Catalio Capital Management is adding to its team.

The $2.3 billion healthcare investor has hired Ajay Mantha as a partner within its hedge fund, Catalio Public Equities, according to a note to investors seen by Business Insider.

Mantha previously had been an executive at Zimmer Partners, a New York-based stockpicking hedge fund where Mantha built and then ran the healthcare group. He spent nine years in Bain Capital’s public equities division as the head of its healthcare sector group. Prior to that, he worked as an analyst at D.E. Shaw and a consultant for McKinsey.

The note states he will start next year and report to Ben Snedeker, the firm’s head of public equities.

Catalio declined to comment on the hire.

The hedge fund, which now runs roughly $900 million following an infusion of capital from Brevan Howard, is up nearly 16% this year, a person close to the manager says, besting the average fund’s gains of 9.9%.

The hedge fund has returned roughly 55% since rebranding with the Catalio name at the start of 2023, this person added.

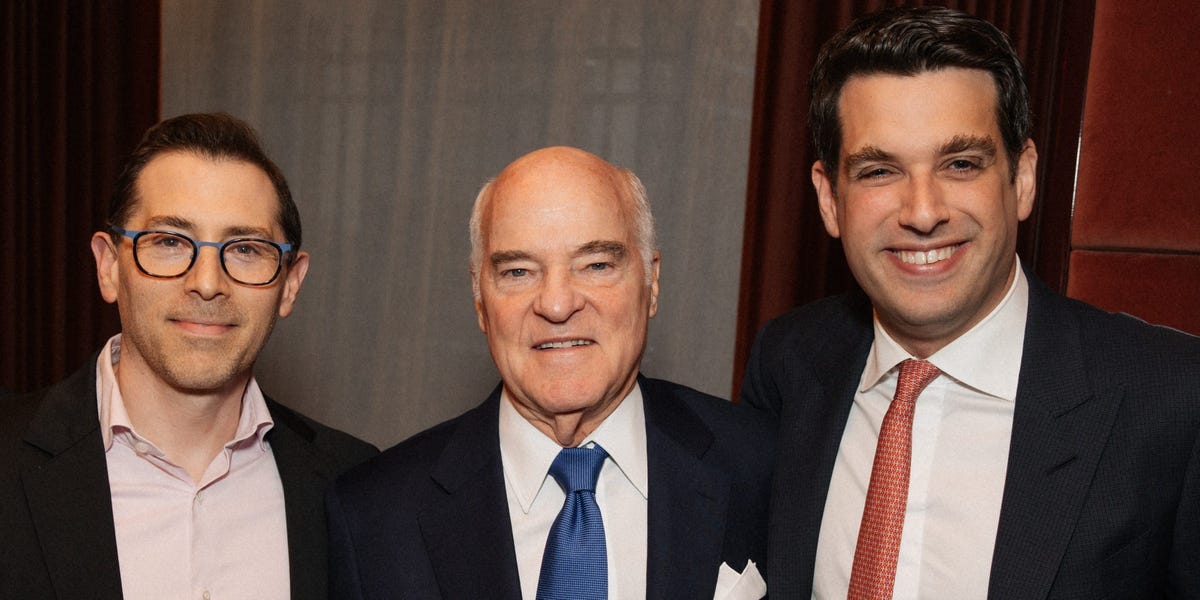

The firm, founded by George Petrocheilos and Jacob Vogelstein, originally focused on private market investments in the healthcare and biotech sectors before acquiring longtime stockpicking hedge fund HealthCor Management at the end of 2022.

HealthCor, founded in 2005 by SAC Capital alums Art Cohen and Joe Healey, was merged into Catalio but is still led by Snedeker, who invested for HealthCor for four years before the sale of the fund.

Catalio counts plenty of big names as backers, including private equity giant KKR. Brevan gave the hedge fund $200 million in a separately managed account earlier this month, Reuters reported.

Wealthy financiers such as Thoma Bravo founder Orlando Bravo and Highbridge Capital founder Glenn Dubin are also investors in Catalio.