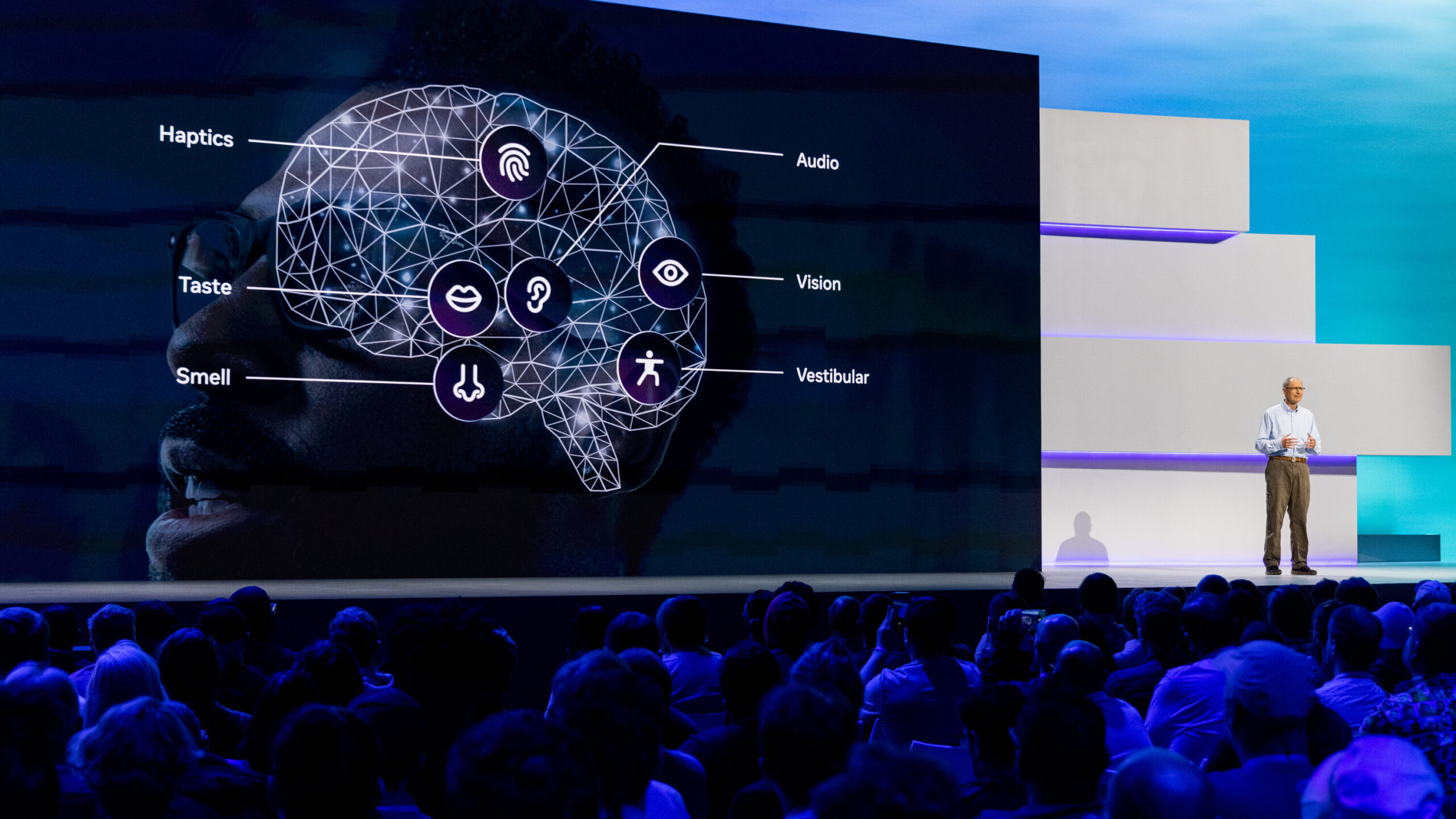

“Corporate investment, particularly in technology and artificial intelligence, continues to provide pockets of momentum,” Johnson continued. “These factors suggest an economy that is slowing but still expanding, avoiding the downturn many feared earlier.”

The AIM Index, which has been running since 1991, is based on a survey of more than 140 Massachusetts employers. It is on a 100-point scale, with 50 being neutral. A reading above 50 is positive; a reading below 50 is negative.

The Index fell to 46.8 in December from 48.5 in November and was down 8.6% from a year earlier.

Companies that participated in the index expressed growing concerns about the cost of doing business, including rising insurance premiums, healthcare costs, and higher supply costs.

Another company noted that it is losing too many people ages 18 to 50 due to the state’s housing costs and taxation rates.

Elmore Alexander, Dean Emeritus of the Ricciardi College of Business at Bridgewater State University and a BEA member, noted that the U.S. economy is experiencing a paradox: a rising stock market and weak confidence among consumers and businesses.

“One concern is that spending is uneven, with many companies reporting a pullback by lower- and middle-income consumers,” Alexander said. “Another concern is inflation.”

Alexander said the core personal consumption expenditure price index (excluding food and energy) rose 2.9% in the third quarter, up from 2.6% in the second.

AIM President and CEO Brooke Thomson said Massachusetts businesses will face a bevy of important issues during 2026, from data security to rising costs for health care and energy.

“Add in the possibility that voters may face as many as 11 statewide ballot questions in the fall, and there are many potential issues that are likely to affect business confidence this year,” Thomson said.

Sign up for the Today newsletter

Get everything you need to know to start your day, delivered right to your inbox every morning.