Epigraph

“History does not repeat itself; it stress-tests institutions again and again, often with more aggressive players and fewer restraints.”

Key Issues Impacting Markets and Policy

Early 2026 is about testing the durability, legality, and economic consequences of pressured policy decisions. Markets are shifting from reacting to emergency interventions to judging if those moves can withstand legal scrutiny, fiscal limits, and execution risks.

Investors are weighing a global growth regime that has stabilized at a lower trend, precedent-setting actions in Venezuela, cooling but resilient labor conditions in the United States, uncertainty surrounding tariff authority, and Puerto Rico’s shift from reconstruction-led growth toward a normalization phase.

While these forces are headline-intensive, near-term systemic risk to markets remains contained. The prevailing macro narrative—moderating growth, easing inflation pressures, and a Federal Reserve positioned for gradual normalization—remains intact. Absent renewed inflationary pressure or broad geopolitical escalation, one to two interest-rate cuts in 2026 remain the base case.

The following sections provide a structured assessment of the ongoing global adjustment, spotlighting major regional and sectoral dynamics influencing current market and policy developments.

1. Global Growth in Transition: Policy Shocks Fade, but Momentum Remains Constrained

The global economy is entering 2026 in a phase of managed deceleration. Near-term growth forecasts have been revised modestly higher, but the broader picture remains one of subdued expansion, constrained by policy uncertainty, structural headwinds, and the fading of temporary supports that buoyed activity earlier in 2025. The global economy is not sliding into recession, but it is not regaining pre-policy-shift momentum either. A Modest Upgrade—Still Below Potential

Global growth is projected to slow gradually:

• 2024: 3.3%

• 2025: 3.2%

• 2026: 3.1%

These figures represent stabilization at a lower cruising altitude than expected prior to recent policy shifts involving trade realignment, industrial strategy, and fiscal recalibration.

Regional Divergence Defines the Cycle

United States — Cooling Toward Trend

U.S. growth is projected to slow from roughly 2.8% in 2024 to about 2.0–2.1% in 2025–2026, reflecting normalized consumption, tighter financial conditions, and the fading of front-loaded trade and investment activity.

Euro Area — Weak Momentum, Structural Constraints

Growth remains near 1.0–1.2%, constrained by productivity stagnation, competitiveness challenges, and energy sensitivity.

Emerging and Developing Asia — Still the Engine, but Slowing

Growth near 5% continues to anchor global expansion, though momentum is moderating as China transitions away from property-led growth and global demand remains uneven.

Latin America and the Caribbean — Stuck in Low Gear

Growth just above 2% reflects limited fiscal space, weak productivity, and high exposure to external financial conditions, reinforcing the need for structural reform over cyclical stimulus.

The overriding constraint is credibility, not stimulus.

2. Venezuela: A Geopolitical and Humanitarian Turning Point With Contained Near-Term Macro Risk

The U.S. operation that resulted in the capture of Venezuelan leadership represents not only a significant geopolitical and legal inflection but also a humanitarian turning point. The removal of an authoritarian regime that systematically oppressed its population, dismantled democratic institutions, restricted free speech, and violated fundamental civil rights is, in principle, a widely welcomed outcome, particularly when such repression has driven one of the largest mass emigration events in modern history.

Over the past decade, Venezuela has experienced one of the most severe peacetime economic collapses on record. Between 2013 and 2023, the economy is estimated to have contracted by approximately 75–80% in real terms, a decline typically associated with war zones rather than commodity-producing nations. This collapse was driven by chronic mismanagement, institutional erosion, and the near-total breakdown of economic governance.

The consequences for living standards have been profound. Venezuela’s GDP per capita fell from roughly $12,000–13,000 in the early 2010s to approximately $3,000–4,000 by 2023–2024, implying a real per-capita income decline of more than 70%. Once an upper-middle-income country by regional standards, Venezuela now ranks among the lowest-per-capita economies in Latin America.

These economic failures translated directly into a humanitarian crisis. Venezuela’s population peaked at approximately 30.5 million in 2013. Today, the resident population is estimated at 22–23 million, reflecting a net loss of 7–8 million people—roughly 25–27% of the population. This mass displacement constitutes one of the largest migration crises globally outside of active war zones.

The oil sector—long the backbone of the Venezuelan economy—illustrates the depth of institutional decay. Despite holding roughly 300 billion barrels of proven reserves, representing approximately 17% of global oil reserves, Venezuela currently produces only 700,000–800,000 barrels per day, down from peaks exceeding 3 million barrels per day in the late 1990s. This places Venezuela at roughly 1% of global oil production, severely limiting its near-term macroeconomic influence despite its geological potential. Industry assessments suggest that restoring meaningful capacity would require over $100 billion in capital investment and an 8–10-year rehabilitation period, even under stable governance and credible legal protections. From a global macroeconomic standpoint, Venezuela’s current weight remains modest. The country accounts for less than 1% of global GDP, and approximately 1% of global oil output. As a result, near-term impacts on global growth, inflation, or financial markets are limited.

However, the broader significance of this moment extends beyond near-term macro aggregates. The removal of an entrenched dictatorship that hollowed out institutions, impoverished its population, and forced millions into exile carries precedent value. It reinforces the principle that prolonged repression, economic collapse, and systemic violations of basic rights can ultimately trigger international action—and that such action, when it brings an end to widespread suffering, is generally perceived as legitimate and necessary.

Venezuela’s transition does not represent an immediate macro shock to the global economy. Second, it underscores how political legitimacy, institutional integrity, and respect for basic freedoms are inseparable from long-term economic stability. Venezuela serves as a stark case study in how the erosion of governance can metastasize into economic collapse, demographic implosion, and ultimately, international intervention—reshaping risk perceptions well beyond its borders.

3. Understanding the Legal Foundations—and Fault Lines—of the U.S. Operation

The U.S. operation has triggered a multifaceted legal debate spanning executive authority, congressional oversight, and international law. While the humanitarian and macroeconomic context frames the broader significance of the action, the legal questions shape its durability, legitimacy, and downstream policy consequences.

Supporters of the administration’s position emphasize the president’s authority as commander-in-chief and point to historical precedent for limited military actions undertaken without prior congressional authorization. Critics argue that such actions test the boundaries of international law, including principles of sovereign immunity and constraints on the use of force. Congressional pushback—while largely symbolic—highlights that institutional tension around war powers and executive reach remains unresolved.

Capital Discipline and the Legacy Claims Overhang

Discussions with U.S. oil executives have centered not on near-term opportunity, but on capital already destroyed and legal protections not yet restored.

• Major U.S. oil companies incurred combined outstanding claims exceeding $14 billion following Venezuelan expropriations beginning in 2007, when the Chávez administration nationalized foreign oil assets.

• ConocoPhillips is the largest non-sovereign creditor, with arbitration awards and related claims totaling approximately $12 billion.

• ExxonMobil has unresolved claims totaling approximately $1.6 billion.

These claims are active constraints on future investment decisions, as we saw in the recent White House meeting.

Sanctions, Licensing, and the Post-2019 Wind-Down Reality

Beginning in 2019, U.S. sanctions against Venezuela’s state oil company PDVSA blocked most oil trade with U.S. entities and restricted financial transactions, effectively forcing foreign firms to wind down operations and preserve capital rather than compete or invest. U.S. oil companies were given limited windows to exit existing engagements, and most were unable to sustain commercial operations under the sanction regime. Chevron has operated under specific licenses, but even those authorizations have been revoked and remain uncertain amid recent policy shifts.

As a result, any prospective re-entry into Venezuela’s oil sector today is conditioned not on geology, but on:

• Legal clarity around property rights and arbitration enforcement.

• Resolution—or credible treatment—of outstanding claims.

• Predictable licensing and revenue-repatriation mechanisms.

Put differently, Venezuela’s oil sector is constrained not by reserves but by rule-of-law credibility and policy stability. Rehabilitation will be a long-run reconstruction—not a simple restart—and will require long-dated capital commitments, enforceable contracts, and institutional stability. Until these conditions are met, capital discipline—not resource potential—will govern outcomes.

4. U.S. Labor Market, Inflation, and the Federal Reserve: Cooling Momentum Within the Dual Mandate Framework

The U.S. labor market is slowing materially, but it remains fundamentally resilient—an outcome that aligns with the Federal Reserve’s dual mandate: maximum employment and price stability.

Labor Market: Normalization, Not Deterioration

Job creation decelerated sharply in 2025:

• 2025 job growth: approximately 584,000, or 49,000 per month

• 2024 job growth: approximately 2.0 million, or 168,000 per month

December payroll gains were near 50,000, and prior months were revised lower. Despite slower hiring, the unemployment rate remains near 4.4%, well below its long-term historical average. This configuration signals labor-market cooling, not collapse—precisely the outcome the Fed seeks as it transitions from restrictive policy to normalization.

Inflation: Progress With Residual Noise

Inflation has moderated meaningfully from its post-pandemic peak, though recent data have been complicated by statistical noise stemming from the 2025 government shutdown and base-effect distortions. Headline and core measures remain above the Fed’s 2% target, but they show no evidence of re-acceleration.

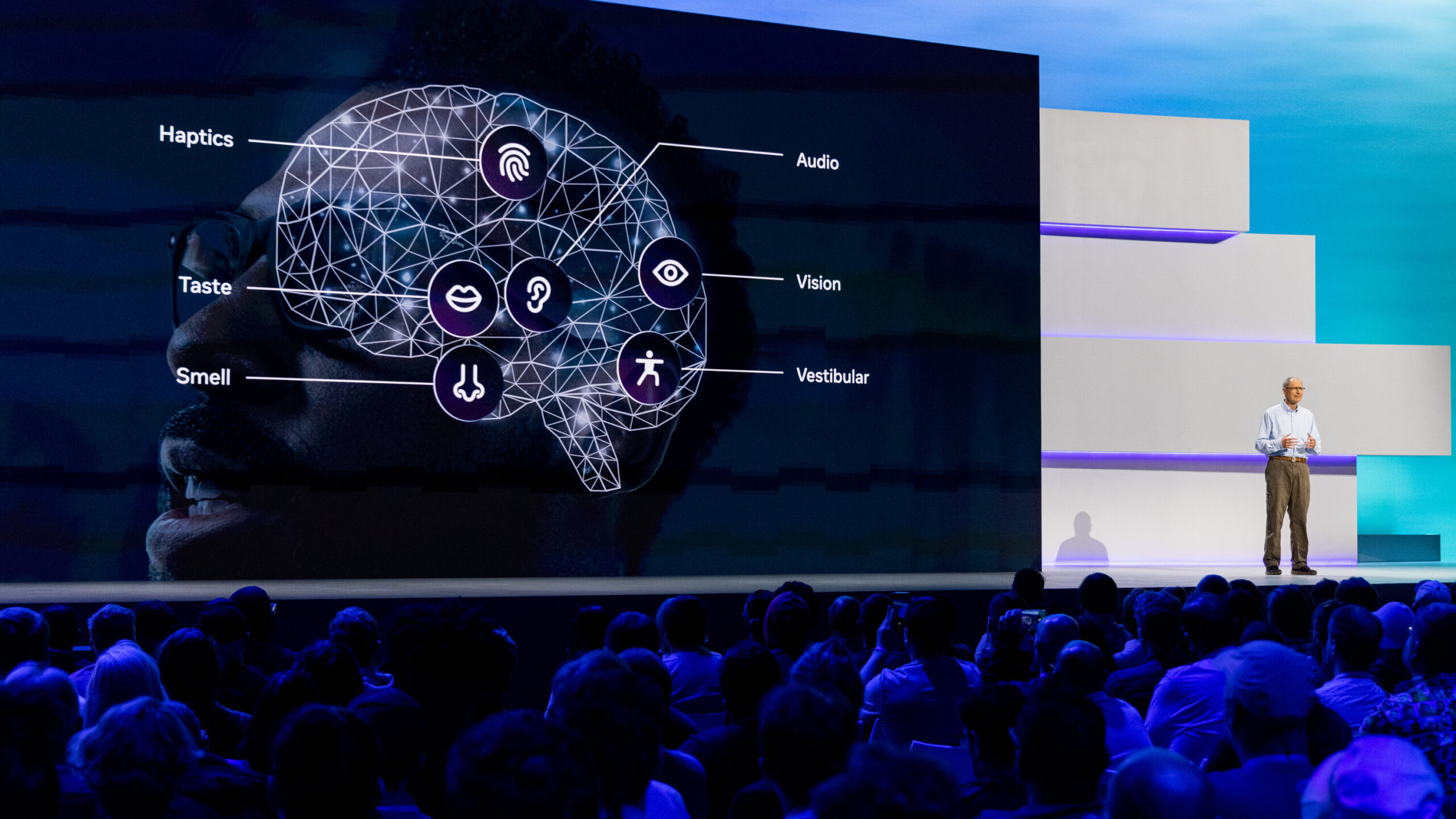

Federal Reserve Policy Outlook: Dual Mandate in Balance

Within the dual mandate framework, the Federal Reserve now faces a more symmetric risk profile:

• The risk of labor-market overheating has receded.

• The risk of inflation persistence remains manageable but non-trivial.

As a result, the Fed has shifted from an outright stance of restraint to a posture of measured optionality.

Current Federal Reserve projections and policy signaling indicate:

• Two interest-rate cuts are expected over the course of 2026, contingent on continued labor-market cooling and further progress on inflation.

• Cuts are expected to be gradual and data-dependent, not front-loaded.

Importantly, markets have largely aligned with this view. The probability of a rate cut at the January 2026 Federal Open Market Committee meeting is currently estimated at approximately 5%, reflecting the consensus that policymakers will require additional confirmation before initiating easing.

This low near-term probability underscores a key point: while the direction of policy is easing, the pace will be deliberate.

The Federal Reserve is executing a careful balancing act—maintaining credibility on inflation while allowing labor-market normalization to proceed. That balance argues against aggressive positioning around early-cycle rate cuts and instead favors disciplined, duration-aware, and diversification-focused strategies. In short, the Fed is no longer fighting inflation—it is managing the landing.

5. Supreme Court and Tariffs: A Test of Presidential Economic Power, Policy Durability, and Market Risk

At its core, the case now before the Supreme Court is not a trade dispute. It is a test of presidential economic power—specifically, how far a president can go in reshaping trade and imposing broad economic costs under emergency authority without explicit congressional authorization.

Tariffs are simply the mechanism through which a larger constitutional question has surfaced: whether emergency statutes can function as a standing substitute for legislation in economic policymaking, or whether they are meant to remain temporary tools reserved for narrowly defined crises.

The Constitutional Question Beneath the Tariff Debate

The Court is effectively being asked to determine the outer boundary of unilateral executive authority in economic affairs. A ruling that upholds expansive emergency tariff powers would affirm a model of governance in which speed, discretion, and executive judgment dominate trade policy. A ruling that constrains those powers would reassert congressional primacy, forcing future administrations to rely on statutory, procedural, and more durable trade mechanisms.

Either outcome matters less for the fate of any single tariff schedule and more for the institutional balance of power that will govern future presidencies.

Why the Refund Debate Misses the Bigger Picture

Much of the public discussion has focused on the possibility that tariffs imposed under emergency authority could be invalidated, potentially giving rise to importer refund claims estimated at $150–200 billion. While material in isolation, this figure overstates the near-term macroeconomic relevance.

Any refund process would almost certainly be:

• Legally contested

• Administratively complex

• Distributed over multiple fiscal years

As a result, any stimulative effect would be incremental rather than immediate, and unlikely to materially alter inflation or growth trajectories on its own.

Crucially, a decision limiting emergency authority would not eliminate tariffs. Alternative statutory pathways remain available, including trade actions grounded in national security considerations or unfair trade practices. These avenues are slower, more procedurally intensive, and subject to review—but they are also legally durable.

Stress Testing the U.S. Constitution

This Supreme Court case is best understood as a constitutional stress test, not a binary referendum on tariffs. The outcome will recalibrate how trade policy is executed, how rapidly it can change, and how confidently markets can price its durability.

In that sense, the ruling—regardless of direction—is unlikely to derail markets. Instead, it will redefine the rules of engagement between presidential power, Congress, and the capital.

6. Puerto Rico: Planning Board Outlook (2026–2027) and the Shift to Normalization

Puerto Rico is transitioning from an extraordinary reconstruction rebound to a policy-determined normalization phase.

Planning Board projections indicate:

• FY2026: +0.4%

Financial Oversight Board

• FY2026: 0.10%

This deceleration reflects the fading of one-off supports—reconstruction spending, insurance inflows, and federal transfers—rather than renewed contraction.

Relative to advanced economies, Puerto Rico tracks global normalization but with a critical distinction: it exits a capital-intensive rebuild, leaving a newer capital stock and improving infrastructure reliability.

The Final Word: The Policy Test—Credibility, Institutions, and the Price of Execution

This is not a year of new shocks; it is a year of judgment.

The global economy has moved beyond crisis management into structural adjustment. Growth has stabilized below potential, inflation has moderated but not disappeared, and monetary policy is no longer tightening—yet remains constrained by credibility. Across regions, the margin for policy error is narrower.

Venezuela provides the starkest lesson. Its humanitarian collapse, mass migration, and destruction of capital were not exogenous events, but the result of prolonged institutional erosion and economic mismanagement. The transition underway reinforces a core market truth: sustainable economic stability depends on political legitimacy, rule of law, and basic freedoms.

In the United States, the Federal Reserve is carefully balancing its dual mandate. Labor markets are cooling without breaking, inflation is easing without re-accelerating, and the base case of two rate cuts in 2026 reflects confidence in the landing—tempered by a deliberate pace that prioritizes credibility over speed. The Supreme Court tariff case underscores that markets are pricing not just policy outcomes, but who holds power and how durable that power is.

Across all fronts, the message is consistent: fundamentals, institutions, and execution now matter more than rhetoric.

The policy shock is over. The policy test has begun.